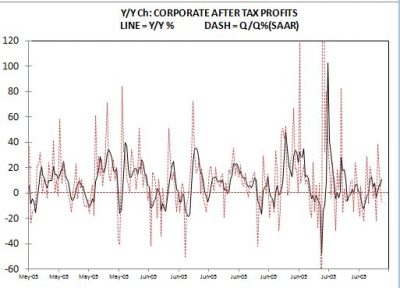

Along with fourth quarter GDP, corporate profits for the the fourth quarter was also reported. Profits growth was either quite strong or very weak depending on how you looked at them. On a year over year basis, after tax profits growth was 11% and appeared to be accelerating. However, on a quarter to quarter basis after tax profits actually fell -6.73% (SAAR) in the fourth quarter and that is after a third quarter annual growth rate of only 3.7%(SAAR). By comparison after tax profits growth surged 38.4 % (SAAR) and 14.0 % (SAAR) in the first and second quarters, respectively. Much of this early 2018 growth was due to the tax cut. But now that the tax cut is behind us, it looks like the Administrations promised strong growth remains just that, a

Topics:

Spencer England considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Along with fourth quarter GDP, corporate profits for the the fourth quarter was also reported. Profits growth was either quite strong or very weak depending on how you looked at them. On a year over year basis, after tax profits growth was 11% and appeared to be accelerating. However, on a quarter to quarter basis after tax profits actually fell -6.73% (SAAR) in the fourth quarter and that is after a third quarter annual growth rate of only 3.7%(SAAR). By comparison after tax profits growth surged 38.4 % (SAAR) and 14.0 % (SAAR) in the first and second quarters, respectively. Much of this early 2018 growth was due to the tax cut. But now that the tax cut is behind us, it looks like the Administrations promised strong growth remains just that, a Republican forecast and we all know how seriously to take them.

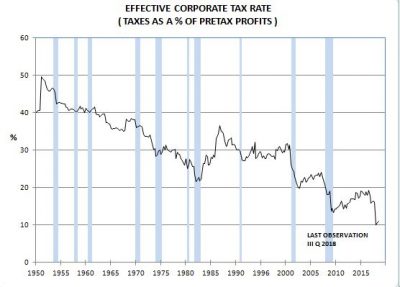

After this it looks like a good time to look at the impact of the corporate tax cut on the effective corporate tax cut — taxes as a share of pre-tax profits.

The effective tax rate fell from around 20% to just over 10%. That sounds like a big drop, but compared to the historic trend where the effective tax rate has fallen from almost 50% in 1950 to just over 10% now it does not look like such a massive tax cut after all. Moreover, as the data shows the big impact appears to be behind us and is unlikely to provide much of a boost to growth in 2019.

It also raises serious questions about the Republican promises to eliminate loopholes and other special arrangements so that the revenue loses from lower corporate taxes would not be significant. I have not seen them make much of an effort along those line. But maybe I am missing something and commenters can point out such legislation.