From David Ruccio Maarten Vanden Eynde, The Invisible Hand (2015)* We hear it all the time. On a regular basis. Having to do with pretty much everything. Why is the price of gasoline so high? Mainstream economists respond, “it’s the market.” Or if you think you deserve a pay raise, the answer again is, “go get another offer and we’ll see if you’re worth it according to ‘the market’.” Alternatively, if you want to solve a particularly pressing problem—such as climate change, widespread unemployment, or Third World poverty—mainstream economists’ usual answer is “let markets handle it.”** Markets have a magical, quasi-mystical status within mainstream economics. They are both the original starting-point and far-reaching conclusion of mainstream economic theory. What I mean, first,

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

We hear it all the time. On a regular basis. Having to do with pretty much everything.

Why is the price of gasoline so high? Mainstream economists respond, “it’s the market.” Or if you think you deserve a pay raise, the answer again is, “go get another offer and we’ll see if you’re worth it according to ‘the market’.”

Alternatively, if you want to solve a particularly pressing problem—such as climate change, widespread unemployment, or Third World poverty—mainstream economists’ usual answer is “let markets handle it.”**

Markets have a magical, quasi-mystical status within mainstream economics. They are both the original starting-point and far-reaching conclusion of mainstream economic theory. What I mean, first, is markets are there at the very beginning, without any explanation of where they come from or how they are formed—although there may be an occasional nod to Adam Smith (who famously invoked a natural “propensity to truck, barter, and exchange one thing for another”) or Robinson Crusoe (which presents, on one reading of Daniel Defoe’s novel, the model of two individuals who trade to their mutual benefit under conditions of equality, reciprocity, and freedom).*** Otherwise, markets are just there, with the requisite price and quantity axes and supply and demand schedules, as the starting point for economic analysis. Then, after a great deal of theoretical work (concerning the underlying determinants and the final consequences), markets are declared to be the best solution to the problem of scarcity (in finding a perfect balance between limited means and unlimited desires).

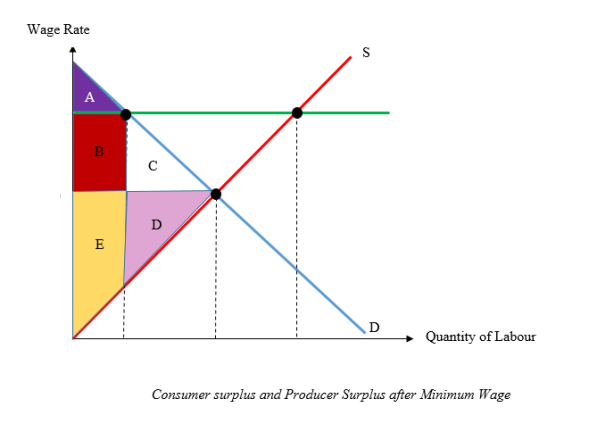

The “proof” of the superiority of markets often occurs in two steps (although today, in the usual sloppy teaching of mainstream economics, the second step is left out). At the level of individual markets, mainstream economists’ argue that economic welfare—consisting of the sum of consumer and producer surplus—is maximized at equilibrium. “Consumer surplus” is the extra benefit enjoyed by consumers in a market who pay less for goods and services than they were willing and able to pay for it (areas A + B + C, in the diagram above). Meanwhile, “producer surplus” is the difference between what producers are willing and able to supply a good for and the price they actually receive (areas E + D). At the equilibrium, the sum of the two is at its maximum. In contrast, when the market is not at equilibrium (such as when there’s a minimum wage, a wage rate above the market equilibrium wage rate, the green line in the diagram), there’s a “deadweight loss” (consisting of C + D). As far as mainstream economists are concerned, each market in equilibrium (whether for oranges or labor) creates the most total welfare for market participants.

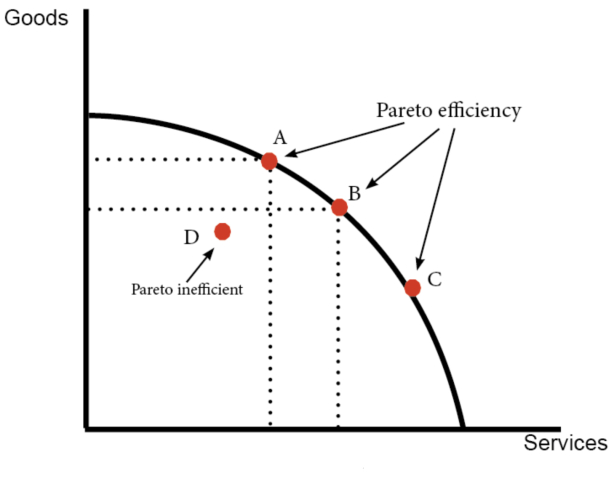

What about the market system as a whole? Here, the argument is somewhat different. It’s a theory about efficiency, not welfare.**** Mainstream economists claim that, when taken together (in what is referred to as general equilibrium), markets can generate a set of prices that finds a point—for example, A, B, or C, in the diagram above—on the “production possibilities frontier.”***** That’s the maximum amount an economy, given its technology and resources, can produce. Any point inside the frontier (such as D) represents an inefficient allocation of resources (more can be produced of either or both goods without the kind of tradeoff that occurs on the frontier). Importantly, Pareto efficiency means that no one can be made better off without making someone worse off.

That’s the remarkable, counter-intuitive conclusion of the mainstream theory of markets: everyone—every individual and society as a whole—benefits in a world in which all households and firms make decisions based solely on their own self-interest.

Thus, mainstream economists’ celebrations of the market and market solutions for all economic and social problems rely on both the presumption of markets as the given starting-point of analysis and their sweeping conclusions, concerning individual markets and the market system as a whole.

It is, of course, easy to criticize one or another of the assumptions underlying the celebration of free markets, many of them formulated by mainstream economists themselves. For example, markets may have “negative externalities,” that is, social costs that are greater than private costs (pollution is a common example). Under such conditions, more of a good or service will be produced than is socially beneficial. Monopoly power also distorts markets, since with market power firms will produce less, at a higher price, than if they operated according to the model of perfect competition (and, as mainstream economists are now discovering, it’s likely they will pay lower wages).****** Imperfect and asymmetric information, too, will lead to inefficient market outcomes—such as, for example, when conflicts of interest arise between a principal and an agent in a firm or banks are able to sell more financial products (such as derivatives) if they can conceal the true level of risk.

Thus, we can understand the two poles of debate within mainstream economics. Economists within the conservative or libertarian free-market wing celebrate free markets and criticize any and all forms of government intervention, while those in the more liberal wing focus on market imperfections and call for more government regulation of markets. Once again, it’s the invisible hand versus the invisible hand.

But underlying and informing the debate between the two wings of mainstream economics is a shared utopianism of markets as the best, natural and most efficient way of allocating goods and services—including labor, money, and natural resources. They may and often do disagree about the necessity and effectiveness of freeing-up or regulating markets, which comes down to whether or not they “see” exceptions to the basic model of perfect markets. But they share a belief that the logic of decentralized private markets is the appropriate way of thinking about and organizing the “world of goods.” In other words, mainstream economists debate, often intensely and with no small degree of sneering and sarcasm, the best way of getting markets to operate correctly—but that’s only because they utilize the same basic theory according to which a properly functioning market system is the only appropriate foundation and goal for theory and policy. Market fundamentalism thus represents the utopian horizon of mainstream economics.

The critique of market fundamentalism starts where mainstream economics leaves off—with the idea that the world of goods can and should be organized by markets.*******It highlights the hidden ground of the mainstream theory of markets and calls into question the very possibility of market exchange. The result is a different utopian horizon, which both refuses the self-suturing conception of market value and opens up the realm of possibility for other ways of organizing economic and social life.

When mainstream economists blithely draw the diagram or write down the equations for a market, what they’re doing is presuming—while failing to mention, let alone discuss—a whole host of conditions. Callari focuses on mainstream economists’ “image of the economy as a world of goods, and of the world of goods as a homogeneous field.” Such an image serves as the foundation for the positing of calculable “interests,” which thus become the central code of the economy and society. Within the homogeneous field of goods, every action can be connected with every other action in a measured (that is, analytically calculable) way. Once all the appropriate calculations are completed, “the market”—both individual markets and the market system as a whole—finds its equilibrium, the self-suturing reconciliation of all the competing interests. It also closes off the field of goods to any inspiration or influence other than self-interested rationality—be they traditions, social obligations, or ethical commitments.

Taking up on and extending that point, Amariglio argues that many of the features of non-market transactions involving goods and services (such as the gift) also haunt market exchanges.

There is nothing at all “certain” about any act of exchange, and nothing in it less symbolic or less “about” power, responsibility, meaning, and so forth. Likewise, there is something fundamentally “constituted” and “constituting” about identities and subjectivities in every act of exchange. Leaving aside the question of the multiplicity within selves who enter into trades, the fact remains that exchange is a very overloaded activity, and trading partners not only may be of several different minds about the transaction, but are often uncertain as to what exactly such transactions “mean” in terms of their own or others’ wealth and property, the effects on their well-being, who or what subject positions they occupy, what exactly is being traded, and so forth.

Market exchanges are therefore crosscut—just like any other allocative transaction, be it the gift, planning, or plunder—with a whole host of perturbations and undecidables. Both markets and the interests they are said to represent rely on “external” (historical and social) conditions and are, in different times and spaces, characterized by considerable uncertainty and indeterminacy. And once we begin to investigate those conditions, once we begin to analyze the “openness” of markets, we are forced to confront the ability of any act of exchange—and, for that matter, any economic discourse about markets—to successfully suture itself, at least in any kind of “permanent” act of closure.

The impossibility of market exchange, in general, suggests the need to recognize and attend to the historical and social specificity of individual markets—without any overarching, general theory of price or exchange-value. It also opens the door both to other commitments, whether ethical or political, and to other means of transacting goods and services, as they imply different conditions and consequences for society, for the social relations among persons, things, and nature.

Imagining and enacting those possibilities represent the utopian horizon of the critique of markets and mainstream economists’ theory of the market system.

*The Invisible Hand is a rubber copy of the right hand of Leopold II, taken at night from the 1926 sculpture by Thomas Vinçotte, located at the Regentlaan in Brussels, Belgium. The mould was taken to a former rubber plantation in Kasai-Occidental in the Democratic Republic of Congo and filled with natural rubber. The rubber hand was presented at Art Brussels 2015. It refers both to Adam Smith’s theory (as elaborated in the Theory of Moral Sentiments and The Wealth of Nations) and to Leopold II’s use of the International African Association (1877-79) and later the Congo Free State (1885-1908) to pillage the available natural resources. The grotesque result is that, by doing so, he “unwittingly” instigated local economic growth but at a high price: more than 10 million people are estimated to have died as a consequence of Leopold’s “Invisible Hand.” The Invisible Hand also points to the custom of chopping off the hands of enslaved people to ensure the rubber quota. To paraphrase Marx, markets come “dripping from head to foot, from every pore, with blood and dirt.”

**With one notable exception: healthcare.

***The Robinson Crusoe story has been read in a radically different vein by many heterodox economists, including Stephen Hymer and Ulla Grapard.

****Mostly because of Kenneth Arrow’s “Impossibility Theorem,” which challenged the idea that there’s a procedure for deriving a collective or “social” ordering—a Social Welfare Function—based on individual preferences.

*****While mainstream economists can claim to have solved the problem of “existence” (i.e., that there is such a set of prices consistent with overall efficiency), much to their consternation they have not been able to prove either “stability” (that prices, if away from the equilibrium set will move toward the equilibrium) or “uniqueness” (in other words, there may be many such sets of prices).

******That’s why, as I teach my students, there is such a thing as a free lunch: just abolish monopolies and oligopolies, and the economy can increase production (technically, the economy can move from inside to the production possibilities frontier without any additional resources or new technology, just by eliminating imperfect competition).

*******The critique I present here is inspired by two key essays—Antonio Callari’s “The Ghost of the Gift: The Unlikelihood of Economics” and Jack Amariglio’s “Give the Ghost a Chance! A Comrade’s Shadowy Addendum—both published in The Question of the Gift: Essays Across the Disciplines, edited by Mark Osteen. It is also informed by research that appeared in Postmodern Moments in Modern Economics, by Amariglio and myself.