An obsession with growth has generated massive inequality, undermined global economic stability, and weakened faith in democracy. Reversing these trends requires reining in the power of financial capital and managing global trade flows.This essay is part of a series of articles, edited by Stewart Patrick, emerging from the Carnegie Working Group on Reimagining Global Economic Governance. It was first published on 17 July 2024 on the Carnegie Endowment website.“Growth” is a term used by...

Read More »Monetary Policy Debates in the Age of Deglobalisation: the Turkish Experiment-II

By Hasan Cömert & T. Sabri Öncü This article first appeared in the Economic & Political Weekly on 18 March 2023. This article is the second in a series of articles on monetary policy debates in the age when deglobalisation became a buzzword. Here, we begin our discussion of the ongoing economic experiment in Turkey as an example to elaborate on these debates. In the third article, we will turn our attention to the post-2018 Turkish currency crisis phase of the experiment by focusing...

Read More »Monetary Policy Debates in the Age of Deglobalisation: the Turkish Experiment-II

By Hasan Cömert & T. Sabri ÖncüThis article first appeared in the Economic & Political Weekly on 18 March 2023.This article is the second in a series of articles on monetary policy debates in the age when deglobalisation became a buzzword. Here, we begin our discussion of the ongoing economic experiment in Turkey as an example to elaborate on these debates. In the third article, we will turn our attention to the post-2018 Turkish currency crisis phase of the experiment by focusing on...

Read More »Monetary Policy Debates in the Age of Deglobalisation: the Turkish Experiment-II

By Hasan Cömert & T. Sabri ÖncüThis article first appeared in the Economic & Political Weekly on 18 March 2023.This article is the second in a series of articles on monetary policy debates in the age when deglobalisation became a buzzword. Here, we begin our discussion of the ongoing economic experiment in Turkey as an example to elaborate on these debates. In the third article, we will turn our attention to the post-2018 Turkish currency crisis phase of the experiment by focusing on...

Read More »Waiting for Deglobalisation – I

This article first appeared in the Economic & Political Weekly on 12 November 2022. Monetary Policy Debates in the Age of Deglobalisation This article is the first in a series of two articles on monetary policy debates in the age in which deglobalisation is a buzzword. The ongoing monetary policy debates of the age will be discussed by focusing on macroprudential measures, capital controls and central bank independence in Part II. Introduction In a recent article, Kornprobst and Wallace...

Read More »Waiting for Deglobalisation – I

Ahmet Öncü & T.Sabri ÖncüThis article first appeared in the Economic & Political Weekly on 12 November 2022.Monetary Policy Debates in the Age of DeglobalisationThis article is the first in a series of two articles on monetary policy debates in the age in which deglobalisation is a buzzword. The ongoing monetary policy debates of the age will be discussed by focusing on macroprudential measures, capital controls and central bank independence in Part II.IntroductionIn a recent article,...

Read More »Waiting for Deglobalisation – I

Ahmet Öncü & T.Sabri ÖncüThis article first appeared in the Economic & Political Weekly on 12 November 2022.Monetary Policy Debates in the Age of DeglobalisationThis article is the first in a series of two articles on monetary policy debates in the age in which deglobalisation is a buzzword. The ongoing monetary policy debates of the age will be discussed by focusing on macroprudential measures, capital controls and central bank independence in Part II.IntroductionIn a recent article,...

Read More »A War No One Can Win – Ukraine and the Weaponisation of Everything

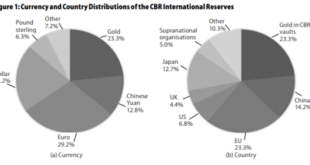

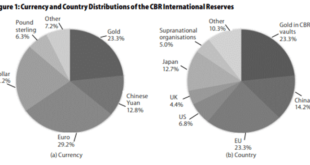

This article first appeared in the Indian journal Economic and Political Weekly on 19 March 2022.Russian Invasion of UkraineThe Russian invasion of Ukraine started on 24 February 2022. Since then, several thousand combatants from both sides and more than 500 Ukrainian civilians have died, bombs have ruined many cities, and more than two million Ukrainians, half of them children, left the country to become refugees. And the sweeping sanctions the West imposed on Russia in response not only...

Read More »A War No One Can Win – Ukraine and the Weaponisation of Everything

This article first appeared in the Indian journal Economic and Political Weekly on 19 March 2022.Russian Invasion of UkraineThe Russian invasion of Ukraine started on 24 February 2022. Since then, several thousand combatants from both sides and more than 500 Ukrainian civilians have died, bombs have ruined many cities, and more than two million Ukrainians, half of them children, left the country to become refugees. And the sweeping sanctions the West imposed on Russia in response not only...

Read More »A War No One Can Win – Ukraine and the Weaponisation of Everything

This article first appeared in the Indian journal Economic and Political Weekly on 19 March 2022. Russian Invasion of Ukraine The Russian invasion of Ukraine started on 24 February 2022. Since then, several thousand combatants from both sides and more than 500 Ukrainian civilians have died, bombs have ruined many cities, and more than two million Ukrainians, half of them children, left the country to become refugees. And the sweeping sanctions the West imposed on Russia in response not only...

Read More » Heterodox

Heterodox