Time to explain ergodicity … The difference between 100 people going to a casino and one person going to a casino 100 times, i.e. between (path dependent) and conventionally understood probability. The mistake has persisted in economics and psychology since age immemorial. Consider the following thought experiment. First case, one hundred persons go to a Casino, to gamble a certain set amount each and have complimentary gin and tonic … Some may lose, some may win, and we can infer at the end of the day what the “edge” is, that is, calculate the returns simply by counting the money left with the people who return. We can thus figure out if the casino is properly pricing the odds. Now assume that gambler number 28 goes bust. Will gambler number 29 be affected? No. You can

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Time to explain ergodicity …

The difference between 100 people going to a casino and one person going to a casino 100 times, i.e. between (path dependent) and conventionally understood probability. The mistake has persisted in economics and psychology since age immemorial.

Consider the following thought experiment.

First case, one hundred persons go to a Casino, to gamble a certain set amount each and have complimentary gin and tonic … Some may lose, some may win, and we can infer at the end of the day what the “edge” is, that is, calculate the returns simply by counting the money left with the people who return. We can thus figure out if the casino is properly pricing the odds. Now assume that gambler number 28 goes bust. Will gambler number 29 be affected? No.

You can safely calculate, from your sample, that about 1% of the gamblers will go bust. And if you keep playing and playing, you will be expected have about the same ratio, 1% of gamblers over that time window.

Now compare to the second case in the thought experiment. One person, your cousin Theodorus Ibn Warqa, goes to the Casino a hundred days in a row, starting with a set amount. On day 28 cousin Theodorus Ibn Warqa is bust. Will there be day 29? No. He has hit an uncle point; there is no game no more.

No matter how good he is or how alert your cousin Theodorus Ibn Warqa can be, you can safely calculate that he has a 100% probability of eventually going bust.

The probabilities of success from the collection of people does not apply to cousin Theodorus Ibn Warqa. Let us call the first set ensemble probability, and the second one time probability (since one is concerned with a collection of people and the other with a single person through time). Now, when you read material by finance professors, finance gurus or your local bank making investment recommendations based on the long term returns of the market, beware. Even if their forecast were true (it isn’t), no person can get the returns of the market unless he has infinite pockets and no uncle points. The are conflating ensemble probability and time probability. If the investor has to eventually reduce his exposure because of losses, or because of retirement, or because he remarried his neighbor’s wife, or because he changed his mind about life, his returns will be divorced from those of the market, period.

Taleb’s excellent example shows why the difference between ensemble and time averages is of such importance in economics.

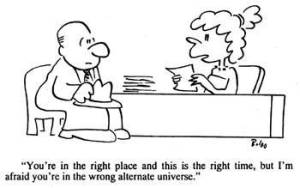

Assume we have a market with an asset priced at €100. Then imagine the price first goes up by 50% and then later falls by 50%. The ensemble average for this asset would be €100 – because we here envision two parallel universes (markets) where the asset price falls in one universe (market) with 50% to €50, and in another universe (market) it goes up with 50% to €150, giving an average of 100 € ((150+50)/2). The time average for this asset would be 75 € – because we here envision one universe (market) where the asset price first rises by 50% to €150 and then falls by 50% to €75 (0.5*150).

Assume we have a market with an asset priced at €100. Then imagine the price first goes up by 50% and then later falls by 50%. The ensemble average for this asset would be €100 – because we here envision two parallel universes (markets) where the asset price falls in one universe (market) with 50% to €50, and in another universe (market) it goes up with 50% to €150, giving an average of 100 € ((150+50)/2). The time average for this asset would be 75 € – because we here envision one universe (market) where the asset price first rises by 50% to €150 and then falls by 50% to €75 (0.5*150).

From the ensemble perspective nothing really, on average, happens. From the time perspective lots of things really, on average, happen. Assuming ergodicity there would have been no difference at all.