Ten years after the financial crisis, will the year 2018 see Europe making a great leap forward? Several factors contribute to this view, but the outcome is far from certain. The crisis in 2008, which triggered the sharpest global recession since the 1929 crisis, clearly originated in the increasingly obvious weaknesses of the American system: excessive deregulation, an explosion in inequalities, indebtedness of the poorest. Supported by a more equalitarian and inclusive model of development, Europe could have seized the opportunity to promote a better system of regulating global capitalism. However, the lack of trust between the members of the European Union, confined within rigid rules applied inappropriately, led them to provoke a further recession in 2011-2013 from which they

Topics:

Thomas Piketty considers the following as important: in-english, Non classé

This could be interesting, too:

Thomas Piketty writes Regaining confidence in Europe

Thomas Piketty writes Trump, national-capitalism at bay

Thomas Piketty writes Democracy vs oligarchy, the fight of the century

Thomas Piketty writes For a new left-right cleavage

Ten years after the financial crisis, will the year 2018 see Europe making a great leap forward? Several factors contribute to this view, but the outcome is far from certain.

The crisis in 2008, which triggered the sharpest global recession since the 1929 crisis, clearly originated in the increasingly obvious weaknesses of the American system: excessive deregulation, an explosion in inequalities, indebtedness of the poorest. Supported by a more equalitarian and inclusive model of development, Europe could have seized the opportunity to promote a better system of regulating global capitalism. However, the lack of trust between the members of the European Union, confined within rigid rules applied inappropriately, led them to provoke a further recession in 2011-2013 from which they are just recovering.

The coming into power of Trump in 2017 is indicative of further considerable shortcomings in the American model. This stimulates the demand for Europe, particularly as the development of the alternative models (China, Russia) is not reassuring, to say the least.

In response to these expectations, Europe will nevertheless have to overcome numerous challenges. To begin with, a general challenge: the global drift towards inequality. Europe will not reassure its citizens by explaining to them that they are better off than people in the United States or in Brazil. Inequality is rising in all countries, encouraged by exacerbated fiscal competiveness in favour of the most mobile, with Europe continuing to feed the flames. The risk of cultural isolationism and of scape-goating will only be successfully dealt with if we succeed in offering the working classes and the younger generations a genuine strategy for reducing inequality and investing in the future.

The second challenge is the North-South divide which has dramatically deepened in the Euro zone and which is based on contradictory versions of events. In Germany and in France, people continue to think that the E.U. helped the Greeks since it lent them money at a lower rate of interest than the rate they would have had to pay on the financial markets, but higher than the rate the EU paid to borrow on these same markets. In Greece, the version is quite different: they see it as a large financial profit. The truth is that the purge imposed on the countries in the Europe of the South, with the dramatic secessionist consequences in Catalonia, is the direct outcome of a short-sighted Franco-German self-centred vision.

The third challenge is the East-West divide. In Paris, Berlin or Brussels, people cannot understand the lack of gratitude on the part of countries which have benefited from huge public transfers. But in Warsaw or in Prague, events are interpreted quite differently. They point out that the rate of return on the private investment from the West was high and that the flows of profits paid today to the owners of the firms far exceeds the European transfers going in the other direction.

In fact, if we examine the figures, they do have a case. After the collapse of communism, Western investors (especially Germans) have gradually become the owners of a considerable proportion of the capital of the ex-Eastern European countries. This amounts to roughly a quarter if we consider the complete stock of fixed capital (including housing), and over half if we restrict ourselves to the ownership of firms (and even more for large firms). Filip Novokmet’s research has demonstrated that while inequality has not risen as strongly in Eastern Europe as in Russia or the United States, it is simply because a considerable share of the higher incomes from the East European capital are paid abroad (which moreover resembles what happened before communism, with the owners of the capital who were already German or French and sometimes Austrians or from the Ottoman Empire).

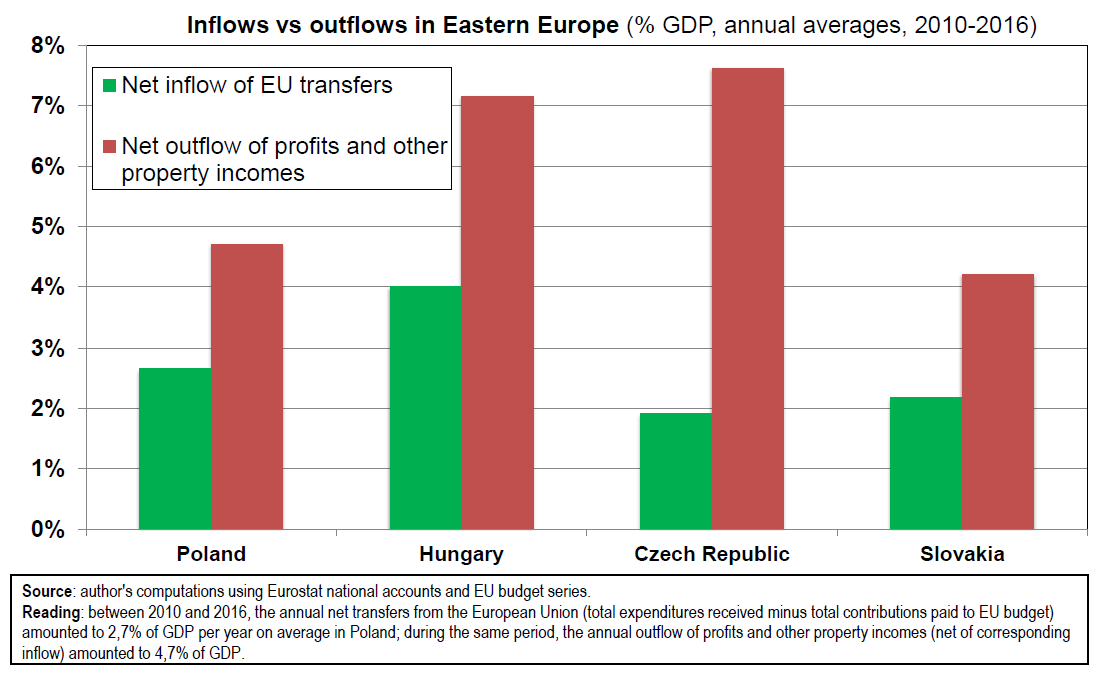

Between 2010 and 2016, the annual outflow of profits and incomes from property (net of the corresponding inflows) thus represented on average 4.7% of the gross domestic product in Poland, 7.2% in Hungary, 7.6% in the Czech Republic and 4.2% in Slovakia, reducing commensurately the national income of these countries

By comparison, over the same period, the annual net transfers from the European Union, that is, the difference between the totality of expenditure received and the contributions paid to the EU budget, were appreciably lower: 2.7% of the GDP in Poland, 4.0% in Hungary, 1.9% in the Czech Republic and 2.2% in Slovakia (as a reminder, France, Germany and the United Kingdom are net contributors to the EU budget of an amount equivalent to 0.3% – 0.4% of their GDP.

Of course, one might reasonably argue that Western investment enabled the productivity of the economies concerned to increase and therefore everyone benefited. But the East European leaders never miss an opportunity to recall that investors take advantage of their position of strength to keep wages low and maintain excessive margins (see e.g. this recent interview with the Czek prime minister).

In the same way as with Greece, the leading economic powers tend on the contrary to consider inequality as natural. They work on the assumption that the market and ‘free competition’ contribute to a fair distribution of wealth and consider the transfers resulting from this ‘natural’ balance as an act of generosity on the part of the winners in the system. In reality, property relations are always complex, particularly within large-scale political communities like the EU, and cannot be regulated uniquely by the goodwill of the market.

These contradictions can only be resolved by a full-scale intellectual and political ‘refounding’ of the European institutions along with their genuine democratisation. Let’s hope that the year 2018 will make a contribution.

All computations and data sources used for the figures on outward and inward flows of property income and European transfers in Eastern Europe are available here. To go further, see the thesis of Filip Novokmet, « Between communism and capitalism. Essays on the evolution of income and wealth inequality in Eastern Europe 1890-2015 (Czech Republic, Poland, Bulgaria, Croatia, Slovenia, Russia) » (2017). See also this article on Poland, and this other one on Russia.