Who would’ve thought?;) The ECB makes this point in a footnote on page 10: The ECB Explains Why Central Banks Can’t Go Bankrupt in a Footnote “Central banks are protected from insolvency due to their ability to create money and can therefore operate with negative equity.” Trade deficit higher than expected. GDP estimates being revised down: International Trade And note the general downturn in trade which has always been associated with recessions in the past:GDP growth forecast down to only +.4% annualized, and the inventory correction impulse is yet to come:No sign of life here yet:Up a bit, but the trend still looking lower from last summer’s highs, as the slump in oil capex works its way through the economy: ISM Non-Mfg Index

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Who would’ve thought?

;)

The ECB makes this point in a footnote on page 10:

The ECB Explains Why Central Banks Can’t Go Bankrupt in a Footnote

“Central banks are protected from insolvency due to their ability to create money and can therefore operate with negative equity.”

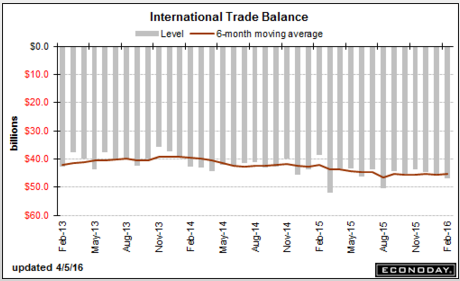

Trade deficit higher than expected.

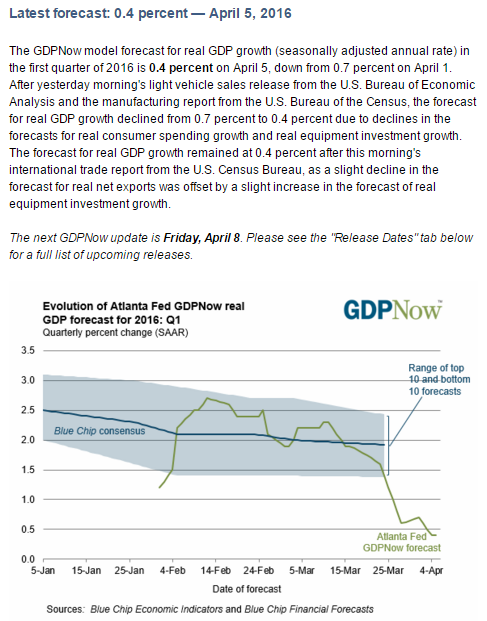

GDP estimates being revised down:

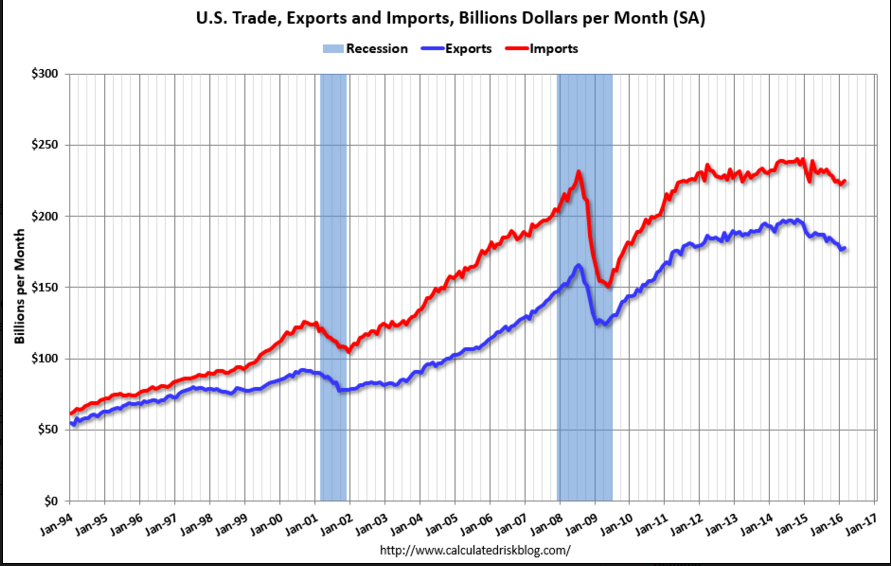

International Trade

And note the general downturn in trade which has always been associated with recessions in the past:

GDP growth forecast down to only +.4% annualized, and the inventory correction impulse is yet to come:

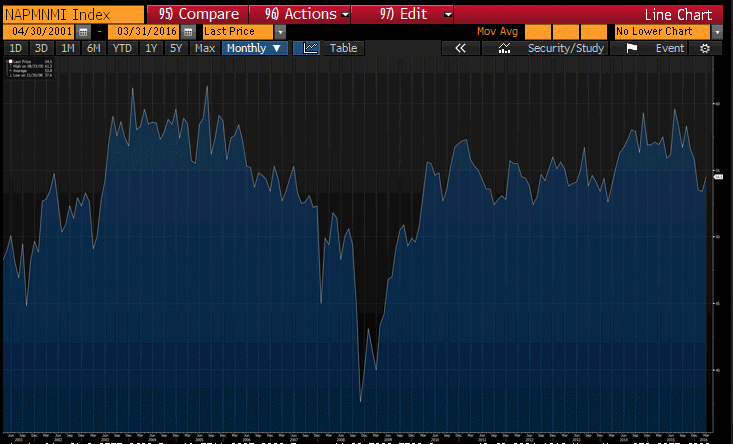

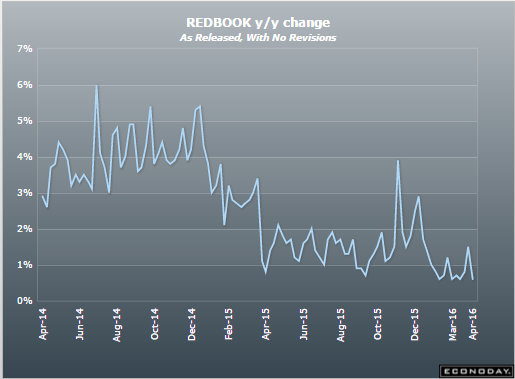

No sign of life here yet:

Up a bit, but the trend still looking lower from last summer’s highs, as the slump in oil capex works its way through the economy:

ISM Non-Mfg Index