What if the final blow for Emmanuel Macron came from the Massachusetts State senator and not from the yellow vests ? Elizabeth Warren, Harvard University law professor, not really an adept of Chavism or urban guerrilla warfare, a declared candidate in the Democratic primaries in 2020, has just made public what will doubtless be one of the key points in the coming campaign, namely the creation for the first time in the United States of a genuine federal progressive wealth tax. Carefully calculated by Emmanuel Saez and Gabriel Zucman, supported by the best constitutionalists, the Warren Proposal sets a rate of 2% on fortunes valued at between 50 million and 1 billion dollars, and 3% above 1 billion. The proposal also provides for an exit tax equal to 40% of total wealth for those who

Topics:

Thomas Piketty considers the following as important: in-english, Non classé

This could be interesting, too:

Thomas Piketty writes Regaining confidence in Europe

Thomas Piketty writes Trump, national-capitalism at bay

Thomas Piketty writes Democracy vs oligarchy, the fight of the century

Thomas Piketty writes For a new left-right cleavage

What if the final blow for Emmanuel Macron came from the Massachusetts State senator and not from the yellow vests ? Elizabeth Warren, Harvard University law professor, not really an adept of Chavism or urban guerrilla warfare, a declared candidate in the Democratic primaries in 2020, has just made public what will doubtless be one of the key points in the coming campaign, namely the creation for the first time in the United States of a genuine federal progressive wealth tax. Carefully calculated by Emmanuel Saez and Gabriel Zucman, supported by the best constitutionalists, the Warren Proposal sets a rate of 2% on fortunes valued at between 50 million and 1 billion dollars, and 3% above 1 billion. The proposal also provides for an exit tax equal to 40% of total wealth for those who choose to leave the country and to relinquish American citizenship. The tax would apply to all assets, with no exemptions, with dissuasive sanctions for persons and governments who do not transmit appropriate information on assets held abroad.

The debate has only just begun and the schedule proposed could still be extended and made more progressive with rates rising for example to 5% -10% per annum for multibillionaires. What is certain is that the issue of fiscal justice will be central to the presidential campaign in 2020. The representative from New York, Alexandria Ocasio-Cortez has suggested a rate of 70% on the highest incomes, while Bernie Sanders defends a tax rate of 77% on the highest inherited estates. While the Warren proposal is the most innovative, the three approaches are complementary and should be mutually beneficial.

To understand this, let’s look back. Between 1880 and 1910, while the concentration of industrial and financial wealth was gaining momentum in the United States, and the country was threatening to become almost as unequal as old Europe, a powerful political movement in favour of an improved distribution in wealth was developing. This led to the creation of a federal tax on income in 1913 and on inheritances in 1916.

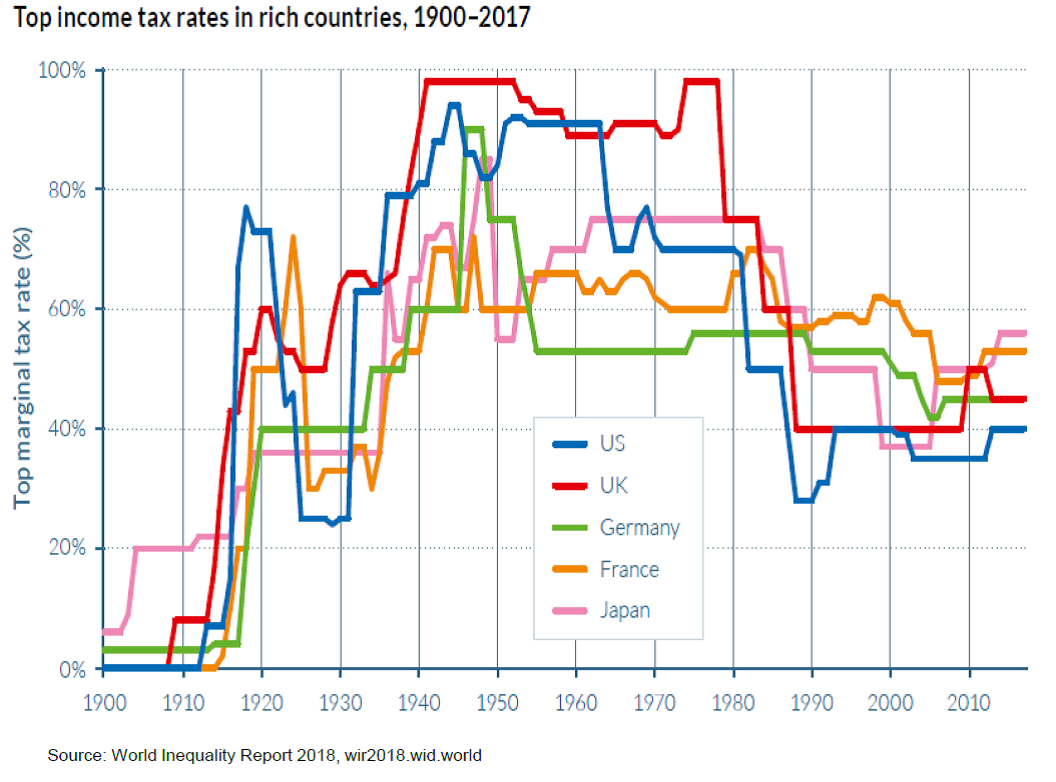

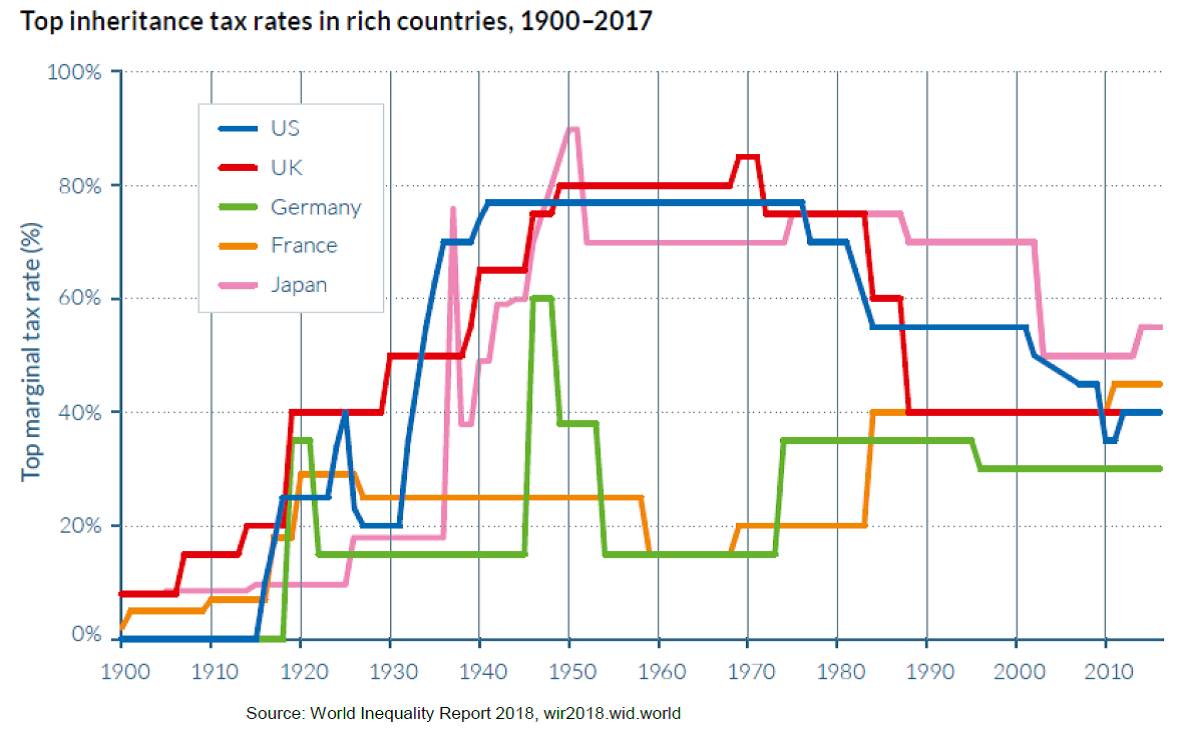

Between 1930 and 1980, the rate applied on the highest incomes was on average 81% in the United States, and the rate applied to the highest inherited estates was 74%. Clearly this did not destroy American capitalism, far from it. It made it more egalitarian and more productive, at a time when the United States had not forgotten that it was their level of educational advancement and their investment in training and skills that was the backbone of their prosperity, and not the religion of property and inequality.

Reagan, then Bush and Trump subsequently endeavoured to destroy this heritage. They turned their backs on the egalitarian origins of the country, by counting on historical amnesia and by fuelling identity-based divisions. With the hindsight we have today, it is obvious that the outcome of this policy is disastrous. Between 1980 and 2020, the rise in per capita national income was halved in comparison with the period 1930-1980. What little growth there was, was swept up by the richest, the consequence being a complete stagnation in income for the poorest 50%. There is something obvious about the movement of return to progressive taxation and greater justice which is emerging today and which is long over-due.

The innovation is that it is now a question of creating an annual wealth tax, in addition to the income and inherited estate taxes. This is a crucial innovation in terms of justice and efficiency. Numerous one-shot capital levies have been successfully applied to real estate, professional and financial assets subsequent to the world wars to pay off public debts, in particular in Japan, in Germany, Italy, France and in many European countries. Collected only once, the rates applied to the largest private estates often rose to 40% -50%, or even more. With an annual wealth tax designed to be applied on a permanent basis, the rates are of necessity more restricted. However, they must be high enough to enable genuine mobility of wealth. From this point of view, the tax on inherited wealth comes much too late. We are not going to wait until Bezos or Zuckerberg reach the age of 90 before they begin to pay taxes. With the 3% annual rate proposed by Elizabeth Warren, a static estate worth 100 billion would return to the community in 30 years. This is a good beginning but, given the average rate of progression of the highest financial assets, the aim should undoubtedly be higher (5% – 10% or more).

It is also crucial to allocate all the revenue to the reduction of inequalities. In particular, the American property tax, like the French real estate tax (taxe foncière) weighs heavily on those with limited resources. Those two venerable property taxes which, contrary to what is sometimes stated, tax not only the ownership of housing (independent of any income, which everyone readily admits, at least for the biggest owners), but also tax business assets (offices, plots of land, warehouses, etc.). The problem is that they have never been genuinely re-thought since the 18th century. The time has come for them to become progressive taxes with graduated rates on net assets, with the key element being strong reductions for indebeted households who are seeking to accede to property ownership. Let’s hope that the forthcoming American campaign, like the French discussion around the yellow vests, will at last afford the opportunity for an in-depth discussion on the taxation of property and fiscal justice.

PS: on the Warren proposal, see also this paper by E. Saez and G. Zucman, « How would a progressive wealth tax work?« .