from Dean Baker The Republicans and Donald Trump seem set on establishing a strategic crypto reserve. They are claiming this will somehow be an important source of economic security for the country. It’s clear that establishing the reserve will be an important way to give tens of billions of dollars to Donald Trump’s campaign contributors, but it is much harder to see how it will provide any economic security to the country. To better understand the logic of a strategic crypto reserve, it...

Read More »The elites’ big lie on inequality

from Dean Baker (I saw that Jeff Bezos wants the Washington Post’s editorial page to run pieces touting the merits of free markets. Here’s my submission.) There are not many issues on which there is largely bipartisan agreement, so the story we tell about the origin of economic inequality stands out. Both sides agree that the increase in inequality of income and wealth is driven by an unfettered market. The difference is that conservatives say it is wise to accept the outcomes of the...

Read More »Weekend read: Keynes’ critique of econometrics is still valid

from Lars Syll Mainstream economists often hold the view that Keynes’ criticism of econometrics resulted from a sadly misinformed and misguided person who disliked and did not understand much of it. This is, however, nothing but a gross misapprehension. To be careful and cautious is not the same as to dislike. Keynes did not misunderstand the crucial issues at stake in the development of econometrics—quite the contrary. He knew them all too well and was not satisfied with the validity and...

Read More »How inequality causes financial crises

from Lars Syll One way that inequality precipitates debt bubbles begins with “relative deprivation.” This concept concerns the discontent people feel when they compare their socio-economic status, measured by income, wealth, consumption, or other indicators of perceived economic welfare, with that of their richer counterparts. Economists have suggested several ways that this discontent may translate into indebtedness. One theory holds that people of a given income level may try to...

Read More »´Extra Unordinarily Persistent Large Otput Gaps´ (EU-PLOGs)

A PLOG is a ´Persistent Large Output Gap´. Read: a long period of high unemployment. Literature about PLOGs tries to mitigate one of the ideas of economic orthodoxy, especially the unsubstantiated idea that lowering high post-economic crisis unemployment will fuel inflation. According to this literature, which is quite empirical, it doesn´t. However, this somewhat older literature does not yet consider the post-2009 Euro Area experience. Here, I will propose an updated definition of...

Read More »Capitalism and Democracy: The market is far more flexible than Christopher Caldwell imagines

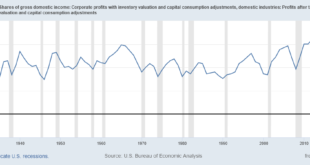

from Dean Baker New York Times columnist Christopher Caldwell devoted his Thanksgiving piece to describing the German sociologist Wolfgang Streeck’s views on capitalism and democracy. I have not read much of Streeck’s work, but as recounted by Caldwell, he gets many of the basic facts about the U.S. economy badly wrong. According to Caldwell’s account, capitalists were willing to sacrifice profits in the decades after World War II for stability. This meant less dynamism but allowed...

Read More »More ´Natural rate of unemployment´ busting, bad measurement edition.

The ´natural rate of unemployment´, also called ´Non-Accelerating Inflation Rate of Unemployment´ (NAIRU) or ´Non-Accelerating Wage Rate of Unemployment´ (NAWRU), is as, on this blog, Lars Syll states (here and here), a dangerous tool. According to NAIRU/NAWRU theory, a) When unemployment falls below a certain threshold, an inexorable increase in inflation will start. This is simply not true, considering the facts. b) As NAIRU/NAWRU theory is untrue, it can´t be measured by...

Read More »Busting the ‘natural rate of unemployment’ myth

from Lars Syll Sixty years ago Milton Friedman wrote an (in)famous article arguing that (1) the natural rate of unemployment was independent of monetary policy and that (2) trying to keep the unemployment rate below the natural rate would only give rise to higher and higher inflation. The hypothesis has always been controversial, and much theoretical and empirical work has questioned the real-world relevance of the idea that unemployment really is independent of monetary policy and that...

Read More »NAIRU — a harmful fairy tale

from Lars Syll The NAIRU story has always had a very clear policy implication — attempts to promote full employment are doomed to fail since governments and central banks can’t push unemployment below the critical NAIRU threshold without causing harmful runaway inflation. Although a lot of mainstream economists and politicians have a touching faith in the NAIRU fairy tale, it doesn’t hold water when scrutinized. One of the main problems with NAIRU is that it is essentially a timeless...

Read More »Monetary developments in the Euro Area, september 2024. Quiet.

Like John Stuart Mill, I´m more interested in credit than in money. Developments in the amount of credit provided are much more instructive to the economist than data on money. Look at the graph below (no. 2 in the ECB press release) , a highly Post-Keynesian graph that originated from the pre-Euro Bundesbank and is now published by the European Central Bank. It shows that money growth in the EU is relatively moderate and, more interesting, caused by a combination of 1) lather large...

Read More » Heterodox

Heterodox