Your model is internally consistent? So what! ‘New Keynesian’ macroeconomist Simon Wren-Lewis has a post on his blog discussing how evidence is treated in modern macroeconomics (emphasis added): The unique property that DSGE models have is internal consistency. Take a DSGE model, and alter a few equations so that they fit the data much better, and you have what could be called a structural econometric model. It is internally inconsistent, but because it fits the data better it may be a better guide for policy. Being able to model a credible world, a world that somehow could be considered real or similar to the real world is not the same as investigating the real world. Even though all theories are false, since they simplify, they may still possibly serve

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Your model is internally consistent? So what!

‘New Keynesian’ macroeconomist Simon Wren-Lewis has a post on his blog discussing how evidence is treated in modern macroeconomics (emphasis added):

The unique property that DSGE models have is internal consistency. Take a DSGE model, and alter a few equations so that they fit the data much better, and you have what could be called a structural econometric model. It is internally inconsistent, but because it fits the data better it may be a better guide for policy.

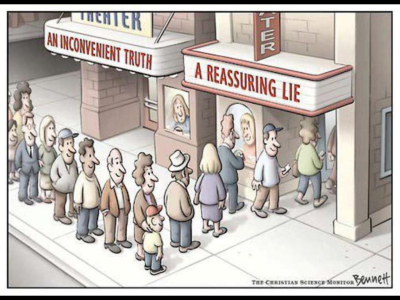

Being able to model a credible world, a world that somehow could be considered real or similar to the real world is not the same as investigating the real world. Even though all theories are false, since they simplify, they may still possibly serve our pursuit of truth. But then they cannot be unrealistic or false in any way. The falsehood or unrealisticness has to be qualified (in terms of resemblance, relevance, etc.). At the very least, the minimalist demand on models in terms of credibility has to give away to a stronger epistemic demand of appropriate similarity and plausibility. One could of course also ask for a sensitivity or robustness analysis, but the credible world, even after having tested it for sensitivity and robustness, can still be far away from reality – and unfortunately often in ways we know are important. Robustness of claims in a model does not per se give a warrant for exporting the claims to real world target systems.

Yours truly and people like Tony Lawson have for many years been urging economists to pay attention to the ontological foundations of their assumptions and models. Sad to say, economists have not paid much attention — and so modern economics has become increasingly irrelevant to the understanding of the real world.

Within mainstream economics, internal validity is still everything and external validity nothing. Why anyone should be interested in that kind of theories and models is beyond imagination. As long as mainstream economists do not come up with any export-licenses for their theories and models to the real world in which we live, they really should not be surprised if people say that this is not science, but autism!

Within mainstream economics, internal validity is still everything and external validity nothing. Why anyone should be interested in that kind of theories and models is beyond imagination. As long as mainstream economists do not come up with any export-licenses for their theories and models to the real world in which we live, they really should not be surprised if people say that this is not science, but autism!

To have valid evidence is not enough. Aiming only for validity is setting the economics aspirations level too low for developing a realist and relevant science.