Bernie Sanders and Elizabeth Warren have proposed forgiving all student debt. Naturally, this is somewhat popular and garnering a lot of attention because free stuff is fun and having the government give out free stuff is also very controversial. Where do I sit on this issue? Well, it’s a complex one, but I’ll try to condense my thoughts here. The Student Loan Market – An Overview The student loan market is .6T spread out over 44MM people. That’s an average balance of ~K and a median balance of ~K.¹ In terms of broader household debt student loans are a relatively small piece of the pie at just 10% of household debt. One interesting trend is the recent slowdown in the growth rate of student loans. The financial crisis had a significant impact on student loans as it became

Topics:

Cullen Roche considers the following as important: Most Recent Stories, My View On...

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Bernie Sanders and Elizabeth Warren have proposed forgiving all student debt. Naturally, this is somewhat popular and garnering a lot of attention because free stuff is fun and having the government give out free stuff is also very controversial. Where do I sit on this issue? Well, it’s a complex one, but I’ll try to condense my thoughts here.

The Student Loan Market – An Overview

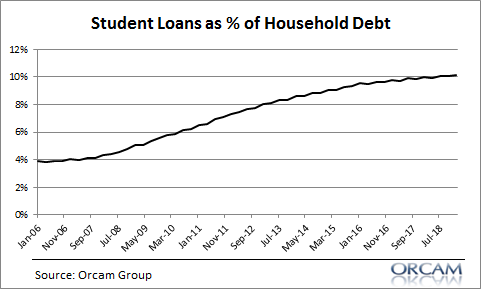

The student loan market is $1.6T spread out over 44MM people. That’s an average balance of ~$36K and a median balance of ~$19K.¹ In terms of broader household debt student loans are a relatively small piece of the pie at just 10% of household debt.

One interesting trend is the recent slowdown in the growth rate of student loans. The financial crisis had a significant impact on student loans as it became increasingly evident that more education was the answer to the financial woes that many were undergoing. So while student loans surged in the post-crisis period the growth rate has rapidly slowed in recent years which is evidenced in the flatlining of the above chart.

The reason that student loans surged in the post-crisis period is simple – college is worth it for most of the borrowers. According to the NY Fed college graduates earn 80% more than high school graduates. A study from Georgetown University (probably the finest school in the world in my unbiased opinion) showed that the top majors will earn $3.4MM more than the bottom majors. In other words, all student debt doesn’t lead to the same outcomes. The argument for education is even stronger for master’s degrees. According to the BLS the wage premium for a master’s degree is 36-89% over a bachelor’s degree.

So, the math here is pretty simple. Total college costs are ~$24K per year on average and the average college graduate is taking on ~$19K in debt to earn $66,500 vs the alternative of having no debt and earning $37,000 with a high school degree. Even with the rising cost of college and student loans the wage premium from college is a no-brainer.

One interesting thing I didn’t realize before studying this topic is that we’re talking about a small part of the US population here. Only 50MM Americans have a bachelor’s degree. That’s about 15% of the US population and 19% of the civilian noninstitutionalized population. So, when we talk about student loans we are talking about a small part of America’s future upper middle class and upper class.²

That said, the concern here is that the earnings of the graduates are uneven. So student loans are disproportionately burdensome upfront when the graduate can least afford it. According to some studies this is suppressing GDP and negatively impacting social outcomes.³

A Solution in Search of a Problem

When I criticized QE and the bank bailouts relentlessly in 2009/2010 I did so not because I thought they were inherently bad programs, but because they didn’t actually solve the problem we were confronted with. And I am applying the same general thinking here.

The problem here (if we can say that earning 80% more than 67% of the US population is a “problem”) is that forgiving student debt doesn’t actually solve the underlying cause (which is the high cost of college). In fact, if you cancel student debt the strong likelihood is that the cost of college will rise in the future since the smart borrower will simply increase their demand for college loans knowing that it will all be forgiven.

Further, debt forgiveness of this type is a very bad precedent with all sorts of moral hazard. Where do we draw the line? Should I get a refund on my years at Georgetown University because I am that much poorer than I’d otherwise be? Should current borrowers all stop paying their loans in anticipation of future forgiveness? And wait a second – if you think student loans are a big problem then what about the $9.2T mortgage debt market. Shouldn’t we consider forgiving all that debt as well since it covers a much broader subset of the American population? I kid, of course. But you can see that the actual logistics of implementing this policy is easier said than done.

A Logical Solution?

There’s interesting precedent for the student loan market that makes a lot of sense to me – Australia. In Australia you don’t pay your student loans until you reach a certain income level. And you don’t pay any interest. This would seem to solve a lot of the problems expressed by the pro-forgiveness crowd without going down the “everyone gets a free pony” rabbit hole.

The Bottom Line

The bottom line is that there isn’t a “crisis” in student debt. Not only is it a fairly small portion of the household debt market, but it is made up of people who will be America’s future upper middle class and upper class.4 Further, forgiving student debt doesn’t actually solve the root of the problem which is the high cost of college (which is expensive because it’s worth it) and could actually make that problem worse. But most importantly, it seems like we can have our cake and eat it too here. We can attack the real concern here (the disproportionate manner in which student loans hurt graduates when they can least afford it) by enacting policy that is more directly tied to incomes without the interest burden that can make student loans so harmful.

Anyhow, that’s my view. Let me know what you think in the forum.

———————————————————————————

¹ – EBRI, Student Loan Debt: Trends and Implications , 2018

² – 40% of student loans are held by graduate students which means that a student debt forgiveness plan is a significant handout to the upper class since these people will earn ~150% more than high school graduates on average. .

³ – One of the arguments here that absolutely kills me is that Millennials can’t afford to buy a house because of their student loans. So, you want to forgive a small debt so they can take on a huge debt? Will someone explain that logic to me!?!?!

4 – The delinquency rate of 11% on student debt is a fairly small part of an already small part of household debt. But more importantly, even if all 11% of these delinquent borrowers were to default it would be equivalent to less than 1% of GDP.