The housing depression continues: Existing Home SalesHighlightsHousing demand continues to soften with existing home sales down a surprising 7.1 percent in February to a 5.080 million annualized rate. This is much lower than expected and well below Econoday’s low estimate for 5.200 million and is the second lowest rate since February last year. The report is weak throughout with single-family sales down 7.2 percent, at 4.510 million, and condos down 6.6 percent at 570,000. All regions show declines in the month. The drop is described as “meaningful” by the usually upbeat National Realtor Association which compiles the report. The weakness in this report is substantial and represents a downgrade for housing, a sector that was supposed to be a leader of the 2016 economy. Still in negative territory: Chicago Fed National Activity IndexHighlightsA warm weather drop in utility output is a major factor behind a much lower-than-expected reading for the national activity index which came in at minus 0.29 vs Econoday expectations for plus 0.25 in February. The headline’s production component fell to minus 0.21 from January’s plus 0.29, pulled down by a 9.3 percent decline in utility output as well as a 9.9 percent decline in the struggling mining component, both masking a respectable 0.2 percent gain in the report’s most important component, manufacturing output.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The housing depression continues:

Existing Home Sales

Highlights

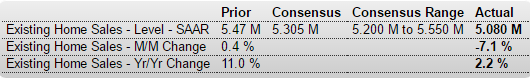

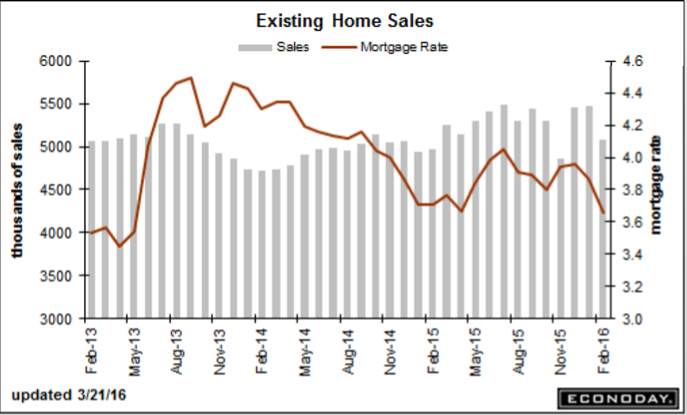

Housing demand continues to soften with existing home sales down a surprising 7.1 percent in February to a 5.080 million annualized rate. This is much lower than expected and well below Econoday’s low estimate for 5.200 million and is the second lowest rate since February last year. The report is weak throughout with single-family sales down 7.2 percent, at 4.510 million, and condos down 6.6 percent at 570,000. All regions show declines in the month. The drop is described as “meaningful” by the usually upbeat National Realtor Association which compiles the report. The weakness in this report is substantial and represents a downgrade for housing, a sector that was supposed to be a leader of the 2016 economy.

Still in negative territory:

Chicago Fed National Activity Index

Highlights

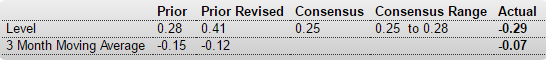

A warm weather drop in utility output is a major factor behind a much lower-than-expected reading for the national activity index which came in at minus 0.29 vs Econoday expectations for plus 0.25 in February. The headline’s production component fell to minus 0.21 from January’s plus 0.29, pulled down by a 9.3 percent decline in utility output as well as a 9.9 percent decline in the struggling mining component, both masking a respectable 0.2 percent gain in the report’s most important component, manufacturing output. But there is also weakness in the employment component which contributed only plus 0.03 to the February composite vs January’s plus 0.19, here reflecting a lower contribution from employment expansion in the household survey (530,000 vs January’s 615,000). A smaller negative comes from the personal consumption & housing component, at minus 0.09 vs minus 0.05, with a fractional drag coming from the sales/orders/inventories component, at minus 0.03 vs minus 0.02. The decline in utility output is a one-time event, pointing to a bounce for the February report.

One reason claims are low: