Partager cet article At the start of 2017, with the elections in France in the Spring and then in Germany in the Autumn, it may prove useful to return to one of the fundamental issues which plagues discussion at European level, that is the alleged economic asymmetry between Germany with its reputation as prosperous and France which is described as on the decline. I use the term ‘alleged’ because, as we shall see, the level of productivity of the German and French economies – as measured in terms of GDP per hour worked, which is by far most relevant indicator of economic performance – is almost identical. Furthermore it is at the highest world level, demonstrating incidentally that the European social model has a bright future, despite what the Brexiters and Trumpers of every hue might think. This will also enable me to return to several of the issues addressed in this blog in 2016 (in particular concerning the long European recession and the reconstruction of Europe) as well as in my December 2016 article « Basic income or fair wage?« . Let’s start with the most striking fact.

Topics:

Thomas Piketty considers the following as important: in-english, Non classé

This could be interesting, too:

Thomas Piketty writes Regaining confidence in Europe

Thomas Piketty writes Trump, national-capitalism at bay

Thomas Piketty writes Democracy vs oligarchy, the fight of the century

Thomas Piketty writes For a new left-right cleavage

Partager cet article

At the start of 2017, with the elections in France in the Spring and then in Germany in the Autumn, it may prove useful to return to one of the fundamental issues which plagues discussion at European level, that is the alleged economic asymmetry between Germany with its reputation as prosperous and France which is described as on the decline. I use the term ‘alleged’ because, as we shall see, the level of productivity of the German and French economies – as measured in terms of GDP per hour worked, which is by far most relevant indicator of economic performance – is almost identical. Furthermore it is at the highest world level, demonstrating incidentally that the European social model has a bright future, despite what the Brexiters and Trumpers of every hue might think. This will also enable me to return to several of the issues addressed in this blog in 2016 (in particular concerning the long European recession and the reconstruction of Europe) as well as in my December 2016 article « Basic income or fair wage?« .

Let’s start with the most striking fact. If we calculate the average labour productivity by dividing the GDP (the Gross Domestic Product, that is the total value of goods and services produced in a country in one year) by the total number of hours worked (by both salaried and non-salaried employees), we then find that France is at practically the same level as the United States and Germany, with an average productivity of approximately 55 Euros per hour worked in 2015, or more than 25% higher than the United Kingdom or Italy (roughly 42 Euros) and almost three times higher than in 1970 (less than the equivalent of 20 Euros in 2015; all figures are expressed in purchasing power parity and in 2015 Euros, that is after taking into account inflation and price levels in the different countries).

Let us state at the outset that the data at our disposal to measure the number of hours worked is not perfect and that the accuracy of these figures should not be exaggerated. Furthermore, the very concept of ‘GDP per hour worked’ is in itself somewhat abstract and simplistic. In reality in these comparisons it is the totality of the economic system and the organisation of labour and production in each country which comes into play, with a wide range of variations between sectors and firms; and it is somewhat unrealistic to claim to resume the totality in a single indicator. But if productivity between countries has to be compared (an exercise which has its utility as long as we recognise its limits; it may enable us to go beyond nationalist prejudices and to set a few orders of magnitude) then the GDP per hour worked is the most meaningful concept.

We should also state that the figures for hours worked which we use here are taken from the series in the OECD data base. The file with all the details of the series and the calculations is available at the end of this article. International series for hours worked are also established by the BLS (the American Federal Government Bureau of Labor Statistics) and the details of the findings obtained by the BLS are also available below. Apart from slight differences between series, all the sources available – in particular those of the OECD and the BLS – confirm that the number of hours worked is roughly at the same level in France, in Germany and in the United States (with differences between these three countries which are so minimal that it is doubtless impossible to make a distinct separation, given the inaccuracy of this measurement), and that countries like the United Kingdom, Italy or Japan are approximately 20-25% lower. In the present state of the data available, these orders of magnitude can be considered valid.

It should also be noted that no country in the world significantly exceeds the level of labour productivity observed in France, Germany and the United States, or at least no country of comparable size and economic structure. We do find significantly higher levels of GDP per hours worked in small countries based on very specific economic structures, for example oil-producing countries (the Emirates or Norway) or tax havens (Luxembourg) but these are the outcome of very different rationales.

At the sight of the figure of an average production of 55 Euros per hour worked in France today, some readers will perhaps be tempted to go straight to their manager to ask for a rise in pay. Yet others, rather more in number, will question the meaning of this figure. We would like to state clearly that this is an average: the average production of goods and services per hour worked may be between 10 and 20 Euros is some sectors and jobs and between 100 and 200 Euros per hour in others (not necessarily the most arduous). It may also obviously happen that in the interaction and balance of forces in wage negotiations, some workers may appropriate a share of the production of others. This average production figure of 55 Euros per hour worked tells us nothing about these subtleties.

We should also specify that the concept of ‘gross domestic product’ (GDP) poses a number of problems. In particular, it would be preferable for statistical institutes to concentrate on the ‘net domestic product’, that is after deduction of the consumption of fixed capital, which corresponds to the depreciation of capital and equipment (repair of buildings and machinery, replacement of computers, etc.). This capital depreciation does not constitute income for anyone, be they wage earners or shareholders and furthermore, it tends to rise over time. The consumption of fixed capital represented about 10% of GDP in advanced economies in the 1970s; today it exceeds 15% of GDP (a sign of the acceleration in the obsolescence of equipment). This means that a (small) proportion of the growth in labour productivity measured above is an illusion. Similarly, if the consumption of natural capital were to be taken into account correctly, then a proportion of the growth in world GDP would disappear (the annual extraction of natural resources is close to the world growth in GDP, or roughly 3% per annum at the moment and tends to rise over time, depending on how this is valued). But there again this would not affect the comparisons between countries on which we focus here.

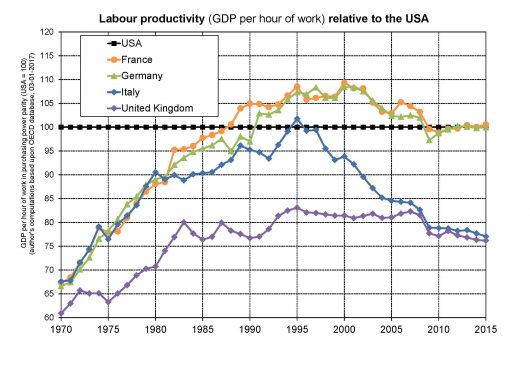

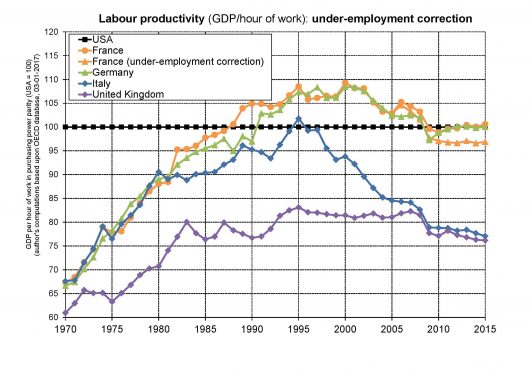

Another way of expressing the findings outlined above consists in measuring the productivity of each country by comparison with the productivity observed in the United States which has long been far in advance of others. We then obtain the following findings:

In summary: in 1970 productivity in France and Germany was in the range of 65-70% of the American level; both countries caught up with the United States in 1970–1980 and since 1990 were at the same level as the United States (slightly above until the crisis in 2008 and since then, a little below but with relatively small differences. Moreover it is permissible to hope that the Euro zone will succeed in recovering from the crisis better than it has done to date).

If we were to go back to the immediate post World War Two period, when Franco-German productivity was barely 50% of the American level, the catch-up effect would be even more striking. It must also be borne in mind that the European disparity in terms of productivity was of much longer standing (it was already very considerable in the 19th century and at the beginning of the 20th, on the eve of World War One and was amplified by the wars). The classic explanation is the relative disparity in educational level. The small American population was fully literate as from the beginning of the 19th century, whereas a similar level was not achieved in France until the end of the century, by which time the United States had already progressed to the following stage (mass secondary education, then higher education). It was the investment in education in the Trente Glorieuses (the thirty years’ post-war boom) which enabled France and Germany to catch up with the United States between 1950 and 1990. The real issue today is to maintain and extend this evolution.

In contrast, the persistent backwardness in British productivity, which never reached the American level, is usually attributed to the historical weaknesses in the educational system. Similarly, according to a recent study, the slower rate in Italy since the mid-1990s can in part be explained by the lack of investment in education made by the Italian public authorities (engulfed in the repayment of an interminable public debt which France and Germany had got rid of through inflation and post-war debt cancellations).

We should also stress that the high level of American activity at the moment is accompanied by considerable inequality. The United States were more egalitarian than old Europe in the 19th century and until the mid-20th century, but in recent decades they have become much less egalitarian. In particular in the educational sector there is a glaring contrast between the excellent, top-ranking universities (unfortunately reserved to the higher incomes) on one hand, and on the other a somewhat mediocre secondary and higher educational system accessible to the greatest number. This largely explains why the incomes of the 50% of the less well-off Americans have not risen since 1980, whereas the incomes of the highest 10% have risen considerably (see this recent study).

While there is no need to boast (particularly as the challenges to be met are numerous, with the demographic evolution in Germany and the modernisation of the fiscal-social system in France), we do have to admit that the social, educational and economic model constructed in France and Germany is more satisfactory. These two countries have achieved the highest level of productivity in the world, as high as that in America, but with a much more egalitarian form of distribution.

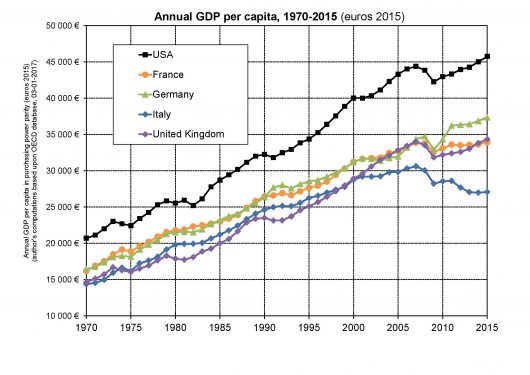

Let’s now examine the GDP per capita. We see that it is approximately 35,000 Euros per annum ( just below 3,000 Euros per month) in Europe – a little higher in Germany, a little lower in France and the United Kingdom – or approximately 25% lower than in the United States (roughly 45,000 Euros per annum):

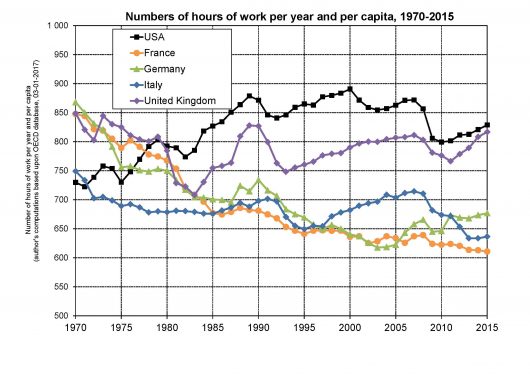

But the important point is that this higher GDP per capita in the United States comes uniquely from a higher of number of hours worked and not from a higher level of productivity than in France and in Germany. Similarly, the United Kingdom succeeds in compensating for its lower productivity and raising itself to the same level of GDP per capita as France it is uniquely as a result of working longer hours:

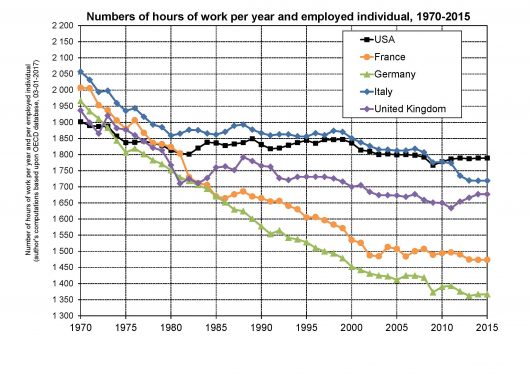

For a better understanding of these discrepancies in hours worked, a distinction has to be made between what comes under number of hours worked per job and what comes under number of jobs per capita. Let’s begin with the number of hours worked per job.

We observe that the annual average hours worked per job is lower in Germany than in France (the consequence of a higher rate of part-time work, which is not always a choice, but which may be more satisfactory than no employment). Beyond this gap, there again we observe a degree of proximity between the trajectories of France and of Germany: these two countries have chosen to use the very high growth rate of the Trente Glorieuses to appreciably reduce the length of the working day since the 1960s, going from an average length of almost 2,000 hours per year in 1970 (which roughly corresponds to 42 hours per week for 48 weeks per year) to less than 1,500 hours per year today (or almost 35 hours per week for 44 weeks per year). In contrast, the United States and the United Kingdom have barely reduced the amount of time worked; as a result, the weeks have remained very long and the paid leave very short (often restricted to two weeks, in addition to public holidays).

Obviously I am not attempting to claim that it is always preferable to reduce the working day and to lengthen the vacations and the question of the rhythm at which the time worked should be reduced is an extremely complex and sensitive problem. But it does appear to be clear that one of the aims of the growth in productivity in the long term is to enable the benefit of more time for private and family life, and cultural and recreational activities, and that the trajectories of France and Germany seem to give more consideration to this aim than those of the United States and the United Kingdom.

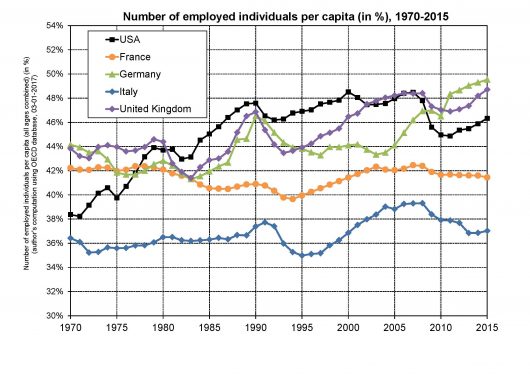

Now let us turn to what is much less successful, beginning with the low rate of employment in France where the difference with the rate of employment in Germany was relatively low in 2005 (only 2 points difference: 42 jobs per 100 inhabitants in France, 44 in Germany) and has considerably increased since the crisis (more than seven points difference, with an employment rate of 42% in France as compared with over 49% in Germany).

If we break down these developments into age groups, we see that the employment rate for the 25-54 years group has always been around 80% in France, as in other countries, and that it is amongst the 15-24 years group and the 55-64 years group that the discrepancy has been more marked in recent years, contemporary with the rise in unemployment.

I will not return here to the multiple reasons for this weakness in employment in France. The very poor budgetary policies adopted in the Euro zone are partly responsible for provoking a ridiculous fall in economic activity in 2011-2013 from which we are only just recovering (the fault is primarily due to the successive French and German governments who concluded an ill-conceived budgetary treaty which should be reformed).

But there are other specifically French factors: less promising industrial specialisations than in Germany, where in particular use has been made of a greater investment of employees in the governance and strategies of firms, and where there is a much better system of vocational training which France could well try to match. In France, the system of financing social protection falls too heavily on the wage bill of the private sector; an overall reform of the taxation system would be required but this is constantly postponed (instead, stopgap measures have been adopted, such as the CICE (Crédit d’impôt compétitivité emploi). This has only added a further layer of complexity to a fiscal-social system which was already incomprehensible. It is also time to consolidate and unify the retirement system which is complex and split between too many regimes. In particular this would reassure the younger generations (at the moment our retirement system is well financed – it is the second most expensive in Europe, the Italians being in the lead – while at the same time it is so opaque that nobody understands anything about their future rights).

Here, I wish simply to stress two elements. On one hand, the present weakness of employment in France implies that the estimates of productivity indicated above are doubtless over-optimistic because the people excluded from the labour market are often the least well qualified. In fact, if we correct the series for productivity by assuming that the number of hours worked have followed the same trend as in Germany since 2005, and by assuming that these new jobs would have had a rate of productivity 30% lower on average than that of the present jobs, then we obtain the following findings:

In other words, we observe a tendency for French productivity to fall between 2000 and 2015. Of course, we are still far from the decline in productivity in Italy, and whatever the hypotheses adopted to account for the under-employment, French productivity remains distinctly above the British figures and very close to Germany and the United States. The fact remains that this trend is potentially worrying and must be countered if France wishes to maintain the momentum achieved in the decades 1950-1990.

From this point of view, the main shortcoming of the five-year term now ending is the weakness in educational investment. This is in particular applicable to the budgets allocated to universities and other higher education institutions, which have stagnated since 2012 (with microscopic, nominal growth barely equivalent to inflation), whereas the number of students has risen by almost 10%. In other words, the real investment in education per student distinctly fell in France between 2012 and 2017, even although all the talk is of the economics of innovation, of the knowledge society, etc. Instead of losing time in poorly conducted and poorly prepared discussions about labour flexibility, the government would have done better to bear in mind that long-term economic performance is primarily determined by investment in training.

The second point on which I would like to insist is the following. Too frequently the economic debate about France and Germany is focussed on the difference in ‘competitivity’ between the two countries, that is to say, on the gap between the French trade deficit and the German trade surplus. Now the correct concept for the evaluation of the economic performance of a country is its productivity and not its ‘competitivity’, which is a fairly nebulous concept. Different countries with similar levels of productivity may temporarily find themselves in totally different situations in terms of balance of trade, for a host of voluntary or involuntary reasons. For example, some countries may choose to export more than they import, in order to have reserves for the future in the form of assets held abroad. This may be justified for an aging country which anticipates a fall in active population and this classical explanation is often used to explain a part of the trade surplus observed in aging countries such as Germany or Japan, in comparison with younger countries like the United States, the United Kingdom or France. These may require to consume and invest more within their territory which may give rise to trade deficits. But the important point is that these situations of trade surplus or trade deficit can only last for a limited length of time and must be compensated for in the long run. In particular, there is no point in having a permanent trade surplus (this would amount to eternally producing for the benefit of the rest of the world, which is of no interest).

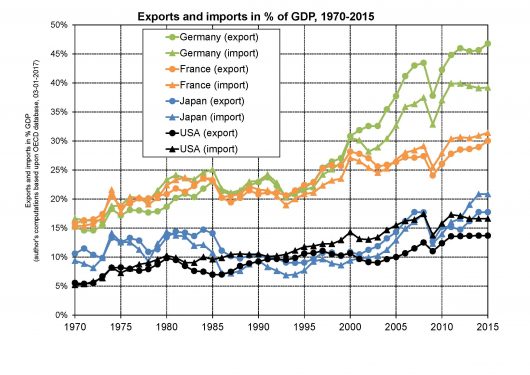

Let us see what happens in practice:

At the outset, we see that the overall level of exports and imports (expressed as a percentage of GDP) has risen significantly since the 1970s (this is the well-known phenomenon of intensification of international trade and corporate globalisation) and that it is much higher in France and in Germany than in the United States or in Japan. This expresses the fact that European economies are smaller in size and are much less strongly integrated with one another, in particular in matters of trade.

We also observe that the phases of trade surplus and trade deficit tend to even out over time. For example, Japan had a trade surplus in the 1990s and the years 2000 (usually between 1% and 2% of GDP per annum), and has experienced considerable deficits since 2011 (-3% of GDP at the moment). France had a trade surplus every year from 1992 to 2004 (usually 1%-2% of GDP) and has had a deficit since 2005 (-1.4% of GDP in 2015). If we take the average over the period 1980-2015, France has an almost perfect balance in trade: -0.2% of GDP (+0.1% for 1990-2015). For Japan, we observe that the dominant trend is a trade surplus (+1.0% in the period 1980-2015, +0.6% in the period 1990-2015), which explains why Japan has accumulated comfortable financial reserves abroad, on which it is drawing at the moment.

However there are situations which are less balanced. For example, the United States is in an almost permanent trade deficit with an average of -2.6% of GDP over the period 1980-2015 (-2.9% in the period 1990-2015). The country’s situation of external financial indebtedness is however less distinctly negative than that which the accumulation of trade deficits should have produced because the United States pays a low return on their debts (due to the confidence in their currency and political regime) and obtains a high yield on their investments (thanks in particular to their investment system and merchant banks).

An even more extreme case of imbalance, and in the opposite direction, is that of Germany, which was in an almost break-even trade balance situation similar to France until 2000 and then had an average trade surplus of +5.0% of GNP over the period 2000-2015 (+3.2% in the period 1990-2015, +1.7% in the period 1980-2015, while we note an average trade deficit of -0.9% from 1980-2000, as compared with +0.2% in France). The German trade surplus has risen to over 6% of GDP since 2012 and rose to almost 8% of GDP in 2015.

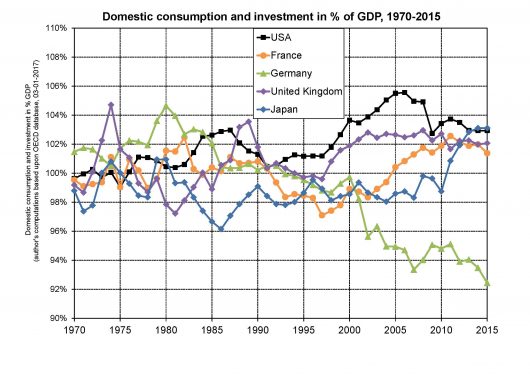

In plain terms this means that a very significant share of goods and services produced in Germany are neither consumed nor invested in Germany: they are consumed and invested in the rest of the world. Another – perfectly equivalent – way of representing the extent of the imbalance consists in calculating what the domestic consumption and investment would represent (that is pursued on the territory of the country considered) as a percentage of gross domestic product (that is of the total production of goods and services manufactured on this same territory):

A ratio above 100% means that a country consumes and invests more than it produces, in other words, it has a trade deficit. In contrast, a ratio below 100% is simply the counterpart of a trade surplus. For most countries, this ratio is on average very close to 100%. In Germany, on the contrary, this ratio fell to 92% in 2015 which is totally unprecedented in economic history.

In summary: France and Germany have similar productivities, but they use their high rates of productivity in very different ways. In recent years, when France produced 100 units of goods and services, it consumed and invested 101 and 102 units on its territory. On the contrary, when Germany produces 100 units it only consumes and invests 92 units. The gap may seem narrow but when it occurs every year it leads to financial and social imbalances of considerable size, which today threaten to undermine Europe.

How has this happened and what can be done? In the first instance, we should point out that while the aging of the population and the demographic decline in Germany may explain a certain amount of trade surplus by the need to constitute reserves for the future, this is not sufficient to rationally account for such huge surpluses. The truth is that this trade surplus is not really a choice: it is the outcome of decentralised decisions made by millions of economic actors and in the absence of an adequate mechanism for correction. To put it simply: there is no pilot in the plane, or at least the pilots available are not very accurate.

After unification, the German governments were very afraid of a drop-off in the competitiveness of the ‘German production site’. They adopted wage-freeze policies to increase productivity and they probably went too far in this direction. At the same time, the entry of Central and Eastern European countries into the European Union enabled German firms to achieve an increased and highly advantageous integration with these new countries. This can be seen in particular with the explosion of the general level of imports and exports, which were very similar to the level in France in 2000 (close to 25%-30% of GDP) and which in 2015 rose to 40%-45% of GDP in Germany (as compared with 30% in France; see the graph above).

This all led to a trade surplus which was doubtless not entirely foreseeable and is in large part due to contingent factors. In its own way, it is an illustration of the strength of the economic forces at play in globalisation which public authorities have not yet learnt to regulate correctly.

We must also stress the fact that there is quite simply no example in economic history (at least not since the beginning of trade statistics, that is, since the beginning of the 19th century) of a country of this size which has experienced a comparable level of trade surplus on a long-term basis (not even China or Japan which in most instances have not risen above 2%-3% in trade surplus). The only examples of countries experiencing trade surpluses in the region of 10% of GDP are oil-producing countries with a relatively small population and with a GDP much lower than that of Germany.

Another indication of the fact that the German surpluses are objectively excessive is due to the poor foreign investments made by firms and the financial system; in contrast to the United States the financial assets accumulated by Germany in the rest of the world are much lower than the amount which the addition of the trade surpluses should have produced.

The solution today would of course be to boost wages, consumption and investment in Germany, both in the educational system as well as the infrastructures. Unfortunately this is being implemented too slowly. The German leaders have an enormous responsibility here; they have other qualities (in particular in their reception policies for migrants) but on this basic point, they have not explained the issues to their public opinion and have even tended to present the trade surplus as a subject for national pride, even a proof of German virtue, which is quite simply beside the point. The German tendency to lecture the rest of Europe and to explain that everything would be fine if everyone copied Germany is logically absurd. If every country in the Euro zone had a trade surplus of 8% GDP, there would be nobody in the world to absorb a surplus of this type (simply because there is on the planet no country of the size of the euro zone that is ready to have a trade deficit of 8%). This irrational tendency is unfortunately one of the risks of globalisation and the heightened competition between countries; we all try first to find a refuge and then to survive.

Fortunately, there are other forces in play, in particular the attachment to the European idea. If the other countries, beginning with France, Italy and Spain (or a total of 50% of the population and the GDP of the Euro zone, as compared with 27% for Germany) were to decide democratically in a joint parliamentary chamber on the formulation of a detailed proposal for a democratic re-foundation of the Euro Zone, including a spur to economic growth and a moratorium on public debts, I am convinced that a compromise can still be found. But it is unlikely that any solution will come from Germany and the transition may be far from smooth. Considerable wrangling will doubtless be required. All that we can hope for is that the clashes will not be too violent; after Brexit, nobody can claim to be unaware of how far this might go.

I would like to end on a positive note. If we compare France and Germany with the United States, the United Kingdom and other, still further, parts of the globe, then they have much in common. In the decades following the self-destructive behaviour of the years 1914-1945, these two countries have succeeded in constructing institutions and policies which have enabled the development of the most social and the most productive economies in the world. France and Germany still have major tasks to accomplish together to promote a model of fair and sustainable development. But they must not get lost in mistaken comparisons which prevent them from advancing towards the future and accepting the idea that they each have a lot to learn from the other and from history.

(The complete data series on duration of work, GDP and the trade balances used to make the calculations presented in this article are taken from the OECD data base and are available here; the series on hours of work compiled by the BLS (Bureau of Labor Statistics, American Federal Government) lead to similar productivity comparisons between countries and are available here).