[embedded content] Old clip from C-SPAN. It's still worth watching. Strong critique of the failures of the IMF and neoliberal policies in leading to the crisis. We know now that the subsequent bubble pushed the major crisis for another 10 years.

Read More »Larry Summers on the necessity of fiscal expansions

As noted before, Larry Summers argues that Post Keynesians and original Keynesians (arguably Keynes and those close to him) did not think in terms of imperfections. The op-ed version of the Tweets here. He says, on the topic of secular stagnation and the lower zero bound that: This formulation of the secular stagnation view is closely related to the economist Thomas Palley’s recent critique of “zero lower bound economics”: negative interest rates may not remedy Keynesian unemployment....

Read More »Larry Summers on Effective Demand

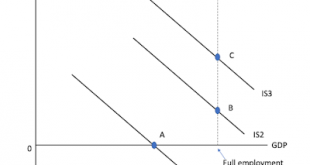

On of the issues between more mainstream Keynesians and their more heterodox counterparts is whether frictions are central for Keynesian results or not. Since the Neoclassical Synthesis the conventional view is that some rigidity or friction was behind the problems of unemployment, be that the liquidity trap (the Keynesian case with the flat LM, since Hicks 1937), the rigidity of wages (since Modigliani 1944), or some other coordination problem (mostly in the New Keynesian literature).In...

Read More »MMT and its Discontents: Again (Wonkish and Longish)

Modern Monetary Theory (MMT) has been in the news again, and for good reasons. I actually had a post with the same title back in February of 2012, hence the again in the title. But now, with the irruption of Alexandria Ocasio-Cortez in the political scene ,and with the discussion of a Green New Deal (discussed here 7 years ago) and the feasibility of higher taxes (here, also long ago, among the many on the topic) taking the center of the political debate, MMT has become trendy. The rise...

Read More »Can Trumponomics work?

Work for whom? That's what Martin Sandbu (subscription required) asks in the Financial Times. In his view, it might. He cites Ken Rogoff -- of spreadsheet fame -- who also has said that it's a possibility. Sandbu cites Summers doubts on Trumponomics, which are all based on supply side factors, but has very little to say about that.* Like Rogoff, Sandbu thinks that what matters is private investment that matters, meaning demand, and, as it must be in these cases, the confidence fairy...

Read More »China and secular stagnation

So in the last couple of weeks the Chinese problems have been in the news. And many suggest that the troubles in the US are not unrelated. For example, the New York Times tells us that according to Larry Summers: “The risks of a deflationary, secular stagnation in the US would be increased by a large devaluation of the renminbi.” And Krugman resuscitates Bernanke's global savings glut as the explanation for everything, from China's slowdown, depreciation and stock troubles to the recent...

Read More » Heterodox

Heterodox