Continues at depressed levels: MBA Mortgage ApplicationsHighlightsPurchase applications are not pointing to Spring acceleration for the housing sector, down 2.0 percent from the April 22 week with the year-on-year rate continuing to come down, to 14 percent from 17 percent. This rate was as high as 30 percent as recently as March. Refinancing activity also declined, down 5.0 percent in the week. Rates remain very low with the average 30-year mortgage for conforming loans (7,000 or less) at 3.85 percent for a 2 basis point rise in the week. About as expected but total activity continued to slow: International Trade in GoodsHighlightsTrade activity slowed sharply in March though the deficit narrowed, down a sharp 9.5 percent to .9 billion vs February’s .9 billion. Exports fell 1.7 percent to 6.7 billion with consumer goods showing a steep decline together with wide declines for industrial supplies, autos, and foods. A positive, however, is a 1.5 percent uptick in capital goods exports, one that follows a smaller gain in February and hints at resiliency for global business investment. But the import side of the report points at declining domestic demand with consumer goods down a very steep 9.1 percent. Capital goods are also weak, down 3.6 percent.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Continues at depressed levels:

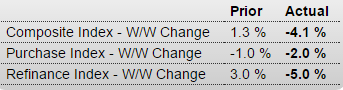

MBA Mortgage Applications

Highlights

Purchase applications are not pointing to Spring acceleration for the housing sector, down 2.0 percent from the April 22 week with the year-on-year rate continuing to come down, to 14 percent from 17 percent. This rate was as high as 30 percent as recently as March. Refinancing activity also declined, down 5.0 percent in the week. Rates remain very low with the average 30-year mortgage for conforming loans ($417,000 or less) at 3.85 percent for a 2 basis point rise in the week.

About as expected but total activity continued to slow:

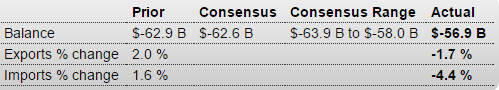

International Trade in Goods

Highlights

Trade activity slowed sharply in March though the deficit narrowed, down a sharp 9.5 percent to $56.9 billion vs February’s $62.9 billion. Exports fell 1.7 percent to $116.7 billion with consumer goods showing a steep decline together with wide declines for industrial supplies, autos, and foods. A positive, however, is a 1.5 percent uptick in capital goods exports, one that follows a smaller gain in February and hints at resiliency for global business investment. But the import side of the report points at declining domestic demand with consumer goods down a very steep 9.1 percent. Capital goods are also weak, down 3.6 percent. Cross-border activity has been a major negative for the global economy and March’s goods data point to continuing trouble though they will, however, give a lift to first-quarter GDP. This report represents the goods portion of the monthly international trade report which will be posted next Wednesday.

No sign here of housing leading the GDP charge this year:

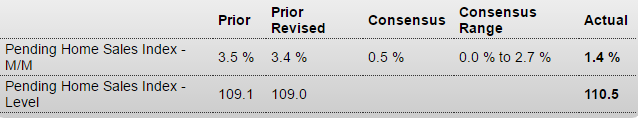

Pending Home Sales Index

Highlights

Growth in the housing sector this year has been mostly soft though today’s pending home sales report does hint at greater strength ahead. The pending home sales index, which tracks contract signing for existing home sales, rose a higher-than-expected 1.4 percent in the March report. Yet the year-on-year rate is showing very little improvement, also at plus 1.4 percent.Pending home sales surged in the Midwest during February but slowed to only plus 0.2 percent in March. Strength in the latest report is centered in the Northeast and also the South, up 3.2 and 3.0 percent respectively. Year-on-year, the Northeast, which is the smallest region for housing sales, is up 18.4 percent with the Midwest up 4.0 percent.

Existing home sales did show life in March as indicated by this report’s February data with today’s data pointing to further improvement. Still, sales data show little momentum going into the Spring selling season.

This is ridiculous and shows no understanding of banking with floating fx. The way I like to put it is ‘the liability side of banking is not the place for market discipline’. Public purpose is best served by the CB supplying unlimited liquidity at the policy rate, and regulating and supervising the asset side:

U.S. proposes rule to shrink big banks’ liquidity risk

(Reuters) The top U.S. banking regulator on Tuesday released its proposal for establishing a Net Stable Funding Ratio. The ratio is intended to ensure liquidity over a one-year horizon, compared with the liquidity coverage ratio of 2014 requiring banks to hold high-quality assets that could be readily converted into cash within 30 days. The ratio will “discourage reliance on more volatile short-term funding,” the FDIC said in its proposal. The proposal is in line with the international Basel standard set in 2015, according to the FDIC. It differs primarily by providing a narrower definition of a “high-quality liquid asset” and a way to address “trapped liquidity.”

GDP=total final sales, so if Apple sales fall $10 billion for a quarter that’s about .2% of GDP (annualized)?

Apple quarterly earnings, revenue miss Wall Street target

(Reuters) Apple said it was raising its capital return program by $50 billion through a $35 billion increase in its share buyback authorization and a 10 percent rise in the quarterly dividend. Apple said it sold 51.2 million iPhones in its second fiscal quarter, down from 61.2 million in the same quarter a year ago. Earnings of $1.90 per share. Revenue of $50.56 billion. Apple forecast third-quarter revenue of $41 billion to $43 billion, short of the Wall Street consensus of $47.3 billion.