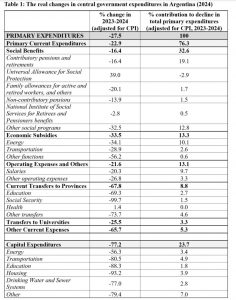

By Cem Oyvat, T Sabri Öncü and Joel RabinovichA slightly edited version of this article first appeared in the Indian journal, Economic & Political Weekly, on 15 February 2025.Cem Oyvat ([email protected]) teaches economics at the University of Greenwich. T. Sabri Öncü ([email protected]) is an independent economist based in İstanbul. Joel Rabinovich ([email protected]) teaches international political economy at King’s College London.IntroductionArgentina’s political and economic landscape has oscillated between neoliberalism and neodevelopmentalism over the past two decades, each model failing to deliver sustained prosperity (Öncü, 2024). After the 2001 economic crisis under neoliberal policies, the country shifted to neodevelopmentalism under Néstor and Cristina Fernández de Kirchner.

Read More »Articles by T. Sabri Öncü

The Poverty of Neo-liberal Economics: Lessons from Türkiye’s ‘Unorthodox’ Central Banking Experiment

February 16, 2025T. Sabri Öncü and Güney DüzçayThis article first appeared in the Indian journal, Economic & Political Weekly, on 14 September 2024. Güney Düzçay ([email protected]) and T. Sabri Öncü ([email protected]) are economists based in Türkiye.Historically, central banks, like the Bank of England, were primarily established to finance wars and manage government finances—serving as the “government’s bank.” Later, they evolved to address commercial and financial crises through their role as lenders of last resort and their regulatory power, acting as the “bankers’ bank.” During the 20th century, particularly in advanced economies, central banks adopted new roles, such as moderating business cycles. While moderating business cycles has become a prominent function, it is important to remember that the

Read More »From Chile in 1973 to Argentina and Türkiye in 2023: Economic Genocide Continues

May 24, 2024In Memory of Andre Gunder FrankA slightly edited version of this article first appeared in the Economic & Political Weekly on 11 May 2024.Economic GenocideThe concept of economic genocide originated in an article published in 1976 in this journal [Economic & Political Weekly]. In his open letter titled “Economic Genocide in Chile: Open Letter to Milton Friedman and Arnold Harberger,” Andre Gunder Frank (1976) gave a brief summary of the Chicago-style economic policy the military dictatorship started to implement after the 11 September 1973 coup d’état, which ended as:— and restructure production and then redirect investment to permit the still greater promotion of “non-traditional” exports of food, raw materials and manufactures at the expense of the Chilean consumers, whose most essential

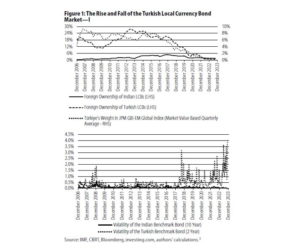

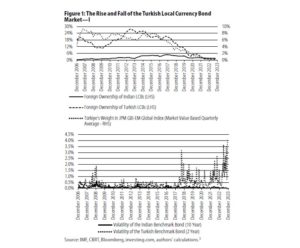

Read More »India’s Inclusion in the JP Morgan GBI-EM (bond) Indices

December 5, 2023A Path to Eden or Just Another Sin?Güney Düzçay and T. Sabri ÖncüThis article first appeared in the 24 November 2023 issue of the Indian journal, Economic and Political Weekly.IntroductionThe concept of “original sin” was introduced by Eichengreen and Hausmann (1999), defining it as “a situation in which the domestic currency cannot be used to borrow abroad or to borrow long term, even domestically.” Subsequently, Eichengreen et al. (2003) redefined the concept as a country’s inability to borrow abroad in its own currency, suggesting the term “domestic original sin” for the country’s inability to borrow in its own currency long-term domestically. We adopt the Eichengreen et al. (2003) definition of original sin.Armed with this information, let us now delve into India’s inclusion in JP

Read More »India’s Inclusion in the JP Morgan GBI-EM (bond) Indices

December 5, 2023A Path to Eden or Just Another Sin?Güney Düzçay and T. Sabri ÖncüThis article first appeared in the 24 November 2023 issue of the Indian journal, Economic and Political Weekly.IntroductionThe concept of “original sin” was introduced by Eichengreen and Hausmann (1999), defining it as “a situation in which the domestic currency cannot be used to borrow abroad or to borrow long term, even domestically.” Subsequently, Eichengreen et al. (2003) redefined the concept as a country’s inability to borrow abroad in its own currency, suggesting the term “domestic original sin” for the country’s inability to borrow in its own currency long-term domestically. We adopt the Eichengreen et al. (2003) definition of original sin.Armed with this information, let us now delve into India’s inclusion in JP

Read More »India’s Inclusion in the JP Morgan GBI-EM (bond) Indices

December 5, 2023A Path to Eden or Just Another Sin?

Güney Düzçay and T. Sabri Öncü

This article first appeared in the 24 November 2023 issue of the Indian journal, Economic and Political Weekly.

Introduction

The concept of “original sin” was introduced by Eichengreen and Hausmann (1999), defining it as “a situation in which the domestic currency cannot be used to borrow abroad or to borrow long term, even domestically.” Subsequently, Eichengreen et al. (2003) redefined the concept as a country’s inability to borrow abroad in its own currency, suggesting the term “domestic original sin” for the country’s inability to borrow in its own currency long-term domestically. We adopt the Eichengreen et al. (2003) definition of original sin.

Armed with this information, let us now delve into India’s inclusion in

To Loot or Not to Loot? How Public-Private Partnerships Harmed Turkey

August 4, 2022This article first appeared in the Indian journal Economic and Political Weekly on 18 July 2022.A Murder in KonyaKonya is a province in Turkey. On 6 July 2022, about an hour before I started writing this article, a murder news hit the Turkish pages of the internet: “In Konya City Hospital, a patient shot and killed a cardiologist and his secretary today.” Whether the assassin committed suicide or the private security killed him is unknown, although there are both rumours.City hospitals, the third largest public–private partnership (PPP) endeavour in Turkey, are the second leg of the Healthcare Reform Programme started by the governing Justice and Development Party (JDP) after it won the election in the late 2002. Also known as the Health Transformation Programme, the World Bank supported

Read More »To Loot or Not to Loot? How Public-Private Partnerships Harmed Turkey

August 4, 2022This article first appeared in the Indian journal Economic and Political Weekly on 18 July 2022.

A Murder in Konya

Konya is a province in Turkey. On 6 July 2022, about an hour before I started writing this article, a murder news hit the Turkish pages of the internet: “In Konya City Hospital, a patient shot and killed a cardiologist and his secretary today.” Whether the assassin committed suicide or the private security killed him is unknown, although there are both rumours.

City hospitals, the third largest public–private partnership (PPP) endeavour in Turkey, are the second leg of the Healthcare Reform Programme started by the governing Justice and Development Party (JDP) after it won the election in the late 2002. Also known as the Health Transformation Programme, the World Bank

To Loot or Not to Loot? How Public-Private Partnerships Harmed Turkey

August 4, 2022This article first appeared in the Indian journal Economic and Political Weekly on 18 July 2022.A Murder in KonyaKonya is a province in Turkey. On 6 July 2022, about an hour before I started writing this article, a murder news hit the Turkish pages of the internet: “In Konya City Hospital, a patient shot and killed a cardiologist and his secretary today.” Whether the assassin committed suicide or the private security killed him is unknown, although there are both rumours.City hospitals, the third largest public–private partnership (PPP) endeavour in Turkey, are the second leg of the Healthcare Reform Programme started by the governing Justice and Development Party (JDP) after it won the election in the late 2002. Also known as the Health Transformation Programme, the World Bank supported

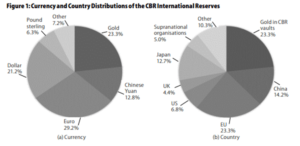

Read More »A War No One Can Win – Ukraine and the Weaponisation of Everything

March 28, 2022This article first appeared in the Indian journal Economic and Political Weekly on 19 March 2022.

Russian Invasion of Ukraine

The Russian invasion of Ukraine started on 24 February 2022. Since then, several thousand combatants from both sides and more than 500 Ukrainian civilians have died, bombs have ruined many cities, and more than two million Ukrainians, half of them children, left the country to become refugees. And the sweeping sanctions the West imposed on Russia in response not only devastated the Russian and Ukrainian economies but also brought the world to the brink of a deep global inflationary recession, worsening the economic hardship of the poor around the globe. Writing a cold-blooded analysis of the sanctions in the midst of witnessing this tragedy, one of the greatest in

A War No One Can Win – Ukraine and the Weaponisation of Everything

March 28, 2022This article first appeared in the Indian journal Economic and Political Weekly on 19 March 2022.Russian Invasion of UkraineThe Russian invasion of Ukraine started on 24 February 2022. Since then, several thousand combatants from both sides and more than 500 Ukrainian civilians have died, bombs have ruined many cities, and more than two million Ukrainians, half of them children, left the country to become refugees. And the sweeping sanctions the West imposed on Russia in response not only devastated the Russian and Ukrainian economies but also brought the world to the brink of a deep global inflationary recession, worsening the economic hardship of the poor around the globe. Writing a cold-blooded analysis of the sanctions in the midst of witnessing this tragedy, one of the greatest in

Read More »A War No One Can Win – Ukraine and the Weaponisation of Everything

March 28, 2022This article first appeared in the Indian journal Economic and Political Weekly on 19 March 2022.Russian Invasion of UkraineThe Russian invasion of Ukraine started on 24 February 2022. Since then, several thousand combatants from both sides and more than 500 Ukrainian civilians have died, bombs have ruined many cities, and more than two million Ukrainians, half of them children, left the country to become refugees. And the sweeping sanctions the West imposed on Russia in response not only devastated the Russian and Ukrainian economies but also brought the world to the brink of a deep global inflationary recession, worsening the economic hardship of the poor around the globe. Writing a cold-blooded analysis of the sanctions in the midst of witnessing this tragedy, one of the greatest in

Read More »Why are the long-term US Treasury yields falling?

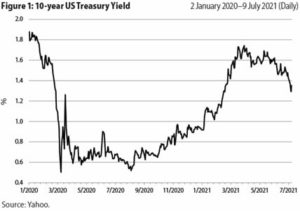

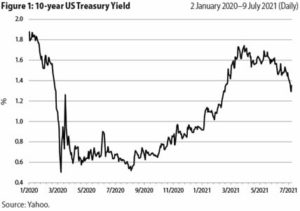

July 22, 2021This article first appeared in the Indian journal Economic and Political Weekly on 17 July, 2021.First, let me answer the question in the title: I do not know because, according to conventional theories, when the realised and expected inflation rates are as high as they are in the United States (US), the long-term US Treasury yields should go up.Although the realised and expected inflation rates have been going up since April 2021, the long-term US Treasury yields, however, have not been rising. Not only that, but they have started falling. We see this from Figure 1, which is the daily graph of the 10-year US Treasury yield from 2 January 2020 to 9 July 2021.The 10-year yield is the most important of the long-term US Treasury yields since it is a vital financial benchmark. It influences

Read More »Why are the long-term US Treasury yields falling?

July 22, 2021This article first appeared in the Indian journal Economic and Political Weekly on 17 July, 2021.

First, let me answer the question in the title: I do not know because, according to conventional theories, when the realised and expected inflation rates are as high as they are in the United States (US), the long-term US Treasury yields should go up.

Although the realised and expected inflation rates have been going up since April 2021, the long-term US Treasury yields, however, have not been rising. Not only that, but they have started falling. We see this from Figure 1, which is the daily graph of the 10-year US Treasury yield from 2 January 2020 to 9 July 2021.

The 10-year yield is the most important of the long-term US Treasury yields since it is a vital financial benchmark. It

Why are the long-term US Treasury yields falling?

July 22, 2021This article first appeared in the Indian journal Economic and Political Weekly on 17 July, 2021.First, let me answer the question in the title: I do not know because, according to conventional theories, when the realised and expected inflation rates are as high as they are in the United States (US), the long-term US Treasury yields should go up.Although the realised and expected inflation rates have been going up since April 2021, the long-term US Treasury yields, however, have not been rising. Not only that, but they have started falling. We see this from Figure 1, which is the daily graph of the 10-year US Treasury yield from 2 January 2020 to 9 July 2021.The 10-year yield is the most important of the long-term US Treasury yields since it is a vital financial benchmark. It influences

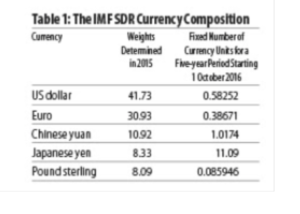

Read More »COVID 19-related debt relief: a consortium proposal to the SDR basket countries

November 28, 2020By T. Sabri Öncü & Ahmet ÖncüIn Memory of David Graeber (1961–2020)This article first appeared in the Indian journal, Economic and Political Weekly, on 21 November, 2020On 30 March 2020, the United Nations Conference on Trade and Development (UNCTAD) called for a $2.5 trillion COVID-19 crisis package for developing countries.[1] The UNCTAD proposals were: (i) $1 trillion to be made available through the expanded use of the International Monetary Fund (IMF) issued Special Drawing Rights (SDRs); (ii) $1 trillion for debt cancellation; (iii) $500 billion to fund a Marshall Plan for health recovery to be dispersed as grants.Shortly after the UNCTAD

Read More »In Memory of David Graeber – COVID 19-related debt relief

November 28, 2020By T. Sabri Öncü & Ahmet Öncü

In Memory of David Graeber (1961–2020)

This article first appeared in the Indian journal, Economic and Political Weekly, on 21 November, 2020 under the title “A Consortium Proposal to the SDR Basket Countries”

On 30 March 2020, the United Nations Conference on Trade and Development (UNCTAD) called for a $2.5 trillion COVID-19 crisis package for developing countries.[1] The UNCTAD proposals were: (i) $1 trillion to be made available through the expanded use of the International Monetary Fund (IMF) issued Special Drawing Rights (SDRs); (ii) $1 trillion for debt cancellation; (iii) $500 billion to fund a Marshall Plan for health recovery to be dispersed as grants.

Shortly after the UNCTAD call, many others jumped on to the bandwagon, and on 12 April 2020, even

Debt, wealth and climate: globally coordinated Climate Authorities for green financing

April 23, 2020By T.Sabri Öncü & Ahmet Öncü This article first appeared in the Indian journal, Economic and Political Weekly on 18 April 2020. The authors’ contact details are at he foot of this article.Abstract Based on the German Currency Reform of 1948 and the “Modern Debt Jubilee” of Steve Keen, a globally coordinated orderly debt deleveraging mechanism is proposed to address the global debt overhang problem. Since the global debt overhang and lack of sufficient climate finance flows are interconnected, Climate Authorities are added to the mechanism. Note: We completed this article two months before the Coronavirus Crisis that started in January 2020. Although we present the article as is, the Climate Authority we propose can be expanded to meet the funding needs of fighting the

Read More »Triggering a Global Financial Crisis: Covid-19 as the Last Straw

March 18, 2020Photo – Black swans in Regent’s Park, London – by Jeremy Smith

T. Sabri Öncü ([email protected]) is an economist based in İstanbul, Turkey. This article was written on 8 March 2020 and first published in the Indian journal Economic and Political Weekly on 14 March 2020.Whether a black swan or a scapegoat, Covid-19 is an extraordinary event. Declared by the WHO as a pandemic, Covid-19 has given birth to the concept of the economic “sudden stop.” We need extraordinary measures to contain it.Initially referred to as the novel coronavirus 2019, the coronavirus disease (Covid-19) originated late in

Read More »Dealing with the overhang of non-financial private debt

November 19, 2019Building on the International Monetary Fund (IMF) Global Debt Database (GDD) comprising debts of the public and private non-financial sectors for 190 countries dating back to 1950, Mbaye et al (2018) identify a recurring pattern where households and firms are forced to deleverage in the face of a debt overhang, dampening growth, eliciting the injection of public money to kick-start the economy. They observe that this substitution of public for private debt takes place whether or not the private debt deleveraging concludes with a financial crisis, and deduce that this is not just a crisis story but a more prevalent

Read More »The End of Super Imperialism?

October 1, 2019T Sabri Öncü ([email protected]) is an economist based in İstanbul, Turkey. This article was first published in the Indian journal the Economic and Political Weekly (EPW) on 28 September 2019.Summary: With intensifying concerns regarding the soundness and stability of the international monetary and financial system, calls for reforming it have been on the rise. One recent call was made by the Bank of England Governor Mark Carney, in August 2019, in which he suggested a synthetic hegemonic currency to replace the US dollar as the key reserve currency. Whether such calls will lead to an end of the key reserve currency status of the dollar remains to be seen. Oldrich Vasicek is an old friend. When I started my “quant” career in bonds in January 1994 in Walnut Creek,

Read More »Thus Spoke the Bond Market

June 20, 2019T Sabri Öncü ([email protected], @tsoncu) is an economist based in İstanbul, Turkey. This article was sent on 7 June 2019 and published first on 15 June 2019 in the Indian journal Economic and Political Weekly. Summary: Would market volatility amidst global trade tensions and uncertainty cause a global recession? Although the world’s major central banks had managed to avoid risks in the first week of June, despite some small variations at some maturities, the United States yield curve remained more or less as it was at the beginning. What will happen in the not-so-distant future? The titles of a few recent articles

Read More »Are We Heading towards a Synchronised Global Slowdown?

February 13, 2019This article first appeared in the Indian journal Economic and Political Weekly on February 9, 2019.Abstract: The global economy is heading towards a downturn. However, is the world prepared to deal with the consequences? Whether it is a slowdown or recession, it remains to be seen as to what the future would hold for the banking systems of Eurozone and China, and the global stocks in general.When the International Monetary Fund (IMF) issued its World Economic Outlook Update in January 2018, the future looked bright. Indeed, even the title of the update was very optimistic: Brighter Prospects, Optimistic Markets, Challenges

Read More »A private debt story: Republic of Turkey (un-)hires McKinsey

October 16, 2018From earlier private debt crisis 10 years ago – President Bush welcomes then Prime Minister Erdogan of Turkey to the G20 Summit on Financial Markets and the World Economy, Nov. 15 2008, Washington D.C. White House photo by Chris Greenberg.

This article first appeared in the Indian Journal the Economic & Political Weekly on 12 October 2018 About four years ago, I penned an article in the Economic and Political Weekly titled, “A Sovereign Debt Story: Republic of Argentina vs NML Capital” (EPW, 17 May 2014 ). Many things have happened since then and it is time to write a private debt story now,

Read More »Did This Straw Break the Finance Sector’s Back?

July 4, 2018Image with acknowledgment to http://carolinaparrothead.blogspot.com/2016/05/breaking-camels-back.html

Abstract: The world’s financial markets are hurtling towards a new phase of crises ranging from currency to balance of payments to sovereign debt to banking crises. The monetary tightening policies of the United States Federal Reserve and the European Central Bank will only precipitate crises in emerging market as well as peripheral eurozone economies, which will have global repercussions.Prologue: the story so far…I will define the ‘straw’, and start with quoting from my July 2017 H T Parekh Finance

Read More »Debts That Cannot Be Paid Will Not Be

July 20, 2017Photo, International Finance Place, Guangzhou, China, by Jeremy Smith

Total global debt has increased, growth has been slowing down since the onset of the global financial crisis in 2007 and has been rapidly decelerating after 2012. This may be a sign that the world has arrived at its debt carrying capacity or has even crossed it, meaning that capitalism is probably already insolvent.With my June 2015 HT Parekh Finance Column article titled “When Will the Next Financial Crisis Start?” (Öncü 2015a) I initiated an investigation of the possibility of a new phase in the ongoing global financial crisis

Read More »