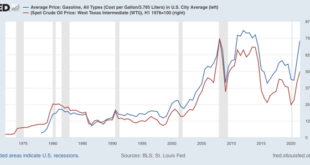

The economic tailwind from last autumn’s declining gas prices is probably over – by New Deal democrat On Wednesday I discussed how gas prices, with an assist from higher stock prices leading to stock options being cashed in, was the primary reason why the coincident indicators hadn’t rolled over yet. I wanted to explore that a little more: was the boost from lower gas prices going to allow for a “soft landing,” or a “modified limited...

Read More »Understanding Inflation using Gasoline Prices

Seems that gas, fuel, gasoline is being used as a marker to understand just how horrible we have it as a result of the current inflation. It’s just sooooooooooo terrible. I’ll just say this. As a marker of inflation and our personal economic experience all it shows is how terrible we are at remembering. Unfortunately for us, such a bad memory leads us to terrible voting decisions. Though, it does allow for easy emotional manipulation of the citizenry...

Read More »The current spike in gas prices

The current spike in gas prices is not sufficient to bring about a recession (at least, not yet!) [Well, I never got around to a COVID update last week. Since most States don’t report over the weekend, I am going to wait until tomorrow. But the bullet point hint is: it increasingly looks like Omicron did what I expected Delta to do last fall. Stay tuned . . . ] Gas prices in my neck of the woods hit $4 over the weekend, and seem to be center...

Read More »Gas prices sound a consumer warning

Gas prices sound a consumer warning I got a note yesterday from a fellow forecaster pointing out that crude oil prices have once again made new 7 year highs. This is something I also highlighted in my “Weekly Indicators” column on Saturday. As I write this on Wednesday morning, West Texas Intermediate Crude trades at slightly under $90/barrel, yet another new 7+ year high. How much trouble does this portend for the economy? Potentially, a...

Read More » Heterodox

Heterodox