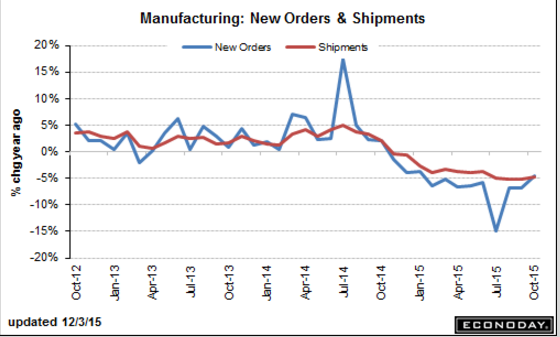

Yes, they were up, but there is a ‘seasonal’ aspect to it, including an air show, so the year over year chart is a bit more indicative of what’s going on and it’s still in negative territory. Also, vehicle orders declined, and inventories remained at levels that beg continuing production cuts. Factory OrdersHighlightsFactory orders bounced sharply higher in October and, together with the bounce higher for manufacturing in the industrial production report, confirm what was a very solid month for the sector. Factory orders rose 1.5 percent in the month led by a 2.9 percent surge in durable goods orders (revised 1 tenth lower from last week’s advance release). This gain offsets a no change result for non-durable goods orders.Excluding transportation, and orders tied to the biennial Dubai airshow, new orders rose a less exciting 0.2 percent. But indications from core capital goods are very strong with new orders surging 1.3 percent on top of a 0.5 percent orders gain in September. Turning to capital goods industries, new orders for machinery jumped 1.2 percent with computer orders up 5.9 percent.A negative in the report is a surprising 2.0 percent decline for vehicle orders, a disappointment that may very well be reversed in coming months based on the sustained and unusual strength of vehicle sales.Looking at other readings, total shipments fell 0.

Topics:

WARREN MOSLER considers the following as important: ECB, GDP, Interest rates

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

Merijn T. Knibbe writes Monetary developments in the Euro Area, september 2024. Quiet.

Lars Pålsson Syll writes Central bank independence — a convenient illusion

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

Yes, they were up, but there is a ‘seasonal’ aspect to it, including an air show, so the year over year chart is a bit more indicative of what’s going on and it’s still in negative territory. Also, vehicle orders declined, and inventories remained at levels that beg continuing production cuts.

Factory Orders

Highlights

Factory orders bounced sharply higher in October and, together with the bounce higher for manufacturing in the industrial production report, confirm what was a very solid month for the sector. Factory orders rose 1.5 percent in the month led by a 2.9 percent surge in durable goods orders (revised 1 tenth lower from last week’s advance release). This gain offsets a no change result for non-durable goods orders.Excluding transportation, and orders tied to the biennial Dubai airshow, new orders rose a less exciting 0.2 percent. But indications from core capital goods are very strong with new orders surging 1.3 percent on top of a 0.5 percent orders gain in September. Turning to capital goods industries, new orders for machinery jumped 1.2 percent with computer orders up 5.9 percent.

A negative in the report is a surprising 2.0 percent decline for vehicle orders, a disappointment that may very well be reversed in coming months based on the sustained and unusual strength of vehicle sales.

Looking at other readings, total shipments fell 0.5 percent in October which is not a good start to the fourth quarter with core capital goods shipments also down 0.5 percent. But future shipments are certain to benefit from October’s orders gain. Inventories, which are widely seen as too high, did dip 0.1 percent but relative to shipments could do no more than hold steady at a ratio of 1.35. Unfilled orders are positive, ending two months of decline with a 0.3 percent gain.

Given that the factory sector has been in decline all year, the order data in this report are encouraging and should help offset concern from this week’s sub-50 reading in the ISM manufacturing report.

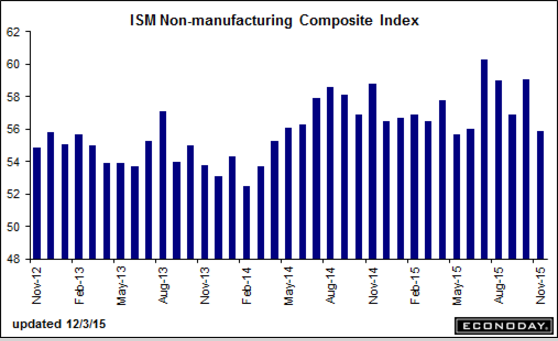

After a ‘normal’ lag non manufacturing is now clearly softening form the decline in aggregate demand that began with the oil capex collapse about a year ago, with nothing that I can see stepping up to replace it. And note that exports went into contraction as it’s been the non manufacturing exports that have held up as other exports declined:

ISM Non-Mfg Index

Highlights

Strength in ISM’s non-manufacturing sample is cooling but remains very solid, at 55.9 in November which is, however, the lowest rate of monthly growth since May. Readings across the report have also edged down to growth levels last seen in the second quarter including new orders (57.5), backlog orders (51.5), and employment (55.5). New export orders, at 49.5, show their first contraction since April. The breadth of strength across industries, with 12 showing growth and six in contraction, is positive but, like most of this report, less positive than prior months. Still, this report surged through the third quarter and into October making a step down to a lower rate no major surprise.

So Draghi increased the tax on deposits, and this time the euro went up. Maybe portfolios don’t have any more left to sell as the high and growing trade surplus drains them from global markets?

Euro Rises After ECB

The Euro gained around 0.58% to 1.0667 USD right after the ECB cut deposit facility rate by 10 bps to -0.3% and said further stimulus measures would be announced during the press conference.

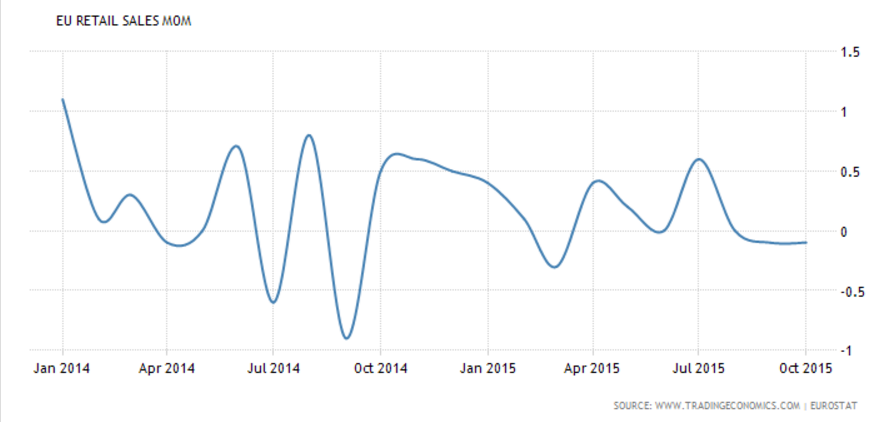

And taking euro away from depositors hasn’t seem to help consumer spending:

Euro Area Retail Sales Unexpectedly Fall

Retail sales in the Eurozone edged down 0.1 percent in October of 2015, following a 0.1 percent drop in September and no growth in August. Figures came below market expectations of a 0.2 percent gain, marking the longest period of no growth since mid-2013. Sales of food, drinks and tobacco shrank 0.5 percent, those of auto fuel fell 0.4 percent while sales of non-food products edged up 0.1 percent.