Like John Stuart Mill, I´m more interested in credit than in money. Developments in the amount of credit provided are much more instructive to the economist than data on money. Look at the graph below (no. 2 in the ECB press release) , a highly Post-Keynesian graph that originated from the pre-Euro Bundesbank and is now published by the European Central Bank. It shows that money growth in the EU is relatively moderate and, more interesting, caused by a combination of 1) lather large...

Read More »Central bank independence — a convenient illusion

from Lars Syll Today’s model of delegation has much to recommend it. But it should not be cloaked in euphemism. It is an abrogation of democratic sovereignty for pragmatic reasons, conditioned on the one hand by deeply entrenched and unflattering assumptions about electoral politics and, on the other, on an unquestioning acceptance of the private organization of credit markets and their lack of confidence in democratic control of economic policy. This may be an abrogation that we are...

Read More »How to deal with inflation?

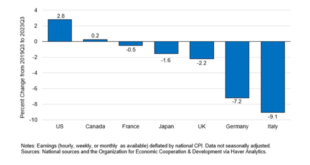

In Europe (the Euro area, to be precise), both unemployment and inflation are down, according to Eurostat,. Which, again, shows that the Phillips curve, a crucial concept behind neoclassical macroeconomic thinking that assumes a more or less stable negative relation between unemployment and inflation (high unemployment will bring inflation down), is not the place to go when predicting or analysing inflation. Sometimes, this relation is specified as a relation between wage increases and...

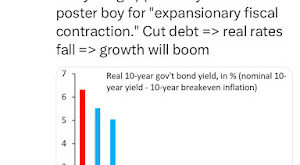

Read More »Brief note on public debt and interest rates in Brazil

Robin Brooks, previously the chief economist at from the Institute of International Finance (IFF), and now at Brookings, suggests Brazil needs austerity, and, here is the punch line, that would promote growth (laugh track here).The notion that it is the fiscal balances that determine the interest rate on public debt, and that fiscal deficits and high debt must imply high interest rates has no correlation with reality. Imagine the rate of interest that Japan would have if that was correct. In...

Read More »April existing home sales remain deeply depressed, continuing the chronic shortfall in housing supply

– by New Deal democrat Let me tie this morning’s report on April existing home sales into my two last posts (Part 1 and Part 2), which concerned the huge role that shelter prices, and the underlying shortfall in housing capacity, have in the continued elevation in overall consumer prices. So let’s start by looking at the last 10 year history of existing home inventories [note: all graphs in this article are from the site Trading Economics,...

Read More »Young people can’t Afford Homes

CNN Tells Us, Young People can’t Afford Homes Even Though more Young People have Homes now than when Trump was in the White House, CEPR, Dean Baker Major media outlets continually push the theme that young people can’t buy homes even though a larger share of households headed by someone under age 35 own homes today than when Donald Trump was in the White House. CNN pushed its entry into the contest for the best “Death of the American Dream” piece...

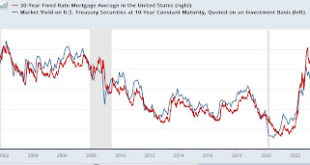

Read More »Existing homeowners still trapped by their 3% mortgages

Dilemma . . . Do I make a jump to a mortgage at 6 to 7% just to have a bigger house? There is more to this than just interest rates. Building supplies as NDd mention have been an issue. If they are decreasing in cost, builders can lower prices to help sell new houses. Existing homeowners are still trapped by their 3% mortgages – by New Deal democrat Higher interest rates have created a bifurcation in the housing market. While builders can...

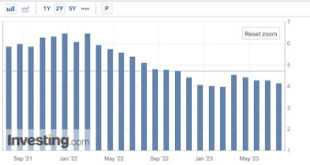

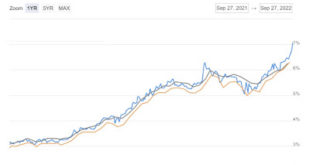

Read More »The importance of 10 (and 20) year new highs in interest rates

The importance of 10 (and 20) year new highs in interest rates – by New Deal democrat As you may have already read elsewhere, interest rates on the 10 year US Treasury just made a new 10+ year high. Perhaps more importantly, 30 year mortgage rates made a new 20+ year high: Both rates are slightly above their previous highs from last October: Almost always in the past, interest rates peaked *before* the Fed finished hiking interest rates....

Read More »Interest rates, the yield curve, and the Fed chasing a Phantom (lagging) Menace

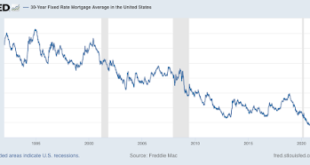

Interest rates, the yield curve, and the Fed chasing a Phantom (lagging) Menace There’s a lot going on with interest rates in the past few days. Mortgage rates have increased above 7%: This is the highest rate since 2008. Needless to say, if it lasts for any period of time it will further damage the housing market. The yield curve has almost completely inverted from 3 years out (lower bar on left; upper bar shows a similar curve in April...

Read More »The worst interest rate upturn since 1994

The worst interest rate upturn since 1994 is likely to produce the worst housing downturn in over a decade No economic news of note today; but tomorrow we will see housing permits and starts for March, and on Wednesday existing home sales. So let’s take an important look at housing. The recent increase in mortgage rates to over 5% is the most serious interest rate threat to housing in at least the past 30 years. As the below graph shows, the...

Read More » Heterodox

Heterodox