By Naked Keynes (Anonymous Guest Blogger)The positive relationship between nominal interest rates and inflation is not a new stylized fact in economic theory. In the 19th Century Thomas Tooke (1774-1858) considered it a general rule illustrated by the data presented in his History of Prices and the State of Circulation, 1792-1856 (published over the period 1838-1857). Tooke rationalized the positive relationship between inflation and interest rates by postulating that the interest rate...

Read More »Lara-Resende, Cochrane and the Brazilian Recession

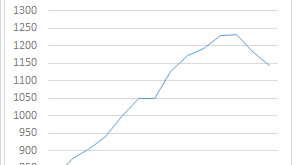

GDP has collapsed by a bit more than 7% in real terms over the last two years in Brazil (graph below show more recent data). This constitutes the worst crisis in recorded macroeconomic history, worse than the debt crisis of the early 1980s, and even the Great Depression. The reasons for this crisis are entirely self-inflicted. I discussed those issues before here (and here). The problem is not fiscal, which resulted from the crisis, nor external, since there was no real issue in financing...

Read More »Clarida on Fed policy: or how does the Fed affect inflation

Richard Clarida gave an interview (right at the beginning of the podcast) on why the Fed should increase the rate of interest. He also said that the Fed can affect inflation, which, he correctly points out, is denied by several economists. However, the degree of confusion on this subject is significant, and modern monetary theory, and its implications for central banking behavior, is, in part, responsible for that.The conventional wisdom on what central banks can do (and one can think of...

Read More » Heterodox

Heterodox