Summary:

New paper on the problems of Krugman and the Liquidity Trap argument (some will be able to download if for free, and I recommend this version; however, there is a previous working paper linked at the bottom for those unable to open).From the abstract: Krugman’s ‘liquidity trap’ model constituted a ground-breaking contribution by attributing the long-lasting Japanese stagnation to a negative natural interest rate. Our critique to such a proposal will focus on three aspects. First, we will question the logical structure of the model, providing an alternative interpretation of its closure and arguing that aggregate demand has no crucial role in it. Second, we will argue that a negative natural interest rate can emerge only after a series of overtly restrictive assumptions in a model that

Topics:

Matias Vernengo considers the following as important: Di Bucchianico;, Garrido, Krugman, Liquidity trap, Natural Rate, Serrano, Summa

This could be interesting, too:

New paper on the problems of Krugman and the Liquidity Trap argument (some will be able to download if for free, and I recommend this version; however, there is a previous working paper linked at the bottom for those unable to open).From the abstract: Krugman’s ‘liquidity trap’ model constituted a ground-breaking contribution by attributing the long-lasting Japanese stagnation to a negative natural interest rate. Our critique to such a proposal will focus on three aspects. First, we will question the logical structure of the model, providing an alternative interpretation of its closure and arguing that aggregate demand has no crucial role in it. Second, we will argue that a negative natural interest rate can emerge only after a series of overtly restrictive assumptions in a model that

Topics:

Matias Vernengo considers the following as important: Di Bucchianico;, Garrido, Krugman, Liquidity trap, Natural Rate, Serrano, Summa

This could be interesting, too:

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Matias Vernengo writes Challenges and Perspectives of International Monetary Policy

Matias Vernengo writes Development Finance, External Constraints and Effective Demand in Maria da Conceição Tavares’ Thought

Matias Vernengo writes More on oligopolistic inflation (Greedflation)

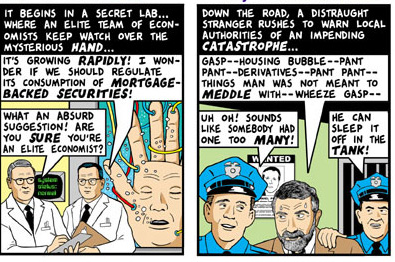

New paper on the problems of Krugman and the Liquidity Trap argument (some will be able to download if for free, and I recommend this version; however, there is a previous working paper linked at the bottom for those unable to open).

From the abstract:

Krugman’s ‘liquidity trap’ model constituted a ground-breaking contribution by attributing the long-lasting Japanese stagnation to a negative natural interest rate. Our critique to such a proposal will focus on three aspects. First, we will question the logical structure of the model, providing an alternative interpretation of its closure and arguing that aggregate demand has no crucial role in it. Second, we will argue that a negative natural interest rate can emerge only after a series of overtly restrictive assumptions in a model that does not treat capital and avoids long-run equilibrium analysis. Finally, we will discuss the mainstream literature which followed up until the recent rediscovery of the Secular Stagnation Theory. Within that line of literature, the key features of the ‘liquidity trap’ model continue to occupy a prominent role, thereby letting the critical issues that have been singled out resurface. Our conclusion is that the ‘liquidity trap’ explanation did not provide a satisfying rationale for Japan’s stagnation and cannot describe later economic predicaments either. A comparison with Post-Keynesian models shows their ability to offer insightful policy prescriptions without relying on those shaky theoretical foundations.

Note that an important part of the argument is the critique of the natural rate of interest, something we have done extensively over many years in this blog, and of the notion of a negative one in the context of Summers' discussion of secular stagnation (also done in this blog; see for example here and more recently here in the context of a debate with Stephanie Kelton and MMTers; btw her book is out and anybody wanting to reviewed it for ROKE send me an email; I look forward to reading it too).

The important thing in the paper is that it goes beyond the capital debates critique, and shows the extra restrictions needed for Krugman to get his results, including some interesting thoughts on the problems associated with intertemporal models.

PS: ROKE will soon publish a paper by Serrano, Summa and Garrido Moreira (Fall issue) in which other limitations of the negative natural rate are explored.

PS': Link to working paper here.