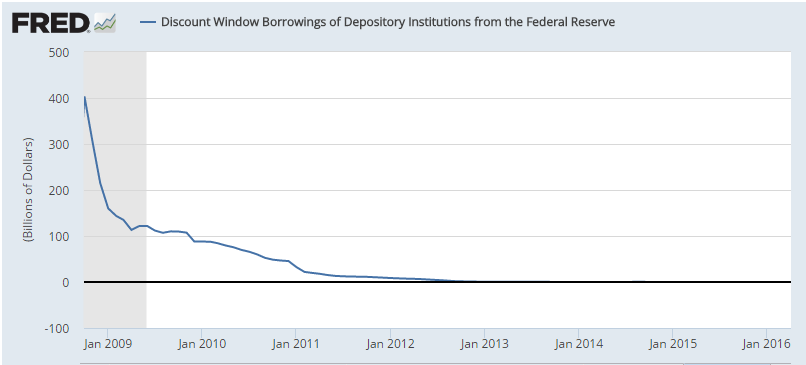

Not good!The regional Feds are calling for higher discount lending rates even though borrowings are at 0! According to the Fed minutes from the discount rate meeting (different from the FOMC minutes), four of the Fed banks called for a hike in the discount rate. It’s the emergency rate at which banks could borrow directly from the Fed’s discount window – currently at 1%. This disclosure suggests that the Fed is becoming increasingly hawkish.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Not good!

The regional Feds are calling for higher discount lending rates even though borrowings are at 0!

According to the Fed minutes from the discount rate meeting (different from the FOMC minutes), four of the Fed banks called for a hike in the discount rate. It’s the emergency rate at which banks could borrow directly from the Fed’s discount window – currently at 1%. This disclosure suggests that the Fed is becoming increasingly hawkish.