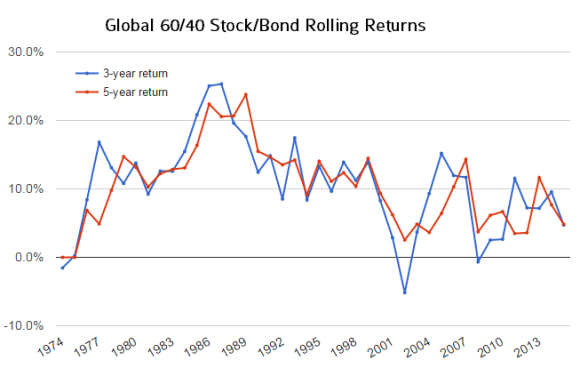

Share the post "The Bear Market Playbook" As many markets enter bear market territory around the globe investors are inevitably getting skittish. Bear markets are a regular part of the financial markets, but that doesn’t make them easy to handle. Here are some keys to handling a bear market: 1. Don’t lose your perspective. In the last 45 years a globally allocated 60/40 stock/bond portfolio has never had a negative rolling 5 year return. Of course, it’s not easy to maintain a 5 year time horizon, but if you have less than a 5 year time horizon you probably shouldn’t be owning stocks and bonds in the first place. Resisting recency bias is the greatest struggle for most investors. And unfortunately, most people never overcome it….I’ve witnessed this for decades with clients. The financial markets are a revolving door of investor after investor dying one funeral at a time thanks to excessive short-termism. You don’t have to be irrationally long-term, but focusing on the short-term is just as irrational. Of course, if you don’t have a proper allocation in the first place then you need to ensure that your risk profile is aligned with your asset allocation. 2. Turn off the news. Most of the financial media isn’t there to help you. They’re there to get your attention so they can earn a profit selling ad placements.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

As many markets enter bear market territory around the globe investors are inevitably getting skittish. Bear markets are a regular part of the financial markets, but that doesn’t make them easy to handle. Here are some keys to handling a bear market:

1. Don’t lose your perspective. In the last 45 years a globally allocated 60/40 stock/bond portfolio has never had a negative rolling 5 year return. Of course, it’s not easy to maintain a 5 year time horizon, but if you have less than a 5 year time horizon you probably shouldn’t be owning stocks and bonds in the first place. Resisting recency bias is the greatest struggle for most investors. And unfortunately, most people never overcome it….I’ve witnessed this for decades with clients. The financial markets are a revolving door of investor after investor dying one funeral at a time thanks to excessive short-termism.

You don’t have to be irrationally long-term, but focusing on the short-term is just as irrational. Of course, if you don’t have a proper allocation in the first place then you need to ensure that your risk profile is aligned with your asset allocation.

2. Turn off the news. Most of the financial media isn’t there to help you. They’re there to get your attention so they can earn a profit selling ad placements. Unfortunately, there is no emotion more powerful than fear. This is why financial TV ratings surge during bear markets. You tune in, get scared out of your wits, churn up a bunch of taxes and fees in your account, sell into panics, rinse wash repeat. I turned off financial TV almost a decade ago. It was one of the best financial decisions I ever made.

3. Stop looking at your account. Fidelity once found that investors who don’t log-in to their accounts perform better than investors who log-in regularly. The best thing most investors could do is lose their password to their account about once every five years. Logging in and incessantly focusing on your portfolio is just about the best way to ensure that you become a victim of recency bias. If you have a reasonable plan in place you just need to let time do the heavy lifting for you.

4. Focus on something else. Get your mind off the short-term swings in the market. There is nothing you can do to control the markets. Excessive activity is the illusion of control during the course of creating inefficient portfolio frictions. Get your mind off your portfolio by focusing on hobbies or work. Sitting around worrying about your portfolio isn’t going to help you or your portfolio.