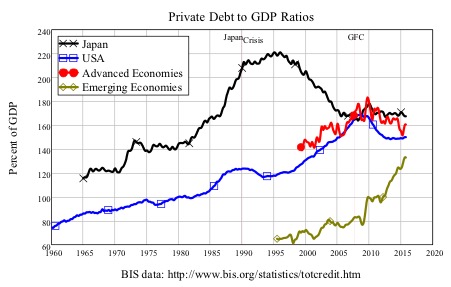

This is an invited paper by the Private Debt Project, an initiative of the philanthropic organization the Governor’s Woods Foundation to raise awareness about the economic importance and dangers of private debt. The era of low growth known as Japan’s “Lost Decade” commenced in 1990, and persists to this day. While most authors acknowledge that the seeds for the Lost Decade were sown by excessive credit growth in the preceding Bubble Economy years, only Richard Koo (Koo, 2009, Koo, 2011, Koo, 2003, Koo, 2014) and Richard Werner (Voutsinas and Werner, 2011, Werner, 2002) have systematically argued that insufficient credit growth during the “Lost Decade” explains Japan’s now quarter-century long slump. Yet these arguments tell us more about the dilemmas facing today’s world economy than many more commonly accepted explanations of the current slowdown. The insufficient credit growth story is rejected out of hand by most economists, for reasons summed up by Paul Krugman. From the perspective of mainstream economics, any event that negatively affects debtors is, to a large degree, offset by the positive effects of that event for creditors.

Topics:

Steve Keen considers the following as important: Debtwatch

This could be interesting, too:

Steve Keen writes Zimpler Casino Utan Svensk Licens ? Utländska Casino Mediterranean Sea Zimpler

Steve Keen writes Login Sowie Spiele Auf Der Offiziellen Seite On The Internet”

Steve Keen writes Login Bei Vulcanvegas De Ebenso Registrierung, Erfahrungen 2025

Steve Keen writes What To Be Able To Wear To The Casino? The Complete Dress Guide

This is an invited paper by the Private Debt Project, an initiative of the philanthropic organization the Governor’s Woods Foundation to raise awareness about the economic importance and dangers of private debt.

The era of low growth known as Japan’s “Lost Decade” commenced in 1990, and persists to this day. While most authors acknowledge that the seeds for the Lost Decade were sown by excessive credit growth in the preceding Bubble Economy years, only Richard Koo (Koo, 2009, Koo, 2011, Koo, 2003, Koo, 2014) and Richard Werner (Voutsinas and Werner, 2011, Werner, 2002) have systematically argued that insufficient credit growth during the “Lost Decade” explains Japan’s now quarter-century long slump. Yet these arguments tell us more about the dilemmas facing today’s world economy than many more commonly accepted explanations of the current slowdown.

The insufficient credit growth story is rejected out of hand by most economists, for reasons summed up by Paul Krugman. From the perspective of mainstream economics, any event that negatively affects debtors is, to a large degree, offset by the positive effects of that event for creditors. Krugman therefore sees no possibility of Koo’s argument of “an entire economy being “balance-sheet constrained”:

Maybe part of the problem is that Koo envisages an economy in which everyone is balance-sheet constrained, as opposed to one in which lots of people are balance-sheet constrained. I’d say that his vision makes no sense: where there are debtors, there must also be creditors, so there have to be at least some people who can respond to lower real interest rates even in a balance-sheet recession. (Krugman, 2013)

Koo is, however, correct: it is possible for an entire economy to be balance-sheet constrained. Understanding why requires an appreciation of private credit creation that goes beyond the mere accounting truism that every entity’s liability is another entity’s asset. This paper will argue that the assumptions made by mainstream economists about the role of credit and banking in the economy are incorrect. When taking into account the “money creation” functions of banking, it becomes clear that the USA and most advanced economies as well as many emerging economies have joined Japan in being balance-sheet constrained, and face their own “lost decade” as a consequence of low credit growth.

I will start with the empirical data and its implications, and then move on to the argument that an entire economy can be balance-sheet constrained.