As the pandemic crisis fuels the demand for social justice more than ever, a new investigation by a consortium of international media (including Le Monde) has just revealed the financial turpitudes of Luxembourg, a tax haven nestled in the heart of Europe. There is an urgent need to get out of these contradictions and to launch a profound transformation of the economic system in the direction of justice and redistribution. Let’s start with the most immediate. The first priority should be social, wage and ecological recovery. The Covid crisis has brought to light low pay in many key sectors. The CFDT, a union that is considered centrist, called in January for an immediate 15% increase in all low- and middle-wage workers in the medico-social sector. The same should be done in education,

Topics:

Thomas Piketty considers the following as important: in-english, Non classé

This could be interesting, too:

Thomas Piketty writes Regaining confidence in Europe

Thomas Piketty writes Trump, national-capitalism at bay

Thomas Piketty writes Democracy vs oligarchy, the fight of the century

Thomas Piketty writes For a new left-right cleavage

As the pandemic crisis fuels the demand for social justice more than ever, a new investigation by a consortium of international media (including Le Monde) has just revealed the financial turpitudes of Luxembourg, a tax haven nestled in the heart of Europe. There is an urgent need to get out of these contradictions and to launch a profound transformation of the economic system in the direction of justice and redistribution.

Let’s start with the most immediate. The first priority should be social, wage and ecological recovery. The Covid crisis has brought to light low pay in many key sectors. The CFDT, a union that is considered centrist, called in January for an immediate 15% increase in all low- and middle-wage workers in the medico-social sector. The same should be done in education, health and all low-wage sectors.

It is also a time to radically accelerate the pace of thermal renovations of buildings, to create jobs on a massive scale in the environment and renewable energy sectors, to extend minimum income systems to young people and students. Where should we stop in public recovery? The answer is simple: as long as inflation is near zero and interest rates are zero, we must continue. If and when inflation will sustainably return to a significant level (say, 3%-4% per year for two consecutive years), then it will be time to ease the pace.

The second step is that the highest private wealth will, of course, have to be used at some point to finance social recovery and reduce public debt. This will require an increased effort at financial transparency. The OpenLux survey has shown that the register of the actual beneficiaries of companies (i.e. genuine owners, and not simply ‘shell’ companies acting as fronts) made public by Luxembourg as a result of a European Union obligation, and which we are still waiting for France to put online, unfortunately has many flaws. The same is true of the system of automatic exchange of banking information set up by the OECD.

In general, all this new information is useful, but on condition that it is actually used by the tax authorities to actively involve the wealthy people who have previously evaded tax. Above all, it is essential that governments provide indicators that allow everyone to check how far this is moving towards a fairer tax system. Above all, it is essential that governments provide indicators that allow everyone to check how far this is moving towards a fairer tax system.

In concrete terms, tax authorities must publish detailed information each year on the taxes paid and the overlaps made concerning the different categories of taxpayers concerned. As with the registers of actual beneficiaries, information should ideally be nominal, especially for the largest companies and the highest fortunes.

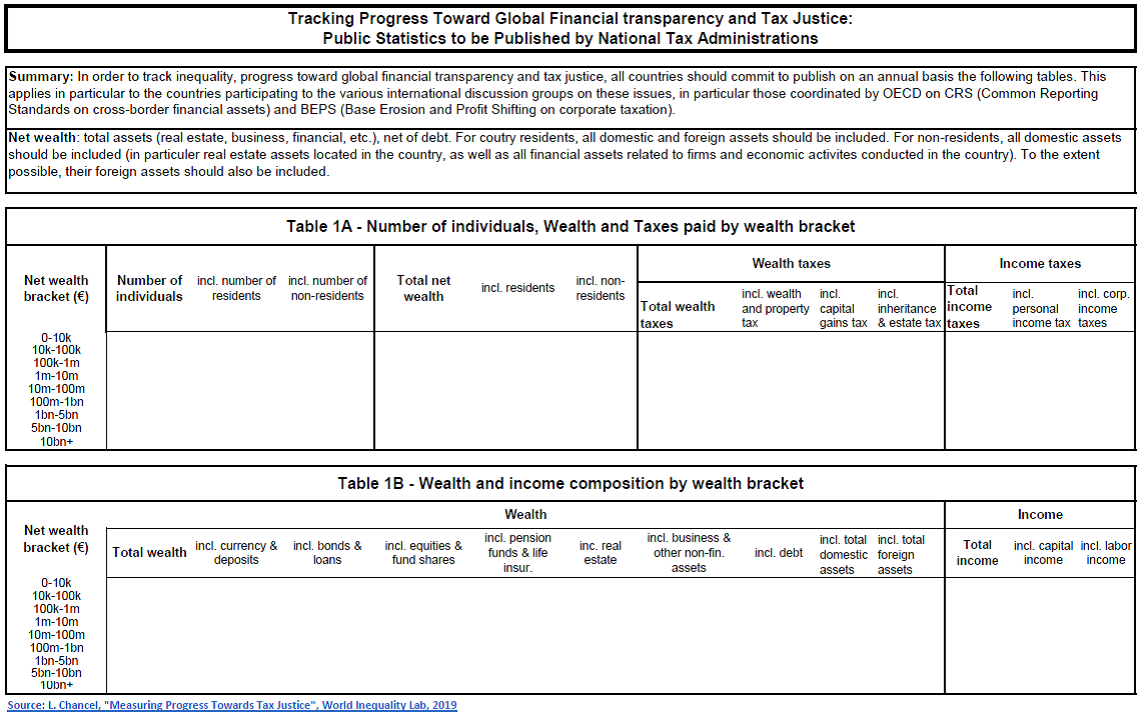

If it is decided that this is not desirable, then at the very least, the published statistical information should make clear the taxes paid by people in very high wealth brackets: fortunes between 1 and 10 million euros, between 10 and 100 million, between 100 million and 1 billion, and so on. Model tables have been proposed by the World Inequality Lab, and they could naturally be discussed and improved.

The general idea is simple: billionaires are everywhere in magazines, and it’s time for them to appear in tax statistics. According to Challenges, the top 500 French fortunes rose from 210 to 730 billion euros between 2010 and 2020 (from 10% to 30% of GDP). How did their taxes change during this period? No one knows. If governments have really made the dramatic progress in terms of transparency that they claim to have made in recent years, then it is time for them to prove this by making this type of information public.

If we extend the focal point of the first 500 fortunes (beyond 150 million Euros of individual assets according to Challenges) to the 500,000 highest assets (about 1% of the adult population, with assets in excess of 1.8 million Euros according to the World Inequality Database), then the total fortunes concerned reach 2500 billion Euros (nearly 120% of GDP), thus increasing the tax stakes.

To go beyond the prevailing conservatism, it is also urgent to go back to history. After the Second World War, when public debt had reached levels higher than today, most countries introduced exceptional levies on the highest private assets. This is particularly the case in Germany with the Lastenausgleich system (or « burden-sharing » system, which was the subject of an excellent historical study by Michael Hughes) adopted by the Christian Democrat majority in 1952. With a levy of up to 50% on the highest financial and real estate holdings, payable over 30 years, this system yielded 60% of GDP to the state, at a time when billionaires were rather less prosperous than today.

Combined with the monetary reform of 1948 and the cancellation of the external debt in 1953, this system allowed Germany to get rid of its public debt without resorting to inflation (which had done so much harm in the 1920s) and by relying on a credible social justice objective.

It is high time to go back to the roots of what made the success of post-war European reconstruction.