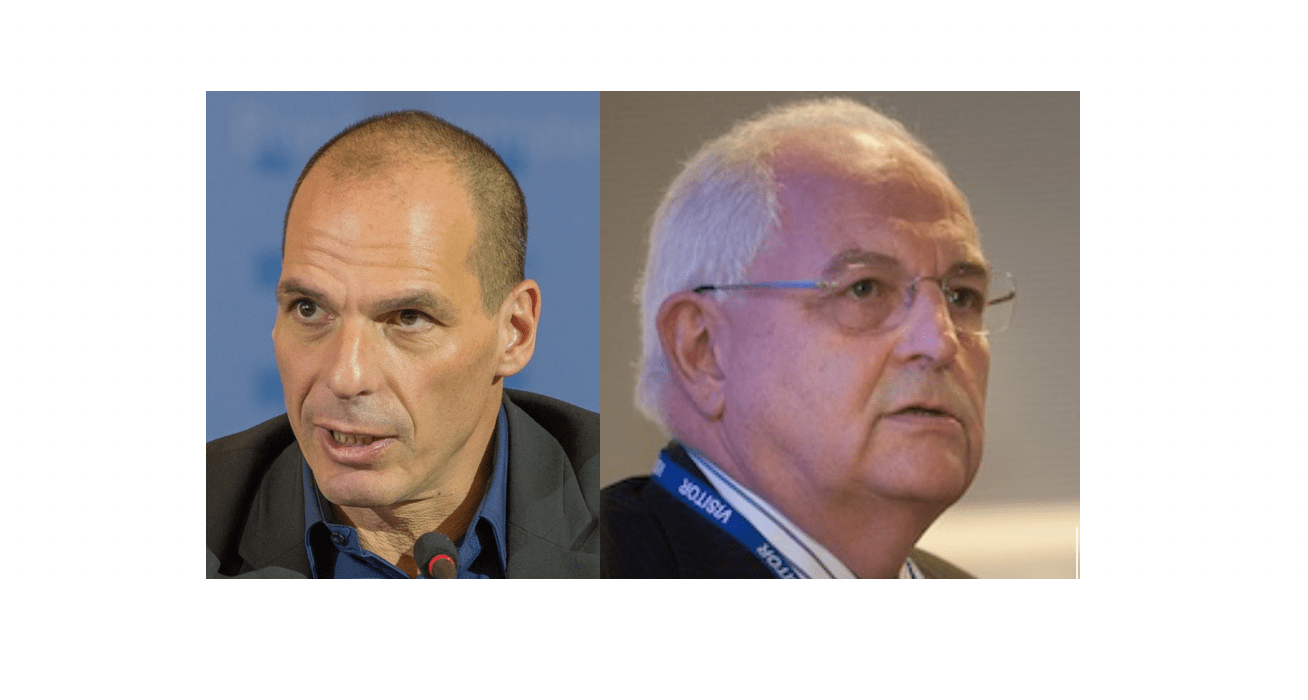

[embedded content] Is capitalism past its due date? Can we even imagine a world without it? On 14th November 2019 Martin Wolf and Yanis Varoufakis debated the question ‘Should liberal capitalism be saved?’. Hosted on November 14, 2019 by the Financial Times to celebrate the Wincott Foundation’s 50th Anniversary, this special live event took the place of the usual annual Harold Wincott Memorial Lecture. You can listen to a recording of the debate here. A transcript of Martin’s and Yanis’ remarks also follow below. As does a more recent newspaper article by Yanis Varoufakis entitled “Imagining a World Without Capitalism” – as published in the Financial News on 31st December 2019.

Topics:

Yanis Varoufakis considers the following as important: Audio, Box1_ENG, debate, DiEM25, English, Financial Times, Politics and Economics

This could be interesting, too:

Bill Haskell writes Another Perspective of the Harris-Trump Meeting

Robert Skidelsky writes Letter: The reason Keynes argued for an active fiscal policy

Robert Skidelsky writes Letter: The economic conditions that make wars more likely

Robert Skidelsky writes Exchange of the week: Did the West create the monster?

Is capitalism past its due date? Can we even imagine a world without it? On 14th November 2019 Martin Wolf and Yanis Varoufakis debated the question ‘Should liberal capitalism be saved?’. Hosted on November 14, 2019 by the Financial Times to celebrate the Wincott Foundation’s 50th Anniversary, this special live event took the place of the usual annual Harold Wincott Memorial Lecture.

You can listen to a recording of the debate here. A transcript of Martin’s and Yanis’ remarks also follow below. As does a more recent newspaper article by Yanis Varoufakis entitled “Imagining a World Without Capitalism” – as published in the Financial News on 31st December 2019. Additionally, you may watch the Munk Debates on the same topic here.

MARTIN WOLF’S REMARKS

WHY LIBERAL CAPITALISM SHOULD BE SAVED

Martin Wolf

“The bourgeoisie has through its exploitation of the world market given a cosmopolitan character to production and consumption in every country. . . In place of the old local and national seclusion and self-sufficiency, we have intercourse in every direction, universal inter-dependence of nations. And as in material, so also in intellectual production. The intellectual creations of individual nations become common property. National one-sidedness and narrow-mindedness become more and more impossible, and from the numerous national and local literatures, there arises a world literature.”

The celebrated authors of this passage understood what was remarkable about capitalism: it was global; and it was revolutionary. Over the past four decades we have re-lived this experience in one of the greatest transformation of world history: the triumphant expansion of the economies of developing Asia, home to over half of humanity, and of China, above all.

“Globalisation”, which is just a name for an emerging global market economy, has brought about a staggering reduction in global poverty. Between 1981 and 2013, according to the World Bank, the share of the world’s population in “absolute poverty” (gross domestic product per head of $1.90 a day, at 2011 purchasing power parity) fell from 42 per cent of the world’s population in 1981 to 10 per cent in 2015. Since 1980, Chinese GDP per head at purchasing power parity has risen from 3 per cent to 30 per cent of US levels. Nothing comparable in scale and speed has ever happened before. India, too, enjoyed a noteworthy acceleration of development after its pro-market reforms of the early 1990s.

Make no mistake: private enterprise was the fundamental driver of this extraordinary progress. The decisive decision was that of Deng Xiaopeng to take the Chinese government out of the way in vital sectors, above all, manufacturing. The share of state-owned enterprises in industrial output collapsed, from 80 per cent in 1978 to 20 per cent in 2016. Return on assets of private industrial enterprises has also massively outstripped that of state owned enterprises.[i] Private enterprise has also driven China’s “tech” revolution: Alibaba, Tencent, Baidu and so on and so forth are all private businesses. So, though its structure is unusual, is Huawei.

When we consider the complaints about globalisation in the West, we need to understand one overriding fact: the problem is not that it failed, but that it succeeded. Nor was this a surprise. We have had something close to controlled experiments on the relative efficacy of private enterprise and socialism since World War II in South versus North Korea, West versus East Germany or, say, Austria versus Czechoslovakia. North Korea is one of the world’s poorest prison states, while South Korea, once poorer than the North, is a high-income country. East Germany collapsed when its people were given a chance to vote with their feet. By 1989, Czechoslovakia’s real GDP per head, was 65 per cent of Austria’s level down from 90 per cent half a century earlier.

As important, the market-oriented countries in these pairings were (or became) democracies. Nor was that an accident. An entrenched market economy should protect democracy from irresponsible demagogy, just as a lively democracy should protect the market economy from a predatory plutocracy. No fully-socialised economy has been a democracy. How could it be? If an economy is socialised, the concentration of power is too great to remain contestable.

There are also more granular aspects to the shift towards the market economy that began to take hold in the early 1980s, especially in the US, under Ronald Reagan, and the UK, under Margaret Thatcher. Important components were privatisation and de-regulation of labour markets.

History surely shows us that the privatisation of businesses that operate in competitive markets was a success: How many now suppose that the state needs to run airlines, steel mills, coal mines, telecoms, or electricity generators? More controversial, inevitably and properly, are the natural monopolies or quasi-monopolies: water; the electricity grid; the rail tracks. Experience has re-taught us that these are difficult industries, whether run as state-owned monopolies or regulated private monopolies. I prefer the relative clarity of the latter. But the risks of regulatory ineffectiveness or capture are real and permanent.

Again, there are important arguments to be had on labour markets. But we can say with some confidence that the combination of substantial de-regulation with a carefully-implemented minimum wage (introduced under Labour) and tax credits for those in work was a success. Today, partly as a result, the UK enjoys its highest employment rate ever.

If the era of global capitalism has worked well in crucial respects, why is it now condemned?

The answer is threefold: first, there has been a lengthy period of rising income and wealth inequality in some high-income countries, especially the US; second, there has also been a long period of real income stagnation for large proportions of the workforce, again, especially in the US, but also elsewhere since the crisis, as well as a slowdown in productivity growth in high-income countries; finally, a huge credit boom ended with an enormous financial crisis, which inflicted a huge recession in the high-income economies and a brutal and brutally-mishandled crisis in the eurozone.

So, how far is global capitalism to blame for these unhappy developments? The answer is: not as much as many suppose.

First, the globalisation of the real economy was not a dominant cause of the ills listed above. In the US, the sentiment is widespread that trade and migration inflicted large losses on what Americans call “middle class”. Arguably, that is why Donald Trump is now president. But the evidence against this view is unambiguous. Rising imports have had an impact, especially in localities where a single plant or industry was the dominant employer. But it has not been a significant cause of rising inequality and stagnant real incomes in the US. The very fact that the US experience in both regards has been much worse than in many other high-income countries, all similarly buffeted by globalisation, demonstrates that trade cannot be the dominant cause of America’s ills (or, for that matter, those of the UK).

So what have been the true failures? There is increasing evidence, especially for the US, of a noteworthy increase in concentration and, with it, declining competition. As Thomas Philippon of New York University points out in a compelling recent book, The Great Reversal, margins have risen and investment has declined. The combination suggests rising monopoly and monopsony. Behind this, in turn, lie over-generous protection of intellectual property, abandonment of restrictions on mergers and acquisitions, notably in the case of “big tech”, short-sighted and exploitative corporate governance, including via the “bonus culture”, as Andrew Smithers argues. Behind the latter in turn is excessive “financialisation” of corporate governance. Contrary to impressions, “natural” monopoly in big tech may be more an excuse than a reality, except perhaps in the case of search (and so Google) and, to a lesser degree, social media (and so Facebook). Such powerful natural monopolies do need to be regulated.

The financial crisis of 2007-09 and the subsequent crisis of the eurozone was also partly the product of grossly irresponsible behaviour by a poorly regulated and undercapitalised financial system. We can argue that a good part of this failure was due not to capitalism per se, but to implicit and explicit guarantees, not offset by adequate oversight. To that extent, it was as much a failure of policy, as of finance. Nevertheless, we have been reminded of the tendency of the capitalist economy towards instability. In the case of the eurozone, this instability was greatly exacerbated by a huge policy error: the decision to create a currency union without the necessary institutions of risk-sharing and adjustment needed if it was to work successfully. This was not a failure of capitalism, but of over-enthusiastic politics.

So where does this leave us today? Let me return to that quotation at the beginning of my speech. It was of course from The Communist Manifesto. Its authors prophesied the end of capitalism and its replacement by socialism. It did not happen. Where it was tried, the socialism proved a disastrous failure. Instead, capitalism, politics and policy were all reformed in the western world. We need such a reformation again: an active and dynamic anti-trust policy, to overthrow monopoly; tighter control over finance; radical reforms of taxation, to reduce tax avoidance and evasion; more active attention to the roots of “secular stagnation”; and a greater commitment to the supply of essential public goods, including that most important of global public goods, the management of our shared environment; and a more active redistribution of income.

We will need to act both locally and globally.

But we must never forget the role that will have to be played by that dynamic

engine of prosperity and freedom – a market economy that exploits and

encourages the initiative of countless individuals. This has been the great

engine of economic advance. That remains as true today as it has been in the

past. Capitalism cannot be allowed to operate outside politics or above it. That

is the naïve ideology of libertarians. But the market economy has to be an

essential part of any worthwhile political settlement, in our era, as it has

been in our past.

[i] Nicholas Lardy, “Private sector Development”, inRoss Garnaut, Ligang Song, and Cai Fang, eds. China’s 40 Years of Reform and Development: 1978–2018. Acton ACT, Australia: ANU Press, 2018. http://www.jstor.org/stable/j.ctv5cgbnk.

YANIS VAROUFAKIS’ REMARKS

WHY CAPITALISM MUST BE TRANSCENDED

Yanis Varoufakis

It is only fitting that any re-assessment of capitalism ought to begin with its great students. And since Martin Wolf chose to oblige this erratic Marxist by kicking off with a quotation from the Communist Manifesto, I feel compelled to return the favour with a quotation from Adam Smith’s Wealth of Nations – one which, to boot, should have gladdened Harold Wincott’s heart.

Referring to the merchant, Smith wrote that:

“By pursuing his own interest he frequently promotes that of the society more effectually when he really intends to promote it. I have never known much good done by those who affected to trade for the public good… The rich divide with the poor the produce of all their improvements. They are led by an invisible hand to make nearly the same distribution of the necessaries of life, which would have been made, had the earth been divided into equal portions among all its inhabitants…”

Adam Smith, Wealth of Nations, 1776

So, it was Adam Smith, not Milton Friedman, who first advocated the paradoxical hypothesis that the common good is best served when no one is trying to serve it and everyone, instead, seeks to maximise their private gains. As long as firms were small and family owned, Smith had good cause to believe that shared prosperity might result from unfettered private greed.[1]

Karl Marx, who studied Smith meticulously, also celebrated capitalism for its capacity to unleash immense productive powers while, also, tearing down superstitions and poisonous nationalisms. But he also noted the seed of crisis and discontent within capitalism. Taking Smith’s own analysis further, so that it accounts not only for the price of things but also for the price of labour, Marx concluded that: “Society as a whole “is more and more splitting up into two great hostile camps, into two great classes directly facing each other.”” A society split between non-working shareholders and non-owner wage-workers, with physical and fictitious capital accumulation its main driver, is a society that bifurcates, its middle class – the dinosaur in the room – set for extinction.

When I received the invitation to today’s debate, the Wincott Foundation’s chosen question “Should liberal capitalism be saved?” brought to mind something a Marxist friend once said: “A sure sign that capitalism is in deep trouble is when the powers-that-be begin to utter its name again, ending their insistence to speak only of the market system, the price mechanism, the mixed market economy etc.” If he was right, and I believe he was, capitalism today seems to be in the deepest of troubles!

The strongest evidence that capitalism comes in the form of the musings of the ultra-rich. They seem increasingly stressed, guilt-ridden even, as they watch the majority around the globe descend into a crushing precariousness – the price of ending abject poverty in the developing countries. As Marx foretold, a supremely powerful minority is proving ‘“unfit to rule’” over polarised societies, unable to guarantee non-asset owners a reliable existence. Barricaded in gated communities, the smarter amongst the uber-rich, recognise in democracy, and in a redistributive state, the best possible insurance policy. They call for higher taxes on themselves. They even advocate a new Stakeholder Capitalism. Alas, at the same time, they fear that, as a class, it is in their nature to skimp on the insurance premium). [i]

When asked by journalists who or what the greatest threat to capitalism today, I defy their expectations by answering: Capital! Take the chasm between the vision of Smith and the corporate practices supported by economists like Friedman. It is best explained, in my view, by Marx’s analysis of capital accumulation – in particular the remarkable energy unleashed by the decoupling of the market value of labour power from the market value labour instils into commodities; the ever-expanding gulf between those who produce without owning and those who own without working in the firm they own.

This disconnect has always been around. But, while in Adam Smith’s time firms were small and power dispersed, it seemed not to matter much. Competition between privateers produced greater quantities of better commodities at lower prices – exactly what society needed was provided, as Smith had said, by those who did not “trade for the public good”. However then came electromagnetism and the 2nd Industrial Revolution. Since the late 1890s, the rise of networked mega-corporations, of the Edisons and of the Fords, created big business cartels investing heavily into how to usurp states and replace markets.

In their wake, megabanks were fashioned to finance the megafirms and, in the process, filled the world with fictitious money resting upon mountain ranges of impossible debt. Together, captains of industry and masters of finance accumulated war chests of billions with which to pad campaigns, capture regulators, ration quantities, destroy competitors and, in this manner, control prices. The first time the inevitable crisis hit that audacious superstructure was, of course, in 1929.

John Kenneth Galbraith was once asked how he went about, as FDR’s ‘Price Czar’, fixing countless prices during the War Economy. He answered: “It was pretty easy, considering that they were already fixed!” Through interminable mergers and acquisitions, corporations had replaced markets by a global Technostructure (Galbraith’s term) oozing with the power to shape the future for themselves and in their image.

For too long we lived under the illusion of world capitalism as a small-town, front-porch community rather than the weaponised Soviet-like (or maybe Google-like) planning system that it is. The larger the Technostructure grew the larger the financial sector necessary to conjure up the fictitious capital needed to fund its largesse. Bretton Woods was a remarkable attempt to reclaim political power on behalf of our societies and to stabilise the Technostructure.

When Bretton Woods died, officially on 15th August 1971, and financialisation became a necessity for financing the increasing deficits of the American Hegemon keeping global capitalism quasi-balanced (the Global Minotaur, as I called it), capitalism’s global imbalances were turbocharged. Before we knew it, General Motors turned into a huge hedge fund that also produced some cars on the side while, across the West, the tug-of-war between profits and wages was supplemented by the workers’ struggle for credit.

By the middle of the naughties, out of the one hundred wealthiest entities on Earth sixty-five were financialised corporations, not states. How could anyone expect them to operate in synch with society’s values and priorities – whatever those might be. Even the prospect of environmental catastrophe cannot convert such a highly concentrated, obscenely powerful power grid into the agent of our collective will.

Then came 2008. It proved that, even when the overheated Technostructure-on-financial-steroids melts down, its stranglehold over society grows proportionately to the black holes in their accounting books. In a fascinating inversion of Darwinism, the larger their failure and the steeper their financial losses the greater their capacity to appropriate society’s surplus via gargantuan bail-outs that their political agents push through neutered parliaments.

Capitalism, thy name has become Bankruptocracy: Rule by the most bankrupt of bankers. Democracy, in this context, resonated like a cross between a fond memory and a cruel joke.

So, setting aside the normative question “Should liberal capitalism be saved?”, let’s ask the more practical question: “Can it be saved?” Those who passionately believe that it should be saved tend to argue that it can be saved – confusing a normative and a practical question. They, correctly, identify three causes of liberal capitalism’s malaise:

- Excessive Financialisation

- Inordinate Concentration (i.e. monopoly/monopsony power, usually due to network externalities)

- Massive Malfeasance (i.e. fraud, corruption, capture and tax evasion).

Their understandable conclusion is that we need institutional interventions that put the financial genie back into its proverbial bottle, break up monopolies, and limit corrupt practices (tax evasion in particular). Additionally, the more democratically inclined propose a fourth task: Reversing the process of shifting important decisions from parliaments to unelected pseudo-technocrats.

These are fine aspirations with a good pedigree, in the form of the original Bretton Woods system. I too advocate a New Bretton Woods that restricts financial flows, legislates global curbs on tax havens and, last but not least, denominates cross-border trade and finance in a digital IMF-issued transnational accounting unit (implementing, at last, Keynes’ International Clearing Union) which can then be deployed to finance the International Green New Deal we so desperately need.

However, there are two obstacles in the path of this internationalist program for humanising, and stabilising, liberal capitalism: First, there is no latter-day FDR or any sign of the global political agency to implement it. Secondly, even if it were to be implemented, its therapeutic effects would, again, not last long – resembling antibiotics that lose their potency with use or, for that matter, Quantitative Easing.

As the fate of the original Bretton Woods system showed, private capital accumulation and financial asset creation – the two sides of really-existing capitalism’s coin – capture regulators and yield inexorable forces that tear through all institutional obstacles put in their way. It is, in short, in the nature of the beast to be untameable and, ultimately, illiberal.

The hypothesis I want to put to you today is that we are at a historic crossroads. Our dilemma is no longer between a road leading to authoritarian state-run socialisation and another road leading to a reformed liberal capitalism. That used to be our dilemma. No longer. Today, we face a harder and, at once, a more exciting choice made possible by advances in AI, 3D printing etc:

One road, the one we are treading, continues along the path of what Larry Summers refers to as secular stagnation, coupled with unbearable inequality, in a system where rent trumps both profit and wages every time and liberal democracy is consistently bunk.

The alternative road is one that we can, and I think we must, create from scratch once we have reigned in the Technostructure through a transformation of our institutions (e.g. an International Green New Deal that is pursued via a New Bretton Woods)

Let’s fleetingly imagine what this alternative road might be like. To build it, we must, first, revisit property rights over the means of production (Who owns the robots, AI and the right to claim their products and income?). Then we must redefine money (pulling the rug from under the financiers’ feet). Finally, we must dare to imagine an advanced, liberal, decentralised society in which capital is not only increasingly socially produced but also increasingly socially owned – the gist here being the crucial distinction between social and state ownership.

What would a post-capitalist liberal, technologically advanced social economy look like? Let’s do some more imagining, shall we? Imagine for a moment:

- Corporations whose shares resemble electoral votes (in that they neither be bought or sold), with each new hire receiving a single share granting a single vote to be cast in the all-member ballots deciding every matter of the corporation – from management and planning issues to the distribution of its net revenues

- Corporations, thus, in which the profit-wage distinction makes no sense

- States that collect no personal income tax, or VAT, just land and corporate taxes

- A trust fund for every baby, to be used to finance future ventures that set up new companies owned equally by its founders and newcomers

- Perfect freedom to move across firms and jurisdictions, together with one’s accumulated personal capital

- A universal basic dividend that allows one to live in dignity, but not in wealth, outside the paid labour process

- Central Banks providing each a twin bank account, one account for one’s personal capital fund, the other a current account

This is enough imagining for now. I just wanted us to share a glimpse of a truly liberal post-capitalist technologically advanced society to inspire us to admit that which Marx wrote in Das Capital, Vol. 1, in 1867 – a truth we have known since the inception in 1599 of the first joint stock company, the East India Company. That when the means of production belong to faceless shareholders, and worked by harassed employees,

“The increase in value of the world of things is directly proportional to the decrease in value of the human world.”

I can fully understand that it is hard to imagine an advanced, liberal society featuring all sorts of markets but free of stock exchanges and an almighty financial sector. But, then again, we used to take slavery and the divine right of Kings as permanent givens!

****

To conclude, Marx did, indeed, provide the most epic, pertinent celebration of capitalism – as Martin helpfully reminded us. But he also celebrated, or at least highlighted, another facet of capitalism: The seed of crisis and unsustainability within capitalism.

- Capitalism manufactures previously inconceivable wealth on the same production line that generates unimagined deprivation.

- Capitalism trades on the virtues of competition to procure a Technostructure that necessarily destroys competition

- Capitalism is at once the greatest propagator and the worst enemy of authentic liberty, which can only prosper in the presence of shared prosperity.

Economists, taking their cue from Adam Smith, believe that at the root of all conflict there is scarcity. But, under the Technostructure which long-ago usurped Adam Smith’s world, the direction of causality is reversed: It is not dearth that necessitates exploitation today. It is exploitation, of humans and nature, that causes dearth.

This reversed causality is why the prevailing price of labour leaves millions underemployed, the destruction of the planet is ‘free’ and the price people pay for money is the loss of their soul. This is why environmental catastrophe, depravity and dispossession grow in the humid shadows cast by an enormous superflux, like a dismal moss that the superflux feeds on.

So, what should we do? Yes, we must use really-existing capitalism’s own institutions to limit financialisation, concentration and malfeasance. However, we shall not be able to do this if we fail to overcome the greatest modern absurdity pointed out by my great friend Slavoj Zizek: A greater readiness to fathom the end of the world than to imagine the end of capitalism.

APPENDIX: The unsung defeat of personal liberty in (il)liberal capitalism’s hands

Liberals demand a strong fence protecting our private sphere from a busybody external world eager to interfere with our hopes and dreams. They say that our desires that are no one’s business but our own. They believe we should all live within safe haven where we can be sovereign and free to develop as individuals before relating with others, before leasing ourselves to an employer on mutually agreed terms and always on the understanding that the property rights over a person are non-tradeable. In short, inalienable self-ownership.

The first breach of the liberals’ essential fence appeared when industrial products became passé. Richard Branson had captured that moment with a statement that made William Morris spin in his grave: Who produces stuff and how does not matter one bit. Only brands matter now, proclaimed Sir Richard. Before long, branding took a radical new turn, imparting personality to objects, boosting consumer loyalty and, of course, the Technostructure’s profits.

Before they knew it, people felt compelled to re-imagine themselves as brands. The Internet allowed colleagues, employers, clients, detractors, and ‘friends’ constantly to survey one’s life, putting pressure on each to evolve into a profile of activities, images, and dispositions that amount to an attractive, sellable brand. Our sovereign personal space is now almost gone. The right to a time during the day when we are not for sale has vanished. Our liberty’s wetlands have been drained, its habitat destroyed.

Young women and men lacking a trust fund thus end up in one of two dead-ends. Condemned to working under zero-hour contracts and for wages so low that they must work all hours to make ends meet, rendering ridiculous any talk of personal time, space, or freedom. Or they must invest in their own brand every waking hour of every day, as if in a Panopticon where they cannot hide from the attention of those who might give them a break.

In job interviews enlightened employers tell them: “Be true to yourself, follow your passions.” Angst-ridden, they redouble their efforts to discover passions that future employers may appreciate, and to manufacture a true self that the job market will want to pay for. They struggle breathlessly to work out what average opinion among opinion-makers believes that average-opinion thinks is the most attractive of their potential true selves. Never slow to miss an opportunity, the Technostructure creates entire industries to guide them on their quest made up of counsellors, coaches and varied ecosystems of substances and self-help.

The Technostructure that emerged in the 1920s is developing new capabilities daily. It can now manufacture not just prices, money and consent but also desires and our self-image. Emasculated prices guarantee its profit. Hyper-complicated debt allows it fully to usurp the state’s monopoly over money. And turning over the private realm into a digital Panopticon destroys resistance to its authority. Liberalism, not just democracy, has thus become incompatible with contemporary capitalism.

[1] The

difference between the two economists is that, while in Smith’s estimation for

the market to procure its miracle firms had to be small and family owned, for

Friedman it did not matter whether the market featured giant conglomerates or

merely Smith’s fabled baker, butcher and brewer.