I joined The Investor’s Podcast for a special Masterclass in Inflation. In this episode we covered the following topics: 00:00:00 – Intro 00:00:45 – What is inflation, and what is it not 00:05:51 – How much of inflation is due to base effects 00:09:53 – How can expected inflation drive inflation 00:14:21 – If the current inflation is temporary 00:21:37 – How is inflation reflected in the real estate prices 00:28:27 – Why do we have regional differences in inflation 00:36:40 – If...

Read More »What is “Fractional Reserve Banking”?

The term “fractional reserve banking” is commonly used in a confusing manner in both mainstream economics and within lay conversations about economics. I hope this article with clear up some of the common confusions. Fractional reserve banking is the idea that banks take their reserves and lend them into some fraction based on the quantity of reserves they hold. This idea has been largely debunked since the financial crisis. In reality, banks do not lend their reserves, except to one...

Read More »Understanding Government Liabilities

I keep running into a strange issue in macroeconomic discussions – no one seems to agree on how we should account for government liabilities. For instance, Gold standard economists believe government issued cash is not a liability (even though the Federal Reserve specifically shows it as a liability on their balance sheet). MMT economists say government “debt” is an IOU, but not borrowed debt. They also, at times, refer to government debt as equity.¹ Other people think the government’s...

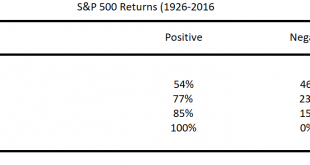

Read More »Why Stocks and Bonds are the Core of any Portfolio

“Stocks are overvalued and risky. Bonds yield nothing and expose you to interest rate risk. So you need to invest in alternative assets.” – Pretty Much Everyone I am a big advocate of a core and satellite approach to asset allocation. For instance, in my book I talked about the Total Portfolio approach. That is, everyone should own a diverse group of assets and consider how their Total Portfolio relates to what we typically think of as our “investment portfolio”. This might include real...

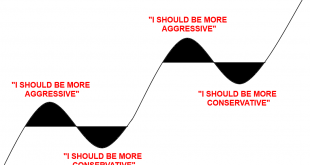

Read More »The Psychology of the Stock Market, in One Image

What a wild year it’s been. You could say that the pandemic was like an entire market cycle all rolled into one year. A boom, a bust and a boom. In January I wrote the following piece about how to manage a crazy booming stock market and avoid the temptation to get overly aggressive. Then just 3 months later I wrote this piece about how to manage a crazy collapse and avoid the temptation to get overly conservative. But this is the battle we constantly wage with ourselves. Successful...

Read More »40 Things I’ve Learned in 40 Years

I turn 40 years old today. Since I hate birthday presents I figured I’d pass along some of the presents people have taught me over the last 40 years. 1) Always try to be a good person. This is the most obvious one and also often the hardest one. Life is hard and everyone is fighting their own personal battles. Help them through it by being kind enough to try to understand their battle. 2) Never mistake money for wealth. The person who mistakes money for wealth will live a life...

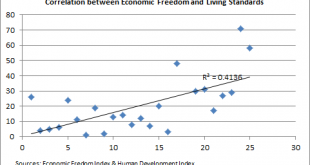

Read More »My View on “Late Stage Capitalism”

I am going to spend some time trying to put the debate about Capitalism and Socialism into perspective here. But before we can do that I need to properly define the terms because they’re used in a rather lazy manner in the mainstream media. So, let’s establish some understandings: Capitalism – a system in which the means of production are privately owned and the economic benefits of that production are distributed by the owners and regulated by the government. Socialism – a system in which...

Read More »EVERYONE Funds Their Spending

One of the most confused (and confusing) elements of endogenous money is the idea of “funding”. Endogenous money is not a new theory, but it is not well understood even to this day. Even many supposed endogenous money theorists, like the MMT people, misunderstand it and as MMT has gained some popularity I am seeing increasing misinterpretations. So let’s dive in and see if I can’t explain this more succinctly and clearly. Endogenous money is the fact that anyone can expand their balance...

Read More »Let’s Stop Talking About “Paying Off the National Debt”

When we talk about personal finance we often talk about paying off our debts to become financially free. But this is a fallacy of composition. While some households can pay off their debts, the economy actually relies on expanding debt (and assets) to have liquidity and growth. After all, debt isn’t necessarily bad. Yes, there are bad types of debt (like credit card debt which almost always have a negative long-term return), but there are also good types of debt (for instance, when someone...

Read More »Is Government Debt “Equity”?

I’ve noticed a trend in some economic circles that seems to stem from the Positive Money and MMT people – this idea that government “debt” is “equity”. While the taxonomy in mainstream macroeconomics can sometimes be messy I don’t think this is a case where we need to be trying to reinvent well established terms. Let me explain. First off, I understand the desire to create a more coherent taxonomy for terms that seem to have no meaning (for instance, the term “money” in mainstream macro),...

Read More » Heterodox

Heterodox