Below are the slides from my presentation at Beyond Covid on 12th June. The whole webinar can ve viewed here.The pandemic seems to me to resemble the "nuclear disaster" scenarios of my youth: hide in the bunker, then creep out when the immediate danger is over, only to find a world that is still dangerous and has fundamentally changed in unforeseeable ways. Rabbits hiding from a hawk is perhaps a kinder image, though hawks don't usually leave devastation in their wake. And I like rabbits. So...

Read More »Pandemic economics: the role of central banks and monetary policy

Below are the slides from my presentation at Beyond Covid on 12th June. The whole webinar can ve viewed here.The pandemic seems to me to resemble the "nuclear disaster" scenarios of my youth: hide in the bunker, then creep out when the immediate danger is over, only to find a world that is still dangerous and has fundamentally changed in unforeseeable ways. Rabbits hiding from a hawk is perhaps a kinder image, though hawks don't usually leave devastation in their wake. And I like rabbits. So...

Read More »Doing “Whatever It Takes”

The economy slumbers in its induced coma. Businesses are closed, workers furloughed or laid off. But the astonishing headline falls in economic indicaters such as GDP and PMI conceal a grim reality. Businesses are closing not just because they have been ordered to do so, but because they are running out of money. And people who have lost their jobs or become ill are also running out of money. If businesses fail instead of being mothballed, the eventual economic recovery will be slow. And...

Read More »Doing “Whatever It Takes”

The economy slumbers in its induced coma. Businesses are closed, workers furloughed or laid off. But the astonishing headline falls in economic indicaters such as GDP and PMI conceal a grim reality. Businesses are closing not just because they have been ordered to do so, but because they are running out of money. And people who have lost their jobs or become ill are also running out of money. If businesses fail instead of being mothballed, the eventual economic recovery will be slow. And...

Read More »When is the right time for UBI and helicopter money?

“Give me chastity and continence, but not yet,” sighed St. Augustine in his Confessions. Today, as the world reels under the impact of coronavirus, policymakers are at last reaching for tools I have long advocated: helicopter money and Universal Basic Income. And yet, like St. Augustine, I find myself sighing, “Lord, grant us helicopter money and Universal Basic Income, but not yet.”I have spent much of the last decade advocating giving people money. Helicopter money in recessions, to...

Read More »When is the right time for UBI and helicopter money?

“Give me chastity and continence, but not yet,” sighed St. Augustine in his Confessions. Today, as the world reels under the impact of coronavirus, policymakers are at last reaching for tools I have long advocated: helicopter money and Universal Basic Income. And yet, like St. Augustine, I find myself sighing, “Lord, grant us helicopter money and Universal Basic Income, but not yet.”I have spent much of the last decade advocating giving people money. Helicopter money in recessions, to...

Read More »Money creation in a post-crisis world

As many of you know, I have spent much of the last seven years explaining to anyone who will listen that banks do not "lend out" deposits or reserves. Rather, they create both loan assets and matching deposit liabilities "from nothing" by means of double entry accounting entries. Creating money with a stroke of the pen (or a few taps on a computer keyboard) is what banks do.But this does not mean that the money that banks create comes from nowhere. It doesn't. It is only created when they...

Read More »Keynes and the Quantity Theory of Money

"Best diss of the Quantity Theory of Money comes from Keynes", commented Toby Nangle on Twitter, referring to this paragraph from Keynes's Open Letter to Roosevelt (Toby's emphasis): The other set of fallacies, of which I fear the influence, arises out of a crude economic doctrine commonly known as the Quantity Theory of Money. Rising output and rising incomes will suffer a set-back sooner or later if the quantity of money is rigidly fixed. Some people seem to infer from this that output...

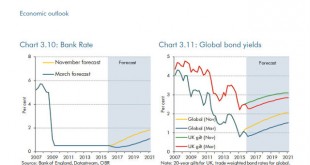

Read More »Bond yields and helicopters

The ever-optimistic OBR has some encouraging forecasts for interest rates and global government bond yields: Well, ok, they were rather more encouraging in November than they are now. The uplift was supposed to start ANY DAY NOW, but there has been an interruption to normal service. Leaves on the line, perhaps. Or the wrong sort of snow.The trouble is, the OBR has a long record of hockey-stick forecasting. Not that it is unique in having a noticeable bias to the upside: If ever there were...

Read More » Heterodox

Heterodox