The gross substitution axiom Economics is perhaps more than any other social science model-oriented. There are many reasons for this — the history of the discipline, having ideals coming from the natural sciences (especially physics), the search for universality (explaining as much as possible with as little as possible), rigour, precision, etc. Mainstream economists want to explain social phenomena, structures and patterns, based on the assumption that the agents are acting in an optimizing (rational) way to satisfy given, stable and well-defined goals. The procedure is analytical. The whole is broken down into its constituent parts so as to be able to explain (reduce) the aggregate (macro) as the result of interaction of its parts (micro). Building their economic models, modern mainstream neoclassical economists ground their models on a set of core assumptions (CA) — describing the agents as ‘rational’ actors — and a set of auxiliary assumptions (AA). Together CA and AA make up what I will call the ur-model (M) of all mainstream neoclassical economic models. Based on these two sets of assumptions, they try to explain and predict both individual (micro) and — most importantly — social phenomena (macro). The core assumptions typically consist of completeness, transitivity, non-satiation, optimisation, consistency, gross substitutability, etc., etc.

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

The gross substitution axiom

Economics is perhaps more than any other social science model-oriented. There are many reasons for this — the history of the discipline, having ideals coming from the natural sciences (especially physics), the search for universality (explaining as much as possible with as little as possible), rigour, precision, etc.

Mainstream economists want to explain social phenomena, structures and patterns, based on the assumption that the agents are acting in an optimizing (rational) way to satisfy given, stable and well-defined goals.

The procedure is analytical. The whole is broken down into its constituent parts so as to be able to explain (reduce) the aggregate (macro) as the result of interaction of its parts (micro).

Building their economic models, modern mainstream neoclassical economists ground their models on a set of core assumptions (CA) — describing the agents as ‘rational’ actors — and a set of auxiliary assumptions (AA). Together CA and AA make up what I will call the ur-model (M) of all mainstream neoclassical economic models. Based on these two sets of assumptions, they try to explain and predict both individual (micro) and — most importantly — social phenomena (macro).

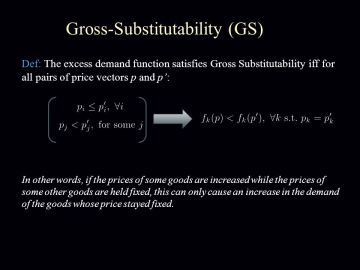

The core assumptions typically consist of completeness, transitivity, non-satiation, optimisation, consistency, gross substitutability, etc., etc.

The core assumptions typically consist of completeness, transitivity, non-satiation, optimisation, consistency, gross substitutability, etc., etc.

Beside the core assumptions (CA) the model also typically has a set of auxiliary assumptions (AA) spatio-temporally specifying the kind of social interaction between ‘rational actors’ that take place in the model.

So, the ur-model of all economic models basically consist of a general specification of what (axiomatically) constitutes optimizing rational agents and a more specific description of the kind of situations in which these rational actors act (making AA serve as a kind of specification/restriction of the intended domain of application for CA and its deductively derived theorems). The list of assumptions can never be complete, since there will always be unspecified background assumptions and some (often) silent omissions (like closure, transaction costs, etc., regularly based on some negligibility and applicability considerations).

The hope is that the ‘thin’ list of assumptions shall be sufficient to explain and predict ‘thick’ phenomena in the real, complex, world.

Empirically it has, however, turned out that this hope is almost never fulfilled. The core — and many of the auxiliary — assumptions turn out to have preciously little to do with the real (non-model) world we happen to live in. And that goes for the gross substitution axiom as well:

The gross substitution axiom assumes that if the demand for good x goes up, its relative price will rise, inducing demand to spill over to the now relatively cheaper substitute good y. For an economist to deny this ‘universal truth’ of gross substitutability between objects of demand is revolutionary heresy – and as in the days of the Inquisition, the modern-day College of Cardinals of mainstream economics destroys all non-believers, if not by burning them at the stake, then by banishing them from the mainstream professional journals. Yet in Keynes’s (1936, ch. 17) analysis ‘The Essential Properties of Interest and Money’ require that:

1. The elasticity of production of liquid assets including money is approximately zero. This means that private entrepreneurs cannot produce more of these assets by hiring more workers if the demand for liquid assets increases. In other words, liquid assets are not producible by private entrepreneurs’ hiring of additional workers; this means that money (and other liquid assets) do not grow on trees.

2. The elasticity of substitution between all liquid assets, including money (which are not reproducible by labour in the private sector) and producibles (in the private sector), is zero or negligible. Accordingly, when the price of money increases, people will not substitute the purchase of the products of industry for their demand for money for liquidity (savings) purposes.

These two elasticity properties that Keynes believed are essential to the concepts of money and liquidity mean that a basic axiom of Keynes’s logical framework is that non- producible assets that can be used to store savings are not gross substitutes for producible assets in savers’ portfolios. If this elasticity of substitution between liquid assets and the products of industry is significantly different from zero (if the gross substitution axiom is ubiquitously true), then even if savers attempt to use non-reproducible assets for storing their increments of wealth, this increase in demand will increase the price of non- producibles. This relative price rise in non-producibles will, under the gross substitution axiom, induce savers to substitute reproducible durables for non-producibles in their wealth holdings and therefore non-producibles will not be, in Hahn’s terminology, ‘ultimate resting places for savings’. The gross substitution axiom therefore restores Say’s Law and denies the logical possibility of involuntary unemployment.