By J.D. ALT Recently, I’ve been trying to zero in on a peculiar set of ingredients that seem to be baked into our economic pie―and which are depriving that pie of a sustenance we, as a collective society, need it to provide. The peculiar ingredients have to do with our monetary system. Specifically, the fact that we―whether intentionally or by happenstance―have put in place and operate a money system that seamlessly creates dollars, as necessary, for profit-making enterprise, but...

Read More »CROWDSOURCING the COLLECTIVE “WE”

By J.D. ALT Let’s jump ahead to the day (surely it will come, right?) when we realize a general consensus has actually been established that, yes, it IS possible to sustainably pay for collective goods and services by the direct issuing of sovereign fiat dollars―that our federal government doesn’t have to collect taxes in order to have dollars to spend, that it doesn’t have to issue Treasury bonds to get the dollars it needs but imagines it doesn’t have. Now that we’re here in this future...

Read More »A Quick Point about Bill Mitchell’s Views on Speculative Capital Movements

Bill Mitchell sketches his views on international speculative capital movements here:“… I do not think that the imposition of country-by-country capital controls is the best way to eliminate the destructive macroeconomic impacts of rapid inflows or withdrawals of financial capital.If we consider that the only productive role of the financial markets is to advance the social welfare of the citizens – that is, advancing public purpose – then it is likely that a whole range of financial...

Read More »Another Dimension

By Thornton “Tip” Parker As NEP readers know, the economy consists of private, government, and foreign sectors. Financial flows among the sectors always add up to zero; that is, one sector’s deficits must be offset by surpluses in either or both of the others. If the private sector imports more than it exports, ignoring investment flows, it will run a financial deficit while the foreign sector runs a surplus and the economy will then slow down as money in the private sector becomes...

Read More »A Perfect Example

By J.D. Alt Recent news reports lament the on-going collapse of America’s coal industry―specifically the spectacular loss of jobs which is devastating not only families but entire local economies and communities. On a PBS news report, a woman who’d worked for a local mining company for thirty years teared up and asked the reporter, “What in the world am I going to do?” At a recent event sponsored by Wyoming Public Radio, attendees were asked to fill out 5X7 cards with suggestions about how...

Read More »Video

By J.D. Alt I spent the last couple days reading and contemplating “Political Aspects of Full Employment”, the transcript of a lecture―given in 1942!!―to the Marshall Society by economist Michal Kalecki. This was recommended to me by Nat Uerlich in his May 2 comment to my post “False Choice or Real Possibilities.” Many thanks to Mr. Uerlich for taking the time to make the comment. I urgently recommend Professor Kalecki’s lecture to anyone who feels a little fuzzy (as I have lately been...

Read More »Bill Mitchell on the Euro, Austerity and MMT

Nice, short interviews.[embedded content][embedded content][embedded content][embedded content][embedded content]

Read More »The Urgent Need to Save Orthodox Economists from their Crippling Myths

William K. Black February 29, 2016 Brooklyn, N.Y. A blogger has trolled all heterodox economists as believers in the “occult.” More precisely, he is upset about “econ people” (who are likely not economists) and who tweet him or post comments on his blog site. The blogger further complains that these commenters say that they believe in heterodox economics and “new methodologies [that] are poised to topple mainstream economics.” He then goes on to say: “My typical response is to ask...

Read More »Limits of MMT

The Modern Monetary Theory (MMT) idea – or at least the idea shared by some supporters of MMT online – that imports are only ever a benefit and MMT is a viable policy for all nations are badly mistaken ideas.Now MMT would work for the US, Western Europe, Australia, Japan, South Korea or Taiwan, but not for much of the Third World.That is, MMT-style policies are best suited for advanced capitalist nations, not necessarily for Third World countries, because most of them face severe balance of...

Read More »The Ogre & the Cog

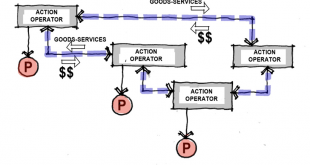

By J.D. ALT Classically, we imagine money being aggregated by an entrepreneur who uses it to build a factory, purchase raw materials, hire labor, and begin manufacturing widgets which are then sold in the marketplace. This same result could be had by the process of an ogre appropriating a factory by intimidation, acquiring raw materials by force, and using slave labor to produce the widgets. The difference is that, in the first case, the process produces customers (the laborers) who can...

Read More » Heterodox

Heterodox