A little while back, Pavlina Tcherneva appeared with Bloomberg’s Joe Weisenthal to talk about the potential infrastructure policy of president-elect Donald Trump. She noted that, contrary to initial assumptions, the upcoming administration may not end up pushing public-debt-financed infrastructure spending, and that if the program simply amounts to tax incentives and public-private partnerships, it won’t be nearly as effective. But Tcherneva added another important dimension to this...

Read More »Wray on Minsky on “Hopping Mad”

On Monday, 31 October 2016, Dr. L. Randall Wray was on the radio program and podcast, Hopping Mad with Will McLeod & Arliss Bunny. The focus of the interview was Wray’s newest book, Why Minsky Matters: An Introduction to the Work of a Maverick Economist. The interview was more than an hour long so Wray was able to give lengthy answers without being pressured for time. Dr. Wray’s book, Why Minsky Matters can be found on the Princeton University Press website and on Amazon where it is is...

Read More »Minsky Meets Brazil Part IV

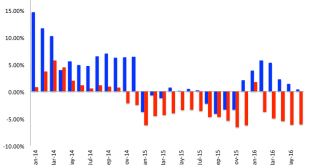

By Felipe Rezende Part IV This last part of the series (see Part I, II, and III here, here and here) will focus on the Brazilian response to the crisis. What Should Brazil do? The Brazilian current crisis fit with Minsky’s theory of instability (see here, here and here). The traditional response to a Minsky crisis involves government deficits to allow the non-government sector to net save. That is, if the private sector desire to net save increases, then fiscal deficits increase to allow it...

Read More »Minsky’s financial instability hypothesis

[embedded content] From Boom, Bust, Boom. Not the best explanation, but accessible. In this version is all about confidence, which is not particularly heterodox. Btw, slow posting will continue until mid-August.

Read More »Boom Bust Boom and the South Sea Bubble

Terry Jones documentary Boom Bust Boom has been out for a while. Worth watching too. The Economist gave it a reasonable review. And there are Minsky and Galbraith puppets. [embedded content] Above a brief, and simple discussion of the South Sea Bubble. I think role of trade with Spanish America is exaggerated. The most relevant part of the scheme was the public debt swap. Dale's The First Crash provides an interesting account of it.

Read More »Why Minsky Matters Events

This weekend: March 11th – 15th 2016, there are events taking place at the Village East Cinemas in New York including a book signing by Randy Wray on the 15th as well as screening of the movie. You can get all the details and list of guest appearances from Village East Cinema’s website here. Flyer for the book signing is after the jump. Why Minsky Matters Events [embedded content] [Translate]

Read More »Why Minsky Matters: An Introduction to the Work of a Maverick Economist

Victoria Bateman has a review of Randall Wray’s book “Why Minsky Matters: An Introduction to the Work of a Maverick Economist” over at Times Higher Education. You can read the review here. [Translate]

Read More »Steve Keen on Minsky, the Great Depression and the Global Financial Crisis of 2008

This is lecture 6 of Steve Keen’s course on economics at Kingston University in the UK. It concerns the theories of Hyman Minsky, financial instability, the Great Depression and the global financial crisis of 2008.[embedded content]

Read More »Randy Wray Discusses his book, Why Minsky Matters, on the Radio

NEP’s Randy Wray will be interviewed tonight on Bob Brinker’s nationally syndicated ABC talk radio show Money Talk, Sunday December 6th at 6:15pm ET for around 30 minutes. Wray will discuss his new book Why Minsky Matters: An Introduction to the work of a maverick economist, Princeton University Press. The show airs live on 200 ABC affiliates including all major markets. Former guests include Alan Greenspan, Sheila Bair, Alan Blinder, Paul O’Neill, William Isaac, Peter Thiel, Joseph...

Read More » Heterodox

Heterodox