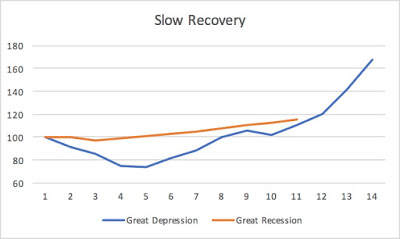

It's hard to believe, but it has been almost a decade since the Great Recession. The official recession started in December 2017, but everybody remembers the collapse of Lehman in September of 2008. When you look at the recovery from the last recession in historical perspective, two things are clear. If you take GDP fall, or increase in unemployment, the Great Recession does not compare to the Great Depression, and that means that fiscal policy (automatic stabilizers and stimulus package) did work. The other is that 10 years into it, we are more or less were we where after 10 years of the Depression (which means the New Deal worked too, since the decline in GDP back then was much more pronounced, and recovery started in 1933). But what I think is crucial, if one extends the historical

Topics:

Matias Vernengo considers the following as important: Great Recession, Secular stagnation, Slow recovery

This could be interesting, too:

Matias Vernengo writes The Economist and the American Economy

Matias Vernengo writes Savings Glut, Secular Stagnation, Demographic Reversal, and Inequality: Beyond Conventional Explanations of Lower Interest Rates

Matias Vernengo writes Beyond Vulgar Economics: Conceição Tavares and Heteredox Economics

Matias Vernengo writes A Stock Market Boom is Not the Basis of Shared Prosperity

But what I think is crucial, if one extends the historical data, is the effect of that crucial Keynesian experiment, World War II. Keynes was correct when he wrote in 1940 that: "It is, it seems, politically impossible for a capitalist democracy to organize expenditure on the scale necessary to make the grand experiments which would prove my case -- except in war conditions." And indeed, it seems very hard to see any circumstances that would push spending up to the extent needed to avoid the slow recovery to continue its course, and for 'secular stagnation' to prevail.

Actually if one looks at GDP per capita (per worker in fact), as The Economist (from last December, which was the inspiration for the graph above) does, then it seems that the New Deal/World-War-II policy experiment already looks better than the last decade.