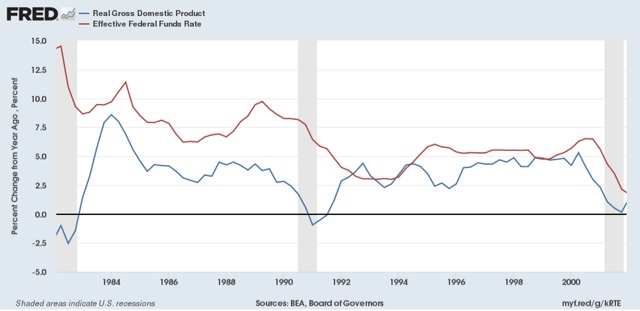

Can the Fed successfully steer between Scylla and Charybdis? An update As I type this, the spread between 2 year and 10 year Treasuries is back to 0.25%, the level below which I switch my rating on the yield curve from positive to neutral. Already the spread is tight enough that, even if it never inverts, it suggests a slowdown in the next 6-12 months, as happened in 1984 and 1995 in the graph below of real YoY GDP growth and the Fed funds rate: One aspect of what is happening in the bond market is that the 2 to 10 year spread is reaching equivalent levels at higher and higher absolute yields. Here’s a graph I generated last week, where I normed both the 2 and 10 year Treasury yields to zero at a point where the spread between them was 0.30%:

Topics:

Dan Crawford considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Can the Fed successfully steer between Scylla and Charybdis? An update

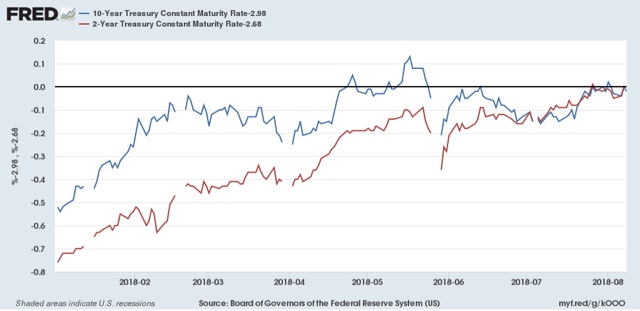

One aspect of what is happening in the bond market is that the 2 to 10 year spread is reaching equivalent levels at higher and higher absolute yields. Here’s a graph I generated last week, where I normed both the 2 and 10 year Treasury yields to zero at a point where the spread between them was 0.30%:

Note that the two lines intersect (meaning the spread between them is 0.30% three times in the past 45 days: first when the 10 year bond was yielding about 2.83%, then when it was yielding 2.87%, and last week when it was yielding 2.98%.

In other words, the dynamic is that the yield on the 10 year bond has to be at higher and higher levels in order not to be too tight. And the higher those 10 year bond yields, the higher mortgage rates go as well, gradually strangling the housing market.

Can the Fed successfully steer between the Scylla of an inverted yield curve and the charybdis of a housing market downturn?

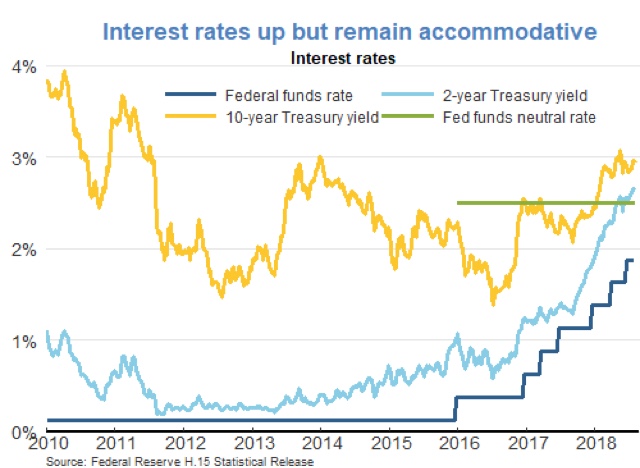

Possibly. The San Francisco Fed’s staff just published a paper in which they suggested that the “neutral Fed funds rate” was 2.5%, as shown in this graph which they generated:

If the Fed stops after two more hikes, it’s at least possible that there could be a tight but not inverted yield curve with 10 year bonds yielding roughly 3%.

But the Fed’s own “dot plot” from their meetings suggest that they intend to hike the Fed funds rate to at least 3%. If that happens, I see no way the economy doesn’t wind up on the rocks.