The term “fractional reserve banking” is commonly used in a confusing manner in both mainstream economics and within lay conversations about economics. I hope this article with clear up some of the common confusions. Fractional reserve banking is the idea that banks take their reserves and lend them into some fraction based on the quantity of reserves they hold. This idea has been largely debunked since the financial crisis. In reality, banks do not lend their reserves, except to one...

Read More »Understanding Government Liabilities

I keep running into a strange issue in macroeconomic discussions – no one seems to agree on how we should account for government liabilities. For instance, Gold standard economists believe government issued cash is not a liability (even though the Federal Reserve specifically shows it as a liability on their balance sheet). MMT economists say government “debt” is an IOU, but not borrowed debt. They also, at times, refer to government debt as equity.¹ Other people think the government’s...

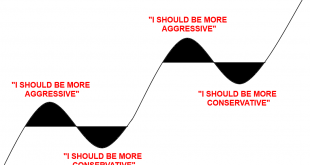

Read More »The Psychology of the Stock Market, in One Image

What a wild year it’s been. You could say that the pandemic was like an entire market cycle all rolled into one year. A boom, a bust and a boom. In January I wrote the following piece about how to manage a crazy booming stock market and avoid the temptation to get overly aggressive. Then just 3 months later I wrote this piece about how to manage a crazy collapse and avoid the temptation to get overly conservative. But this is the battle we constantly wage with ourselves. Successful...

Read More »40 Things I’ve Learned in 40 Years

I turn 40 years old today. Since I hate birthday presents I figured I’d pass along some of the presents people have taught me over the last 40 years. 1) Always try to be a good person. This is the most obvious one and also often the hardest one. Life is hard and everyone is fighting their own personal battles. Help them through it by being kind enough to try to understand their battle. 2) Never mistake money for wealth. The person who mistakes money for wealth will live a life...

Read More »Why is Shorting Stocks so Difficult?

Did you hear about Tesla? Yeah, it’s up a lot. A lot. A lot. Like, hundreds of percent a lot. Or, 400% from its recent lows. Now, that might not matter much except that that rally now makes Tesla an extraordinarily large business by market cap. At 160B market cap they’re now the 44th largest firm in the world. That’s roughly the same size as McDonalds and larger than Nike. It’s FOUR times the size of Ford and GM. TWO times as large as Ford and GM COMBINED. Whoa. Much of this growth seems...

Read More »Let’s Stop Talking About “Paying Off the National Debt”

When we talk about personal finance we often talk about paying off our debts to become financially free. But this is a fallacy of composition. While some households can pay off their debts, the economy actually relies on expanding debt (and assets) to have liquidity and growth. After all, debt isn’t necessarily bad. Yes, there are bad types of debt (like credit card debt which almost always have a negative long-term return), but there are also good types of debt (for instance, when someone...

Read More »Is Government Debt “Equity”?

I’ve noticed a trend in some economic circles that seems to stem from the Positive Money and MMT people – this idea that government “debt” is “equity”. While the taxonomy in mainstream macroeconomics can sometimes be messy I don’t think this is a case where we need to be trying to reinvent well established terms. Let me explain. First off, I understand the desire to create a more coherent taxonomy for terms that seem to have no meaning (for instance, the term “money” in mainstream macro),...

Read More »The Monetary Duration Dilemma

I’ve been careful in my research on money not to call money a “store of value”. There’s a good reason for this which I will try to explain in this piece. In traditional definitions of money three criteria are generally applied: Unit of account Medium of exchange Store of value The first two are uncontroversial. Money needs to be denominated in a unit of account (the USD, Yen, Euro, etc) and it needs to be a medium of exchange. As a store of value, however, the best money cannot serve this...

Read More »Was Innis Wrong?

The question is taken from the title of an article by Nancy Olewiler of Simon Fraser University in the Canadian Journal of Economics (November 2017), which, as it happens, was delivered as the Innis Lecture at the meetings of the Canadian Economics Association in 2017: “Canada’s dependence on natural capital wealth: Was Innis wrong?” Her answer: she writes “Literature and recent debate reject his prediction that Canada would suffer lower levels of economic growth and well-being due to its...

Read More »Saskatchewan budget misses opportunity on rental housing assistance

I recently wrote a ‘top 10’ overview blog post about the 2018 Saskatchewan budget. Following on the heels of that, I’ve now written an opinion piece about the budget’s announcement of a phase out a rental assistance program for low-income households. Points raised in the opinion piece include the following: -Across Saskatchewan, rental vacancy rates are unusually high right now, making this a good time to provide rental assistance to tenants for use in private units (indeed, right now it’s a...

Read More » Heterodox

Heterodox