11 years after the huge financial rescue operation, procrastinators look at the cost to the Treasury. The numbers are gigantic. Also the cost was negative. Saving the financial system and preventing a second great depression was, I think, the most profitable trade in human history by far. Crude accounting suggests this, but there are two relatively sophisticated arguments that the rescue didn’t yield profits and was, in fact, costly. First the notorious TARP was a small part of the rescue. Fed purchases of risky securities at prices far higher than anyone else was willing to pay dwarfed TARP. Also the separate rescue of Fannie Mae and Freddie Mac was very large compared to TARP. This means that the profit earned on TARP (which is small only compared

Topics:

Robert Waldmann considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

11 years after the huge financial rescue operation, procrastinators look at the cost to the Treasury. The numbers are gigantic. Also the cost was negative. Saving the financial system and preventing a second great depression was, I think, the most profitable trade in human history by far. Crude accounting suggests this, but there are two relatively sophisticated arguments that the rescue didn’t yield profits and was, in fact, costly.

First the notorious TARP was a small part of the rescue. Fed purchases of risky securities at prices far higher than anyone else was willing to pay dwarfed TARP. Also the separate rescue of Fannie Mae and Freddie Mac was very large compared to TARP. This means that the profit earned on TARP (which is small only compared to the huge amount of wealth at risk) is misleading. In fact, the Treasury made a profit on TARP even including the too small program to help mortgagers (HAMP) which was a gift not a loan and the cost of saving the US automobile industry. But focusing on that implies missing the much bigger picture involving federal reserve banks and the government sponsored entities which have become (again) government owned entities. If one considers them, one sees that the rescue was not just profitable, but the most profitable deal ever.

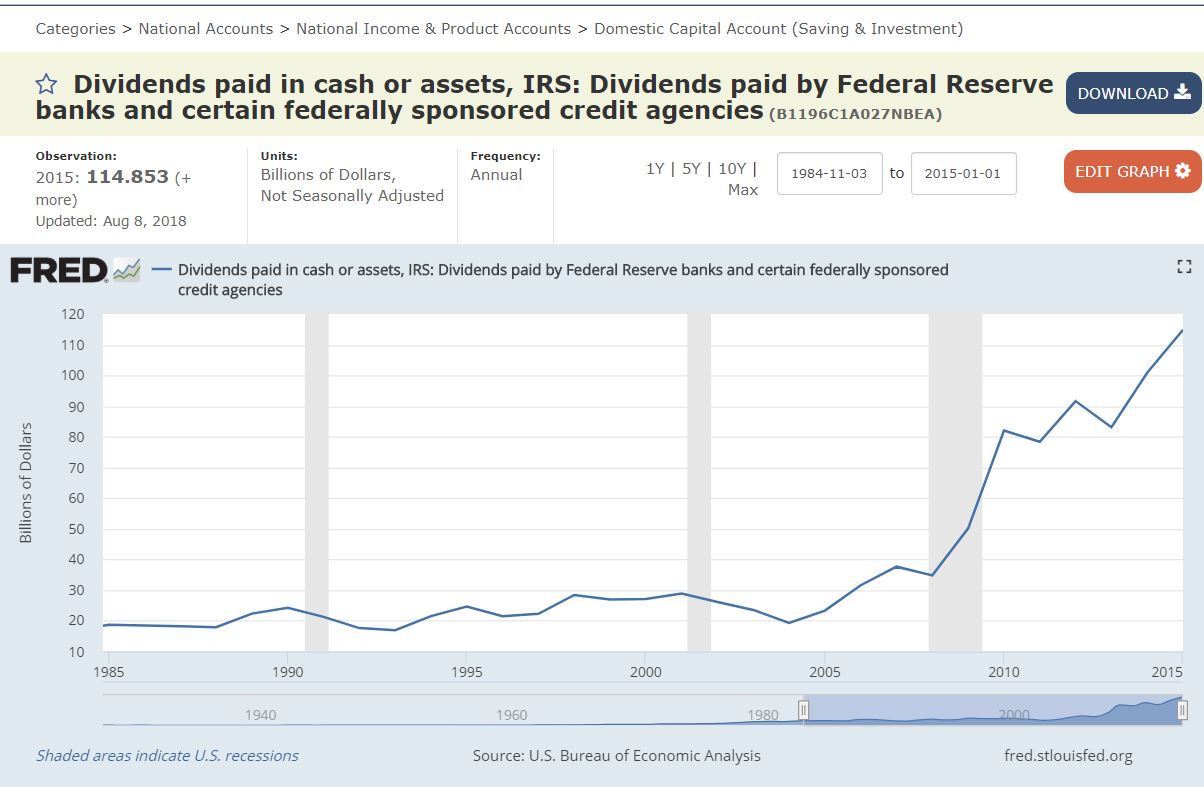

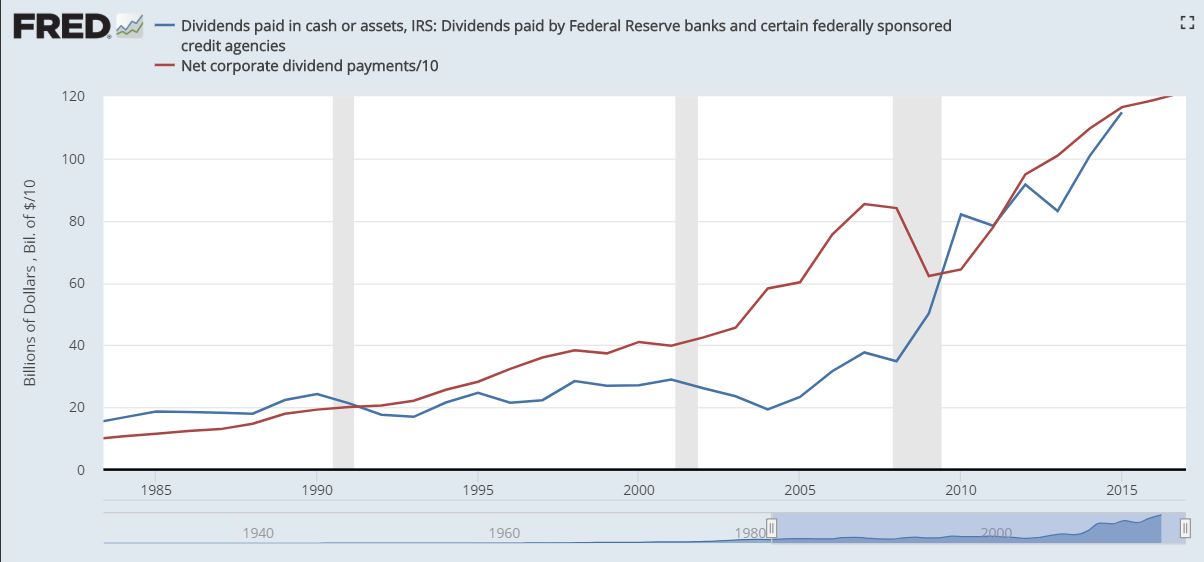

Here is the cash flow. It is huge and the cash is flowing in to the Treasury.

These are large numbers. The dividends largely resulting from the rescue are roughly 10% as large as total dividends paid by corporations.*

The second argument is that crude accounting is vulnerable to extending and pretending — non performing assets appear on balance sheets as if they were worth their face value. The Federal Reserve Banks do not mark their assets to market. It was arguable that their accounts were deceptive and that the profits they weree required to hand over to the Treasury would be more than balanced by losses which the Treasury would have to bear. Now there has never been final proof of anything ever, but I think it is safe to say that this reasonable argument was incorrect. The rescue might end up costing the Treasury if there is a financial crisis which dwarfs 2008. The assets of the Fed, Frannie and Freddie might become worthless, for example if a very large meteor hits the earth. But that’s not the way to bet.

Also, I told you so on September 18 2010