While European leaders are preparing to tighten the conditions of entry into the European Union it is worth trying to get a clearer picture of the current patterns of migration and more broadly of Europe’s positioning in the globalisation process. The data available are incomplete but are sufficient to establish the main orders of magnitude. The most comprehensive data are those gathered by the United Nations Population Division on the basis of demographic statistics provided by each country and a patient labour of homogenisation. They serve to indicate the trend of the migratory flows entering and leaving the different countries in the world; they also include the sensitive issue of the World Population Prospects established for the decades to come. If we consider the most recent

Topics:

Thomas Piketty considers the following as important: in-english, Non classé

This could be interesting, too:

Thomas Piketty writes Regaining confidence in Europe

Thomas Piketty writes Trump, national-capitalism at bay

Thomas Piketty writes Democracy vs oligarchy, the fight of the century

Thomas Piketty writes For a new left-right cleavage

While European leaders are preparing to tighten the conditions of entry into the European Union it is worth trying to get a clearer picture of the current patterns of migration and more broadly of Europe’s positioning in the globalisation process.

The data available are incomplete but are sufficient to establish the main orders of magnitude. The most comprehensive data are those gathered by the United Nations Population Division on the basis of demographic statistics provided by each country and a patient labour of homogenisation. They serve to indicate the trend of the migratory flows entering and leaving the different countries in the world; they also include the sensitive issue of the World Population Prospects established for the decades to come. If we consider the most recent data available, two facts clearly stand out.

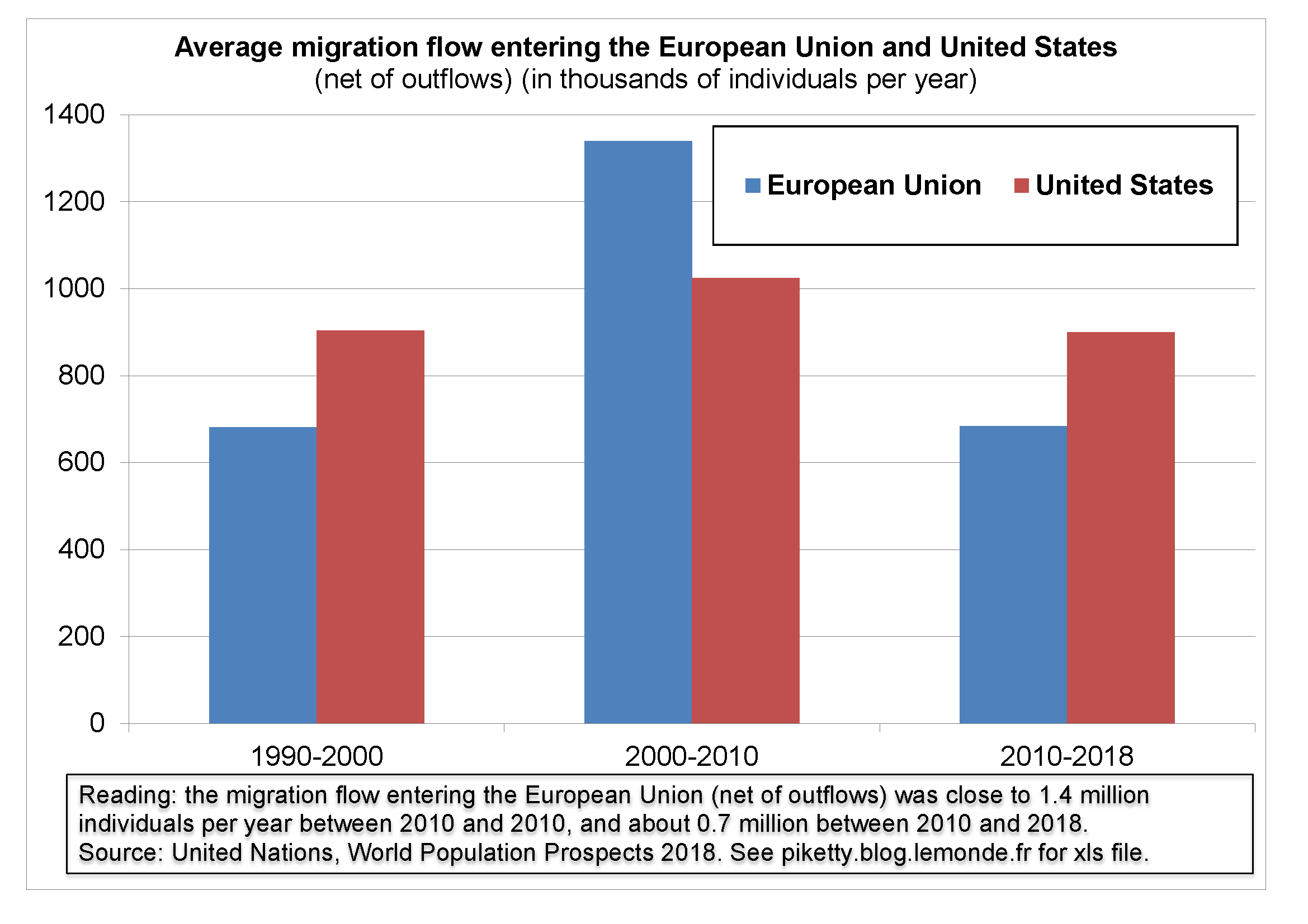

In the first instance, the migratory flows entering the rich countries (net of outflows) have fallen since 2010. From 1990 to 1995 they stood at approximately 2 million persons per year, from 1995 to 2000 at 2.5 million and subsequently from 2000 to 2010 exceeded 3 million; the numbers then fell to around 2 million persons per year between 2010 and 2018, the level on which the United Nations base their forecasts for the years to come. The population of the rich countries is in the region of one billion persons (500 million in the European Union, 350 million in the United States and Canada and 150 million in Japan/Oceania). This means that the migratory flow was below 0.2% per annum in the 1990s, before rising to almost 0.2% per annum since 2010. These flows may seem minuscule and, in a way, they are: the globalisation of the years 1990-2018 is primarily financial and commercial and has never reached the levels of migration observed in the 1870-1914 period.

The difference however is that the new migratory flows lead to greater multicultural exchanges involving people of different cultural origins (whereas in the past the migratory flows were primarily internal to the North Atlantic) and that these migratory flows take place in a context of demographic stagnation: the annual number of births is now less than 1% of the population in a number of rich countries. This means that an annual contribution of 0.2 or 0.3% leads in the long run to an appreciable change in the composition of the population. This is obviously not a problem per se, but recent experience demonstrates that this may unfortunately generate successful bids for the political exploitation of issues of identity, particularly if adequate policies have not been set up to promote the creation of jobs, housing and the requisite infrastructures.

The second striking conclusion which emerges from the United Nations’ data is that the fall in the migratory flows is mainly due to the situation in Europe. The number of migrants entering the European Union (net of outflows) has been halved, falling from almost 1.4 million persons per annum between 2000 and 2010 to less than 0.7 million per annum between 2010 and 2018, despite the influx of refugees and the peak in 2015. In the United States, where the recovery from the recession in 2008 was easier than in Europe, the flow remained stable (1 million per annum between 2000 and 2010, and 0.9 million between 2010 and 2018.

There is a third fact that is worth bearing in mind alongside the first two. According to the most recent ECB (European Central Bank) data the trade surplus of the Euro zone stood at 530 billion Euros in 2017, or almost 5% of the GDP of the Euro zone (11,200 billion Euros) and the trend is the same in 2018. In other words, each time the countries in the Euro zone produce 100 units of goods and services, they only consume and invest 95 in their own country. The gap may seem narrow but, repeated year by year, it is in reality considerable. Never in economic history, or at least never since the existence of trade statistics (that is, since the beginning of the 19th century) have we found evidence of such a huge trade surplus for an economy of this size.

Some oil-producing countries have sometimes had surpluses greater than 5% or 10% of the GNP but these are much smaller economies relative to the world economy and are often countries with very small populations (with the result that the happy owners of these resources do not really know what to do with them, apart from accumulating them abroad).This highly abnormal situation, or in any case totally unprecedented, is driven to a large extent by Germany, but Germany is not alone: Italy for example has had a trade surplus in excess of 3% of its GNP since 2015.

For those advocates of the market as being all-knowing and ever efficient, this situation is the rational consequence of aging; European countries anticipate the future scarcity of labour and production to come – possibly even their total disappearance – and are simply saving for their old age. The truth is that we must above all see there the consequence of exacerbated competition with no political guidance and excessive wage stagnation which has led to compressing growth and boosting trade surpluses.

We should also bear in mind that at the moment the Euro zone has a primary budgetary surplus. Tax payers pay more in taxes than they receive in expenditure, with a gap greater than 1% of GNP. Just as Trump’s budgetary deficits only make the American trade deficit worse, the European budgetary surpluses exacerbate our trading surplus.

If there does come a time when Europe wishes to revive the policies for integration, it will have to begin by learning how to invest and how to consume once again.

NB: the data series on migratory flows referred to are taken from the UN « World Population Prospects » ; all details are available in this excel file. Data on euro zone trade balance comes from the june 2018 ECB economic bulletin (table 3.1, p.S8). Latest series on Italian and German balances are available here and there.