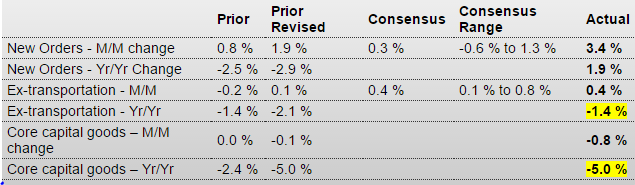

Way up and better than expected, but looks like it was all a large aircraft order and some cars. Another good headline April release also likely to reverse in May: Durable Goods OrdersHighlightsIndications on the factory sector have been mixed as is April’s durable goods report. The headline came in at a stronger-than-expected gain of 3.4 percent with March revised higher to a gain of 1.9 percent. Vehicles orders gave an important boost to April, up 2.9 percent as did the always volatile commercial aircraft component which swung 65 percent higher. But the ex-transportation reading, which excludes vehicles and commercial aircraft, rose a more modest and as-expected 0.4 percent.A negative in the report is a sizable 0.8 percent decline in core capital goods orders which ominously is the third straight decline for this reading and the fifth out of the last six reports. Year-on-year, orders are noticeably in the negative column at minus 5.0 percent. These readings point squarely to stubborn weakness in business investment and uncertainty in the general business outlook.There are, however, solid points of strength in the report including 0.6 percent gains for both total shipments and total unfilled orders. The gain for unfilled orders is the largest since July 2014. Another plus is a 0.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Way up and better than expected, but looks like it was all a large aircraft order and some cars. Another good headline April release also likely to reverse in May:

Durable Goods Orders

Highlights

Indications on the factory sector have been mixed as is April’s durable goods report. The headline came in at a stronger-than-expected gain of 3.4 percent with March revised higher to a gain of 1.9 percent. Vehicles orders gave an important boost to April, up 2.9 percent as did the always volatile commercial aircraft component which swung 65 percent higher. But the ex-transportation reading, which excludes vehicles and commercial aircraft, rose a more modest and as-expected 0.4 percent.A negative in the report is a sizable 0.8 percent decline in core capital goods orders which ominously is the third straight decline for this reading and the fifth out of the last six reports. Year-on-year, orders are noticeably in the negative column at minus 5.0 percent. These readings point squarely to stubborn weakness in business investment and uncertainty in the general business outlook.

There are, however, solid points of strength in the report including 0.6 percent gains for both total shipments and total unfilled orders. The gain for unfilled orders is the largest since July 2014. Another plus is a 0.2 percent decline in inventories which pulls down the inventory-to-shipments ratio to a leaner 1.65 from 1.67.

Vehicle strength is an important foundation for the factory sector, one tied to domestic consumer demand and a strength that highlights this otherwise mixed report.

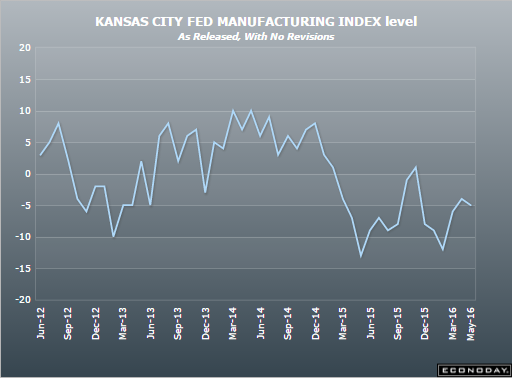

After moving up some in April, backing down in May, and negative all along:

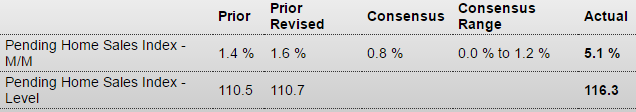

Another upbeat April housing number likely to reverse in May, the way all the other releases have so far:

Pending Home Sales Index

Highlights

News from the housing sector has been improving and very rapidly. First Tuesday’s new home sales report which absolutely surged and now a similar surge in the pending home sales index, up 5.1 percent in April for a third straight gain and pointing to greater acceleration for final sales of existing homes. The West, where existing home sales have been lagging, shot up a monthly 11.4 percent in today’s report with the South showing additional strength, up 5.1 percent. This week’s data, coming right at the beginning of the Spring season, have turned around the housing outlook, from modest growth to sharp growth in what is the latest indication of household strength.

As previously discussed, the logic behind allowing people with existing conditions to buy insurance at the same rate as everyone else is highly suspect: