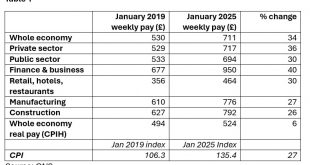

Today (Thursday), the Office for National Statistics published its monthly set of employment stats. While its Labour Force Survey has been under the cosh for some time for unreliability, the ONS’s data on average wage rates and changes retain their importance. The data – this time for January 2025 – covers average total pay, regular pay and bonus pay for the whole workforce. It also provides average wage data by broad sector.The ONS also publishes its estimate of ‘real pay’ after taking...

Read More »Monetary Policy Debates in the Age of Deglobalisation: the Turkish Experiment-II

By Hasan Cömert & T. Sabri Öncü This article first appeared in the Economic & Political Weekly on 18 March 2023. This article is the second in a series of articles on monetary policy debates in the age when deglobalisation became a buzzword. Here, we begin our discussion of the ongoing economic experiment in Turkey as an example to elaborate on these debates. In the third article, we will turn our attention to the post-2018 Turkish currency crisis phase of the experiment by focusing...

Read More »Monetary Policy Debates in the Age of Deglobalisation: the Turkish Experiment-II

By Hasan Cömert & T. Sabri ÖncüThis article first appeared in the Economic & Political Weekly on 18 March 2023.This article is the second in a series of articles on monetary policy debates in the age when deglobalisation became a buzzword. Here, we begin our discussion of the ongoing economic experiment in Turkey as an example to elaborate on these debates. In the third article, we will turn our attention to the post-2018 Turkish currency crisis phase of the experiment by focusing on...

Read More »Monetary Policy Debates in the Age of Deglobalisation: the Turkish Experiment-II

By Hasan Cömert & T. Sabri ÖncüThis article first appeared in the Economic & Political Weekly on 18 March 2023.This article is the second in a series of articles on monetary policy debates in the age when deglobalisation became a buzzword. Here, we begin our discussion of the ongoing economic experiment in Turkey as an example to elaborate on these debates. In the third article, we will turn our attention to the post-2018 Turkish currency crisis phase of the experiment by focusing on...

Read More »Settling the public sector pay disputes now – modest cost, big benefits

Another week goes by. Hundreds of thousands of workers, mainly public sector, on strike last week, and again this week. Pay deals way below inflation. Zero movement from government. Continuing disruption and decay. Why can’t a settlement be reached? Just before Christmas, Prime Minister Sunak told us “I want to make sure that we reduce inflation and part of that is being responsible in setting public sector pay..” On 1st February, Mr Sunak’s Official Spokesman said “We want to have...

Read More »Settling the public sector pay disputes now – modest cost, big benefits

Another week goes by. Hundreds of thousands of workers, mainly public sector, on strike last week, and again this week. Pay deals way below inflation. Zero movement from government. Continuing disruption and decay. Why can’t a settlement be reached?Just before Christmas, Prime Minister Sunak told us“I want to make sure that we reduce inflation and part of that is being responsible in setting public sector pay..”On 1st February, Mr Sunak’s Official Spokesman said“We want to have further...

Read More »Settling the public sector pay disputes now – modest cost, big benefits

Another week goes by. Hundreds of thousands of workers, mainly public sector, on strike last week, and again this week. Pay deals way below inflation. Zero movement from government. Continuing disruption and decay. Why can’t a settlement be reached?Just before Christmas, Prime Minister Sunak told us“I want to make sure that we reduce inflation and part of that is being responsible in setting public sector pay..”On 1st February, Mr Sunak’s Official Spokesman said“We want to have further...

Read More »Central bankers, inflation “cousins” & the real threat to the global economy

Kaye Wiggins in the Financial Times explains that private equity groups, including Blackrock, deliberately inflate the value of their own assets – by buying and then selling said assets to themselves. She shows that the buyout business resembles a pyramid scheme with “circular” deals sold between and within private ownership at high valuations – fuelling asset price inflation.“Windscreen repair and replacement company Belron, which operates internationally under brands including Autoglass...

Read More »Central bankers, inflation “cousins” & the real threat to the global economy

Kaye Wiggins in the Financial Times explains that private equity groups, including Blackrock, deliberately inflate the value of their own assets – by buying and then selling said assets to themselves. She shows that the buyout business resembles a pyramid scheme with “circular” deals sold between and within private ownership at high valuations – fuelling asset price inflation. “Windscreen repair and replacement company Belron, which operates internationally under brands including Autoglass...

Read More »Central bankers, inflation “cousins” & the real threat to the global economy

Kaye Wiggins in the Financial Times explains that private equity groups, including Blackrock, deliberately inflate the value of their own assets – by buying and then selling said assets to themselves. She shows that the buyout business resembles a pyramid scheme with “circular” deals sold between and within private ownership at high valuations – fuelling asset price inflation.“Windscreen repair and replacement company Belron, which operates internationally under brands including Autoglass...

Read More » Heterodox

Heterodox