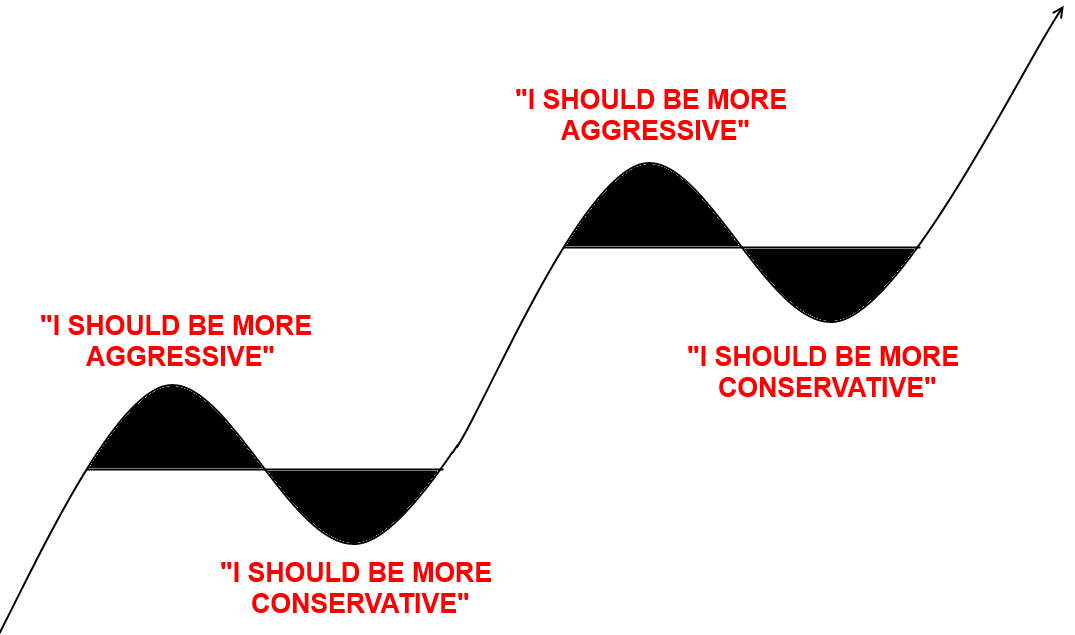

What a wild year it’s been. You could say that the pandemic was like an entire market cycle all rolled into one year. A boom, a bust and a boom. In January I wrote the following piece about how to manage a crazy booming stock market and avoid the temptation to get overly aggressive. Then just 3 months later I wrote this piece about how to manage a crazy collapse and avoid the temptation to get overly conservative. But this is the battle we constantly wage with ourselves. Successful investing is mostly a battle between our ears and staying grounded when everyone else is losing it on the extremes. The key is, how disciplined can you remain through the boom, bust, boom and bust? (The psychology of the stock market in one image)

Topics:

Cullen Roche considers the following as important: Behavioral Finance, Chart Of The Day, Essential Reading, Investing Basics, Recommended Reading, resources, Stuff You Should Read

This could be interesting, too:

Cullen Roche writes The Investors Podcast – Masterclass in Inflation

Cullen Roche writes What is “Fractional Reserve Banking”?

Cullen Roche writes The Scarcity of Money Myth

Cullen Roche writes Understanding Government Liabilities

What a wild year it’s been. You could say that the pandemic was like an entire market cycle all rolled into one year. A boom, a bust and a boom.

In January I wrote the following piece about how to manage a crazy booming stock market and avoid the temptation to get overly aggressive.

Then just 3 months later I wrote this piece about how to manage a crazy collapse and avoid the temptation to get overly conservative.

But this is the battle we constantly wage with ourselves. Successful investing is mostly a battle between our ears and staying grounded when everyone else is losing it on the extremes. The key is, how disciplined can you remain through the boom, bust, boom and bust?

(The psychology of the stock market in one image)