Share the post "Scarcity VS Abundance" Josh Brown and Gavin Jackson have both written excellent pieces on the current environment and the state of the business cycle. Josh argues that we’re in a state of “abundance” and that we’re due for a recession whereas Gavin argues that there is not so much a broad abundance, but a more fragmented abundance. Let’s explore this a bit more. This has become an increasingly difficult conversation in the global economy because there are several different business cycles occurring at the moment. I would argue, for instance, that Europe is involved in one drawn out sluggish cyclical stagnation due to its unworkable currency whereas the USA looks relatively robust and China is at risk of recession. But let’s look more closely at the USA. First, if we pan out 30,000 feet there really doesn’t seem to be much abundance at all. At the macro level the output gap is still tremendous. You’ll notice in the following chart that the economy tends to fall into recession AFTER we’ve seen nominal GDP surpass potential GDP: This makes sense. With U6 unemployment just shy of 10% there is still a good bit of slack in the economy. This also explains why the employment data still looks decent.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Josh Brown and Gavin Jackson have both written excellent pieces on the current environment and the state of the business cycle. Josh argues that we’re in a state of “abundance” and that we’re due for a recession whereas Gavin argues that there is not so much a broad abundance, but a more fragmented abundance. Let’s explore this a bit more.

This has become an increasingly difficult conversation in the global economy because there are several different business cycles occurring at the moment. I would argue, for instance, that Europe is involved in one drawn out sluggish cyclical stagnation due to its unworkable currency whereas the USA looks relatively robust and China is at risk of recession. But let’s look more closely at the USA.

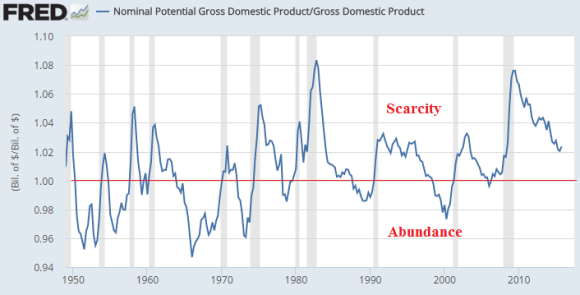

First, if we pan out 30,000 feet there really doesn’t seem to be much abundance at all. At the macro level the output gap is still tremendous. You’ll notice in the following chart that the economy tends to fall into recession AFTER we’ve seen nominal GDP surpass potential GDP:

This makes sense. With U6 unemployment just shy of 10% there is still a good bit of slack in the economy. This also explains why the employment data still looks decent. The economy is still slowly pulling the slack out of the labor market and if history is any guide then we could still squeeze a few percentage points out of the U6 rate.

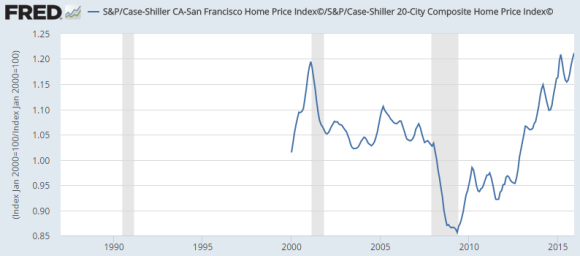

Of course, this doesn’t mean there hasn’t been microcosms of abundance. There are parts of the oil sector and manufacturing sector that are almost certainly in a recession at present. And I think you could say that San Francisco has experienced quite a bit of abundance in the last 5 years. Just have a look at San Francisco house prices versus national house prices as a better gauge on this:

The bottom line: we’re in a highly fragmented economic environment right now. Parts of the global economy are definitely in a recession and certain parts of the US economy are either in recession or on the verge of it. But at the broader level the US economy still looks like there is too much slack out there for a broad and deep recession. I would argue there are pockets of abundance, but that scarcity is still the dominant force at play in the USA.