Confirms what had to be the case as a simple point of logic. Saudis set price and let quantity adjust: Saudi Arabia is producing below its potential capacity because it only responds to demand, the prince said. “If we produced more oil than there is demand, we would destroy many markets. So we consider supply and demand, and we look at any demand we receive and we deal with it.” Less then expected and trending lower: Consumer SentimentHighlightsA week of mostly weak economic data ends on a drop for consumer sentiment, to a much lower-than-expected 89.7 for the flash April reading vs 91.0 for final March.Weakness is centered in the expectations component, down 1.9 points to 79.6 to signal, perhaps, emerging doubts over future job and income prospects. The assessment of current conditions is down only 2 tenths to 105.4 in an early indication that consumer activity in April will roughly match that of March, which however was a weak month judging by the retail sales report posted earlier in the week.In another headache, long-term inflation expectations are eroding further despite the rise in oil prices, down 2 tenths for the 5-year outlook to 2.5 percent. One-year expectations are stable at 2.7 percent.The decline in this report isn’t exactly incremental but is far from a free fall, especially the resilience in current conditions.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Confirms what had to be the case as a simple point of logic.

Saudis set price and let quantity adjust:

Saudi Arabia is producing below its potential capacity because it only responds to demand, the prince said. “If we produced more oil than there is demand, we would destroy many markets. So we consider supply and demand, and we look at any demand we receive and we deal with it.”

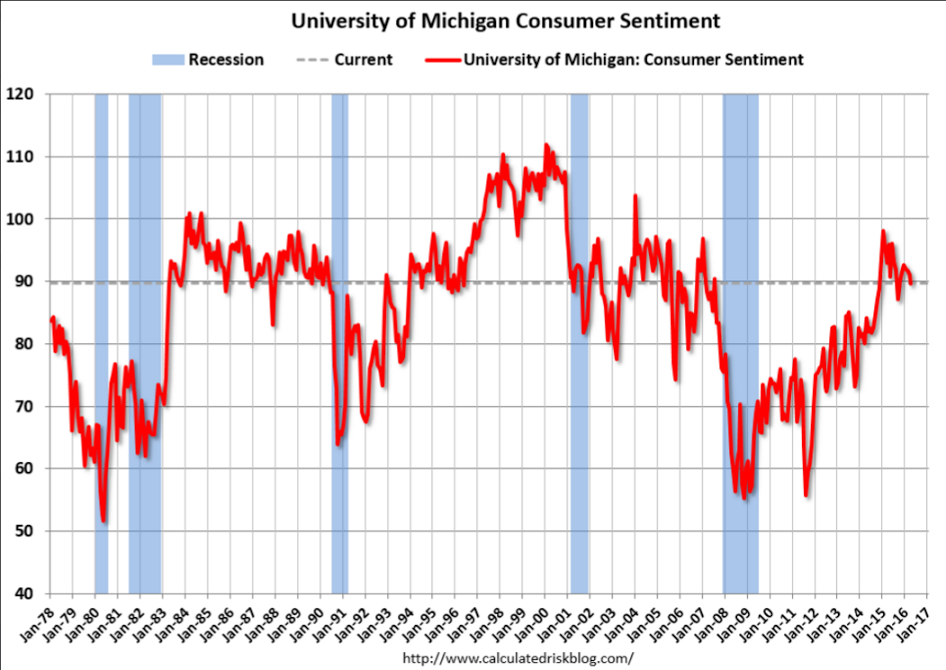

Less then expected and trending lower:

Consumer Sentiment

Highlights

A week of mostly weak economic data ends on a drop for consumer sentiment, to a much lower-than-expected 89.7 for the flash April reading vs 91.0 for final March.Weakness is centered in the expectations component, down 1.9 points to 79.6 to signal, perhaps, emerging doubts over future job and income prospects. The assessment of current conditions is down only 2 tenths to 105.4 in an early indication that consumer activity in April will roughly match that of March, which however was a weak month judging by the retail sales report posted earlier in the week.

In another headache, long-term inflation expectations are eroding further despite the rise in oil prices, down 2 tenths for the 5-year outlook to 2.5 percent. One-year expectations are stable at 2.7 percent.

The decline in this report isn’t exactly incremental but is far from a free fall, especially the resilience in current conditions. Still, low wage growth and a heated political climate are not proving to be positives for consumer confidence.