From C. P. Chandrasekhar and Jayati Ghosh Even while optimistic assessments of growth trends in the global economy proliferate, concerns that the unwinding of inflated asset price markets could abort the recovery are being expressed. Interestingly, there appears to be a substantial degree of agreement on the cause for such uncertainty, which is an excessive dependence on monetary measures in the form of quantitative easing and the associated extremely low interest rate environment to address the post-crisis recession. That lever was not the most effective from the point of view of lifting growth. While the early resort to fiscal stimuli delivered a sharp recovery, the retreat from fiscal triggers and reliance on monetary measures led to a reversal and a new normal of low growth that

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from C. P. Chandrasekhar and Jayati Ghosh

Even while optimistic assessments of growth trends in the global economy proliferate, concerns that the unwinding of inflated asset price markets could abort the recovery are being expressed. Interestingly, there appears to be a substantial degree of agreement on the cause for such uncertainty, which is an excessive dependence on monetary measures in the form of quantitative easing and the associated extremely low interest rate environment to address the post-crisis recession. That lever was not the most effective from the point of view of lifting growth. While the early resort to fiscal stimuli delivered a sharp recovery, the retreat from fiscal triggers and reliance on monetary measures led to a reversal and a new normal of low growth that has lasted almost a decade.

On the other hand, the large-scale infusion of cheap liquidity that this form of intervention triggered saw increased activity in asset markets of different kinds, especially equity, bond and property markets. Two factors played a role here. First, punters of various kinds accessed cheap money to invest in assets that were expected to deliver returns significantly higher than the cost of capital. This affected bond, equity and property markets, where the sheer influx of liquidity resulted in the realization of the punters’ expectations. Second, excess liquidity triggered credit expansion, resulting in a revival of credit access even for those households which had not deleveraged fully to reduce the burden of debt accumulated prior to the crisis, which too was triggered by the last lending and borrowing spree.

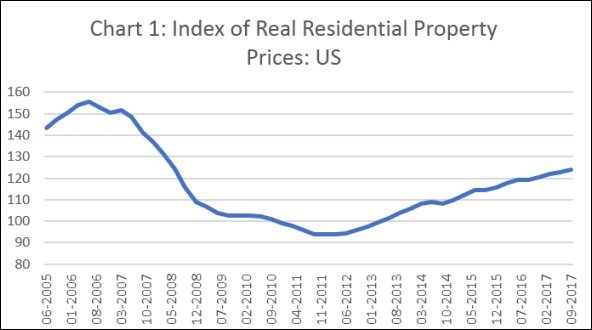

Associated with the revival of credit provision to the household sector was an increase in lending for housing investments, with implications for the residential property markets. In the case of the United States for example, mortgage loans that had peaked at $9.29 trillion in the third quarter of 2008, fell to $7.84 trillion in the second quarter of 2013, but has since risen once again to touch $8.88 trillion in the fourth quarter of 2017. Interestingly, over these dates the share of mortgage loans in total debt of households had fallen from 73.3 per cent to 70.3 per cent and further to 67.6 per cent. The main reason for this was an increase in the share of student loans and credit card debt. But an overall increase in lending triggered by the excess liquidity in the system resulted in an increase in mortgage debt outstanding.

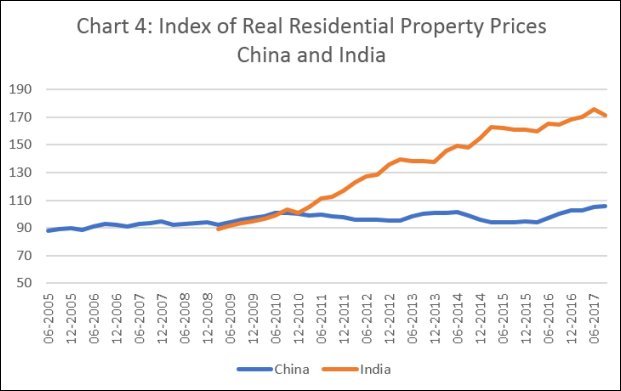

It is no doubt true that the quantitative easing policy has been explicitly pursued by developed country central banks, especially the US Federal Reserve, the European Central Bank and the Bank of Japan. But in all these cases, the excess liquidity so generated has found its way to asset markets in some of the developing countries, as punters attempt to exploit carry-trade opportunities. Developing countries chosen as targets by these punters, who tend to move in herd-like fashion, also show evidence of excessive asset price inflation resulting both from direct investments of foreign capital and from the credit driven by the liquidity created by foreign capital entry. Not all countries ‘benefit’ from such inflows, but there are many that do and show signs of overall buoyancy when net inflows are high.

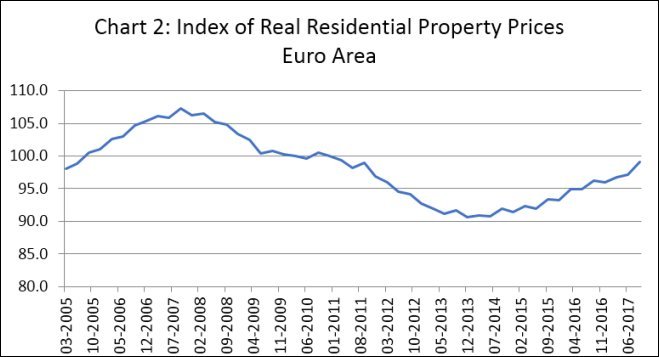

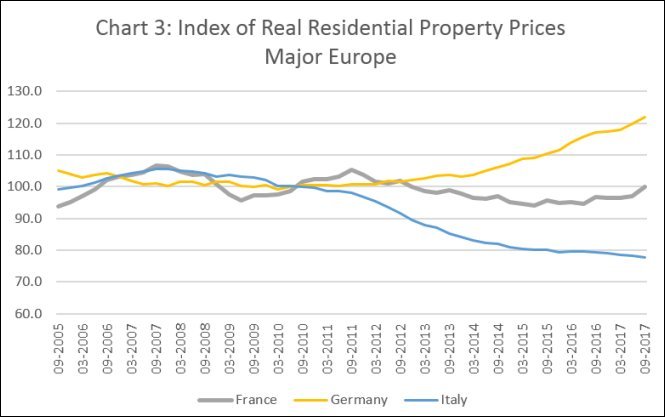

In the event, across countries, developed and developing, the availability and use of mortgage loans, and the resulting demand in the residential property market, has resulted in a degree of buoyancy in real (consumer price inflation adjusted) residential property prices, as captured in statistics from the Bank for Internationalist Settlements. In both the US and the Euro area (Charts 1 and 2), property prices have risen sharply in recent years — since 2012 in the case of the US and 2014 in the case of the EU. As a result, real residential property prices are way above their post crisis troughs, and slowly approaching their pre-crisis peaks. However, as Chart 3 shows, within Europe there are countries in which real residential property prices have been stagnant (France) or falling (Italy), where in others they have been rising (Germany).

This is curious because an impression has gained ground that because of common drivers affecting asset markets in all countries, there is a now a high degree of synchronization of housing price movements. The IMF’s April 2018 edition of the Global Financial Stability Report, for example, argues: “The international transmission of financial conditions, such as those occurring because of a change in monetary policy in one large country, usually occurs through capital flows. These flows do not need to go directly into housing investments as long as they affect credit availability and mortgage rates in the receiving country. In addition, an increase in the global demand for safe assets may compress the rates of sovereign bonds considered as low risk, thereby holding down mortgage rates and supporting booming house prices across many countries at once.”

This case for synchronisation of housing price trends originates from evidence from emerging markets like China and India, where too real property prices, as captured by the database of the Bank for International Settlements, have risen — interestingly, far more sharply and for a longer period in India than in China. But, even among so-called “emerging markets”, the trend has not been so clear cut. There have been many in which prices have been sticky if not stagnant.

This only reflects the fact that even if massive liquidity infusion triggers capital movements into countries across the world, not all countries are targets. Countries which are chosen for specific reasons as targets for capital flows are the principal beneficiaries of the inflow either directly into their asset market or through intermediaries who leverage that capital to provide credit, which in turn flows into asset markets. Combine that with the fact that performance varies across advanced country economies, and capital flows to asset markets varies across countries.

In sum, global housing markets reflect two tendencies in the currently globalised world. An overall average tendency for residential property prices to rise because of the surfeit of liquidity in search of returns. And an unequal distribution of the rise in residential property prices across countries within the OECD and outside it. But under this complex scenario lies the reality that this asset price inflation has been generated by the liquidity created by central banks in the advanced countries to address the recession they were experiencing. That implies, in turn, that many developing countries are prone to an unwinding of unsustainable asset prices in ways that can be damaging. In the long run, regulation to limit interdependence seems to be necessary to reduce vulnerability and enhance policy space.

(This article was originally posted in the Business Line)