New paper on the problems of Krugman and the Liquidity Trap argument (some will be able to download if for free, and I recommend this version; however, there is a previous working paper linked at the bottom for those unable to open).From the abstract: Krugman’s ‘liquidity trap’ model constituted a ground-breaking contribution by attributing the long-lasting Japanese stagnation to a negative natural interest rate. Our critique to such a proposal will focus on three aspects. First, we will...

Read More »60 Years of Production of Commodities by Means of Commodities

ROKE sponsored event soon. It will be live-streamed too.

Read More »Why do we need a theory of value?

The theory of value and distribution is at the heart of economics. To be clear, when I say that it is at the center, it means that discussions of almost any topic in economics, in one way or another, depend on a certain theoretical position about the theory of value and distribution. However, most economists have no clue about it, about the centrality of value. Not only they don't understand the original and now infamous labor theory of value (LTV), that dominated between Petty and Ricardo...

Read More »Distribution and Conflict Inflation in Brazil under Inflation Targeting

I can't watch this either For those interested in the Brazilian situation I highly recommend the recently published paper by Franklin Serrano and Ricardo Summa (Review of Radical Political Economics page here). From the abstract: In this paper, we analyze Brazilian inflation under the inflation-targeting system from a conflict inflation perspective and show how the inflation target system only worked well when there was a trend of exchange rate appreciation. Later, the strengthening of...

Read More »The positive profit with negative surplus-value paradox

New paper by Lucas (not that one) and Serrano. From the abstract: This paper explains the “positive profits with negative surplus-value” example of Steedman (1975) and shows that while in joint production systems individual labour values can be negative, the claim that the total labour embodied in the surplus product of the economy (surplus-value) can also be negative is based on assumptions that have no economic meaning (such as negative activity levels). The paper also provides a way to...

Read More »A Clarification of the clarification of supermultipliers

After my post I got an email and post below by Franklin. Mind you, I still would refer to supermultiplier models as Kaldorian, and the models with autonomous investment as neo-Kaleckian. As Franklin notes Bortis, a Kaldorian and Sraffian, makes the transition to exogenous distribution, even if Kaldor himself didn't. Below the email and the post.Dear Matias:Great Post.Your use of the phrase “no independent investment function” to refer to induced investment models is unfortunately quite...

Read More »Kaldorian and Sraffian supermultipliers: a clarification

This is a post for those interested in demand-led theories of growth. Not long ago I wrote a post on misconceptions about Sraffian economics. Marc Lavoie sent me a nice email about it, and a recent paper he published in Metroeconomica (subscription required), which comments on a paper I wrote with Esteban Pérez (working paper available here). In his discussion of supermultiplier models, which put the multiplier and the accelerator together to explain -- not fluctuations of the level of...

Read More »Misconceptions about Heterodox Economics in general and Sraffian in particular

I had discussed before the meaning of heterodox economics. I suggested a definition based on positive contributions (rather than as a critique of the mainstream) and based on concepts rather than schools of thought. In my view the two principles that were central for defining heterodoxy were the Principle of Effective Demand (PED), based on Keynes and Kalecki's ideas, and the idea that distribution is the result of class conflict, which in my view is best expressed in Sraffa's recovery of...

Read More »Centro Sraffa Lectures

Franklin Serrano will deliver the Pierangelo Garegnani Lecture 2015 titled "Notes on Garegnani, Kalecki and effective demand." Paper not yet available. Also, Christian Gehrke will deliver three lectures in the Phd programme in Economics of Roma Tre University. For those not in Rome, the papers on which the lectures are based are available here.

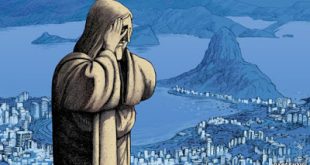

Read More »Brazil´s Sudden Neoliberal U-Turn

By Franklin SerranoA sharp slowdown in the Brazilian economy presents a critical challenge for the Workers’ Party (PT) government led by Dilma Rousseff. Between 2011 and 2014, economic growth averaged only 2.1 percent annually, compared with 4.4 percent in the 2004-2010 period.The recent downturn can be squarely blamed on economic policies implemented by Rousseff’s first administration (2010-14). This policy change sought to reduce the state’s role of directly promoting the expansion of...

Read More » Heterodox

Heterodox