The ´natural rate of unemployment´, also called ´Non-Accelerating Inflation Rate of Unemployment´ (NAIRU) or ´Non-Accelerating Wage Rate of Unemployment´ (NAWRU), is as, on this blog, Lars Syll states (here and here), a dangerous tool. According to NAIRU/NAWRU theory, a) When unemployment falls below a certain threshold, an inexorable increase in inflation will start. This is simply not true, considering the facts. b) As NAIRU/NAWRU theory is untrue, it can´t be measured by estimating a relation between inflation and unemployment. It is hence measured by what boils down to a short-term (3 year) running average of headline unemployment. Actual measurements are more or less equal to the recent rate of unemployment c) This means that when unemployment suddenly explodes to

Topics:

Merijn T. Knibbe considers the following as important: banana-curve, Economics, economy, Federal Reserve, Finance, inflation, NAIRU, nawru, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

The ´natural rate of unemployment´, also called ´Non-Accelerating Inflation Rate of Unemployment´ (NAIRU) or ´Non-Accelerating Wage Rate of Unemployment´ (NAWRU), is as, on this blog, Lars Syll states (here and here), a dangerous tool. According to NAIRU/NAWRU theory,

a) When unemployment falls below a certain threshold, an inexorable increase in inflation will start. This is simply not true, considering the facts.

b) As NAIRU/NAWRU theory is untrue, it can´t be measured by estimating a relation between inflation and unemployment. It is hence measured by what boils down to a short-term (3 year) running average of headline unemployment. Actual measurements are more or less equal to the recent rate of unemployment

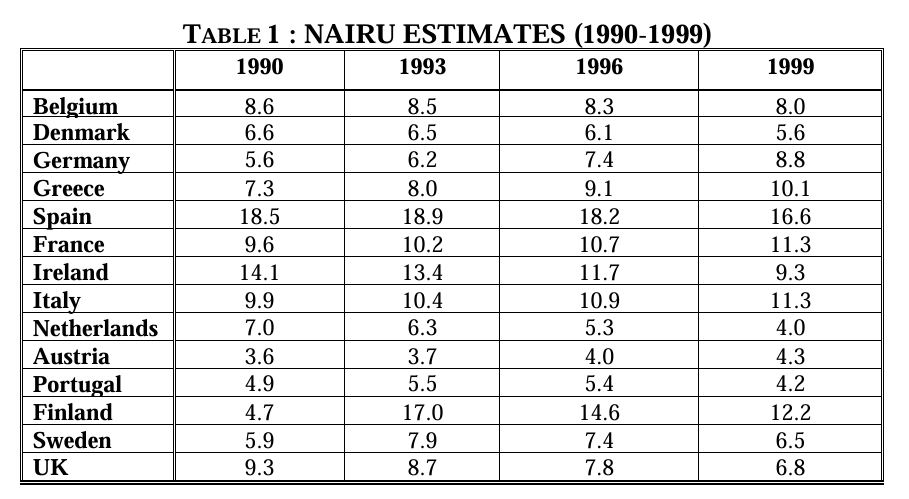

c) This means that when unemployment suddenly explodes to double-digit rates, as is the case during financial crises, economists using this tool will (despite the theory being untrue) state that no policies aimed at lowering double-digit unemployment should be pursued. Look at the case of Finland in the nineties when estimated NAIRU almost quadrupled (Table 1) or Spain around 2009. In both cases, demand-boosting policies (not just government demand but also investments and consumption) were needed. The opposite happened.

Table 1. NAIRU estimates for European countries based on an European Commission report, which, for Finland, show an increase from 4,7 to 17%. Source.

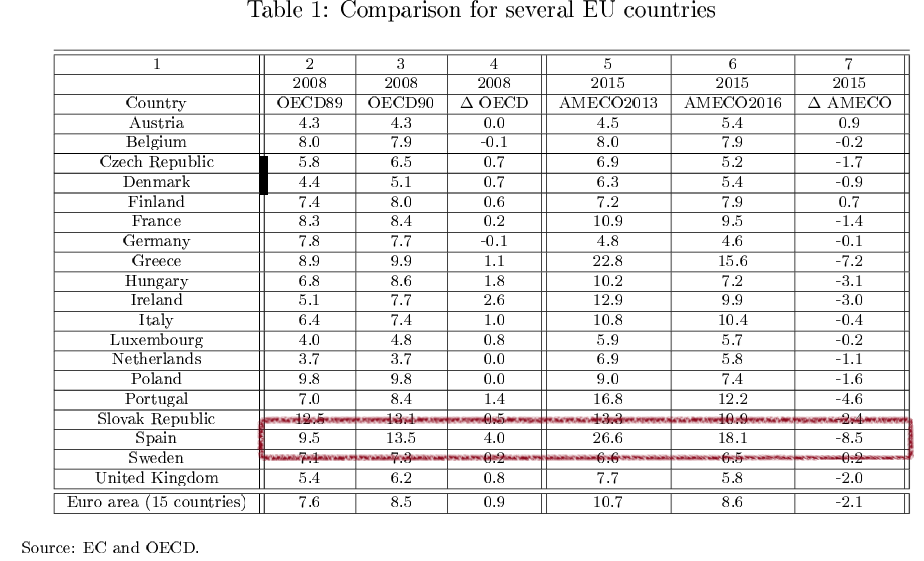

Table 2. NAIRU/NAWRU estimates for European countries 2008-2015,based upon European commission data, almost show a tripling for Spain, from 9.5 to 26%. Later estimates lowered the 26% estimate to 18%, showing the lack of scientific conceptualization, definition, operationalization, and estimation of NAIRU. Source

Spanish unemployment is still in double-digit territory, and Finnish unemployment has never reached its pre-financial crisis level (a crisis thirty years ago…). Economists are to blame. More sophisticated ideas based on better-defined variables and more thorough scientific investigation are doing the rounds, also at the Central Bank level. And structural rigidity problems exist, too. Long-term unemployed become, in the eyes of employers, rapidly less employable as their spell of unemployment takes longer, meaning that all the action on the labour market takes place in the short-term unemployed part of it. But that´s the problem. Double-digit unemployment unavoidably leads to higher long-term unemployment and hence creates additional structural rigidity problems. Which is another reason to get it down, fast. Or to prevent it by, for instance, creating more possibilities for temporary short-term work or a job guarantee. The problem with NAIRU: it tends to rule out such possibilities.

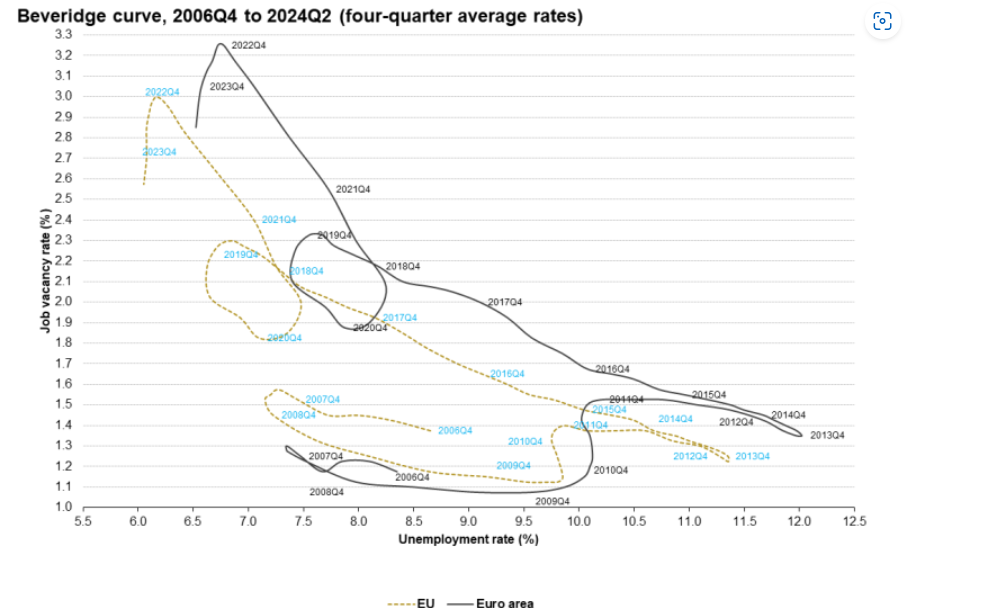

Aside: one of these more sophisticated tools is the Beveridge curve. My idea is to call this the banana-curve. That´s not just a silly remark. The Beveridge curve has two trajectories. In a two-axis system: one closer to the origin during good times and one further from the origin during bad times (the structural rigidities caused by long-term unemployment play a role). Calling it the Banana-curve catches this shape and prevents economists from lamenting that, during recoveries, it is further from the origin because people have become lazy. They haven´t become lazy. Unemployment caused them to become less employable.

Graph 3. The banana curve, EU edition.