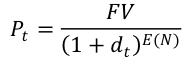

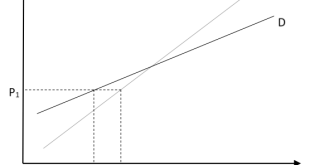

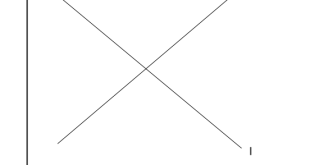

Due to the size of this post, it was split in two. You can find Part B here. The M&B series is back! The goal is to finish the first complete draft of the book by the time I need to teach my Money and Banking course. Over the coming months, the following topics will be covered. Overview of the financial system Federal Reserve System institutional analysis Interest rate and interest rate structure Pricing of securities Off balance sheet: Securitization Off balance sheet: Derivatives...

Read More »Bill Clinton’s Surplus: Not Something to Celebrate

Video from Eric Tymoigne’s Modern Money students at Lewis and Clark College.[embedded content] Share this:

Read More »Money and Banking Part 17: History of Monetary Systems

By Eric Tymoigne This is the last post of this series. Many more topics need to be covered to make a full Money and Banking course, but the series should help those of us who are dissatisfied with the current Money & Banking textbooks (I don’t use any). Here is what is coming up in the near future: I will edit all the posts for typos (most of them hopefully) and to account for comments I received. Devin Smith kindly agreed to post the changes without changing any of the links....

Read More »Money and Banking Part 16: FAQs about Monetary Systems

By Eric Tymoigne The following answers a few question in order to illustrate the previous post and to develop certain points. Q1: Can a commodity be a monetary instrument? Or, does money grow on trees? Let us tackle the idea that “gold is money”. Clearly, a gold ingot is not a monetary instrument. There is no issuer, no denomination, no term to maturity or any other financial characteristics. A gold ingot is just a commodity, a real asset not a financial asset. On the other hand, gold coins...

Read More »Money and Banking Part 15: Monetary Systems

By Eric Tymoigne Throughout this series, posts have used balance sheets extensively to get an understanding of the monetary operations of developed economies, but nothing has been said about what a monetary instrument is. It is time to spend some time on the nature of monetary instruments and the inner workings of monetary systems. A monetary system is composed of two core elements: A unit of account that provides a common method of measurement: the euro (€), the pound sterling (₤), the yen...

Read More »Money and Banking Part 14: Financial Crises

By Eric Tymoigne While visiting the London School of Economics at the end of 2008, the Queen of England wondered “why did nobody notice it?” In doing so, she echoed a narrative that had been promoted among some prominent economists: the Great Recession (“it”) was an accident, a random extreme event and no one so it coming. This narrative is false. Quite of few economists saw it coming and it was not an accident. A previous post showed how different theoretical framework about financial...

Read More »Money and Banking Part 13: Balance Sheet Interrelations and the Macroeconomy

By Eric Tymoigne Past posts have focused on the mechanics of a specific balance sheet, specifically that of the central bank and of private banks. This post looks at the balance-sheet interrelations between the three main macroeconomic sectors of the economy: the domestic private sector, the government sector and the foreign sector. This macro view provides some important insights about issues such as the public debt and deficit, policy goals that are more likely to be achieved, the...

Read More »Money and Banking Part 12: Economic Growth and the Financial System

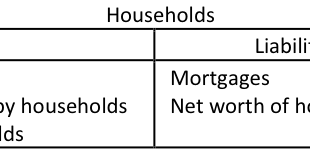

By Eric Tymoigne Money is the blood of capitalist enterprise and finance is about money now for money later. As such a well-developed financial system is essential for economic activity in a capitalist economy. The broader the range of promissory notes that can be issued, the more accommodative the financial system is to the demands of the productive system. Households cannot fund the purchase of a house with a credit card and there is no point in buying groceries with a 30-year mortgage....

Read More »Money and Banking – Part 11: Inflation

By Eric Tymoigne We are done with the study of banking operations. The next step is to incorporate them into the analysis of macroeconomic issues and this post begins on such topic by focusing on inflation. When inflation is mentioned, it is usually in relation to the cost of buying newly produced goods and services for consumption purpose. Another type of inflation concerns asset-prices, i.e. the price of non-producible commodities and old producible commodities. This post does not study...

Read More »Money and Banking-Part 10: Monetary Creation by Banks

By Eric Tymoigne The last three posts have explained how the operations of banks are constrained by profitability and regulatory concerns, and how banks operate to bypass these constraints. It is now time to go into the details of how banks get involved into providing credit and payment services to the rest of the economy. Monetary Creation by Banks: Credit and Payment Services Bank A just opened for business and its balance sheet looks like this: Now come household #1 who wants to buy a...

Read More » Heterodox

Heterodox