It takes something for me to say that The Economist is probably right. Sure enough the cover of The Economist, which has led to many critiques, sarcastic comments, and plain mockery by some friends on the left, was a bit hyperbolic. But the main argument of the piece -- basically that the American economy did pretty well in the recovery from the Pandemic, and that the United States has done well when compared to other advanced economies, and better than it did in the last few recoveries,...

Read More »Savings Glut, Secular Stagnation, Demographic Reversal, and Inequality: Beyond Conventional Explanations of Lower Interest Rates

New Working Paper published by the Political Economy Research Institute (PERI). From the abstract:Interest rates have declined over the last 40 years, a period of increasing inequality. The steady decline in interest rates has been interpreted by and large as resulting from a decline of the natural rate of interest. This paper surveys the main explanations associated with the notion of a decline in the natural rate of interest, including the savings glut and the secular stagnation...

Read More »Beyond Vulgar Economics: Conceição Tavares and Heteredox Economics

My paper (in Spanish) for a book on social thinkers in Latin America edited by Marcelo Rougier and Juan Odisio, and that I presented in a few venues since 2020, is now revised and done. The book includes chapters on Raúl Prebisch, Aníbal Pinto, Víctor Urquidi, Celso Furtado, Juan Noyola Vázquez, Helio Jaguaribe, Aldo Ferrer, and Osvaldo Sunkel, besides mine on Maria da Conceição Tavares. A version available here.

Read More »Summers on secular stagnation, the ISLM, and the liquidity trap

Two short clips from Lawrence Summers talk at the ASSA meeting in San Diego. So he first says that secular stagnation is more plausible now than before. He sees that it can be explained as a shift of the IS curve backwards. His IS has a somewhat marginalist foundation, with a natural rate, and a fairly conventional story for investment. Of course, the negative shift has bee compensated by some sort of stimulus, that is now weaker. I would say a smaller multiplier that affects the slope of...

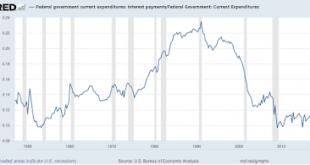

Read More »Financialization and the low burden of public debt

Financialization is a fuzzy concept. There are many definitions, and none is clear cut, at least to characterize the changes of the last 40 years or so, which is the period most authors associate with financialization. I'm not suggesting it's not a useful concept though.* In some sense, financialization refers to the last phase in the capitalist system (even if there are ways in which one might argue that capitalism was always financialized). At any rate, going to the point I wanted...

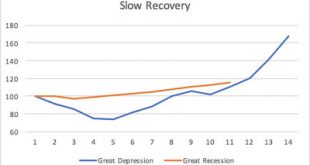

Read More »The slow recovery in historical perspective: 10 years after the Great Recession

It's hard to believe, but it has been almost a decade since the Great Recession. The official recession started in December 2017, but everybody remembers the collapse of Lehman in September of 2008. When you look at the recovery from the last recession in historical perspective, two things are clear. If you take GDP fall, or increase in unemployment, the Great Recession does not compare to the Great Depression, and that means that fiscal policy (automatic stabilizers and stimulus package)...

Read More »The “Natural” Interest Rate and Secular Stagnation

New paper by Lance Taylor in Challenge Magazine. From the blurb: Can America recover ideal rates of growth through interest-rate policies? This important analysis suggests that most economists misunderstand the issue. Updating Keynes, the analysis suggests that fiscal stimulus, labor union bargaining power, and more progressive income taxes are needed to support growth. (The article includes some algebra, which some readers may choose to skip.) Read full paper here.

Read More »The Nature of Capitalism and Secular Stagnation

McCloskey, Lazonick, Despin, and Shaikh (I'm covered) The joint AEA/URPE session was very lively, but suffered from the last minute absence of Brad DeLong. He did send the notes of what he was going to discuss here. On the topic of stagnation per se only Hans Despin suggested that it was an important phenomenon, but not necessarily for the same reasons Larry Summers and Brad De Long. It was unclear to me, however, that his views were based on a demand side story, and, hence, that this...

Read More »Can Trumponomics work?

Work for whom? That's what Martin Sandbu (subscription required) asks in the Financial Times. In his view, it might. He cites Ken Rogoff -- of spreadsheet fame -- who also has said that it's a possibility. Sandbu cites Summers doubts on Trumponomics, which are all based on supply side factors, but has very little to say about that.* Like Rogoff, Sandbu thinks that what matters is private investment that matters, meaning demand, and, as it must be in these cases, the confidence fairy...

Read More »Slow recovery continues

In the first quarter the economy slowed down grinding nearly to a halt. Real Gross Domestic Product (GDP) slowed to a 0.5% annual growth rate in the first three months of 2016, according to the Bureau of Economic Analysis (BEA). By the way, federal government spending has been a drag on growth. And here in lies the problem. Don't expect any stimulus this year, and very unlikely that this would change significantly any time soon. The problem isn't secular stagnation, it is rather...

Read More » Heterodox

Heterodox