By Eric Tymoigne This is the last post of this series. Many more topics need to be covered to make a full Money and Banking course, but the series should help those of us who are dissatisfied with the current Money & Banking textbooks (I don’t use any). Here is what is coming up in the near future: I will edit all the posts for typos (most of them hopefully) and to account for comments I received. Devin Smith kindly agreed to post the changes without changing any of the links. Formatting the text from a Word doc to a webpage is actually tedious work so many thanks to Devin. An M&B menu will be created at the top of the NEP homepage that will direct readers to links for each post. I will also make a fancy-looking pdf with all the posts, a table of content, etc. It will be more textbook-like and may be more appealing for some readers. In the long term, there is a textbook coming. When? Difficult to say. I plan to write most of the first draft of the text next spring while on sabbatical. Then, several rounds of testing (and rewriting) must be done to include feedbacks from students. A test bank and exercises must be created and tested too. So there is some work to do.

Topics:

Eric Tymoigne considers the following as important: Eric Tymoigne, money and banking

This could be interesting, too:

Mike Norman writes Banks And Money (Sigh) — Brian Romanchuk

Mike Norman writes Lars P. Syll — The weird absence of money and finance in economic theory

Eric Tymoigne writes Can the US Treasury run out of money when the US government can’t?

Eric Tymoigne writes “What You Need To Know About The Trillion National Debt”: The Alternative SHORT Interview

By Eric Tymoigne

This is the last post of this series. Many more topics need to be covered to make a full Money and Banking course, but the series should help those of us who are dissatisfied with the current Money & Banking textbooks (I don’t use any).

Here is what is coming up in the near future: I will edit all the posts for typos (most of them hopefully) and to account for comments I received. Devin Smith kindly agreed to post the changes without changing any of the links. Formatting the text from a Word doc to a webpage is actually tedious work so many thanks to Devin. An M&B menu will be created at the top of the NEP homepage that will direct readers to links for each post. I will also make a fancy-looking pdf with all the posts, a table of content, etc. It will be more textbook-like and may be more appealing for some readers.

In the long term, there is a textbook coming. When? Difficult to say. I plan to write most of the first draft of the text next spring while on sabbatical. Then, several rounds of testing (and rewriting) must be done to include feedbacks from students. A test bank and exercises must be created and tested too. So there is some work to do.

Massachusetts Bay Colonies: Anchoring of expectations and inappropriate reflux mechanism

Massachusetts Bay colonies responded to the lack of currency by issuing bills of credit that “shall be accordingly accepted by the treasurer and receivers subordinate to him, in all publick payments, and for any stock at any time in the treasury” (Davis 1900, 10). The government spent by issuing the bills and levied a tax to allow bearers to redeem them. Initially, trust in the bill was low because of the political and financial risks:

When the government first offered these bills to creditors in place of coin, they were received with distrust. […] their circulating value was at first impaired from twenty to thirty per cent. […] Many people being afraid that the government would in half a year be so overturned as to convert their bills of credit altogether into waste paper, […]. When, however, the complete recognition of the bills was effected by the new government and it was realized that no effort was being made to circulate more of them than was required to meet the immediate necessities of the situation, and further, that no attempt was made to postpone the period when they should be called in, they were accepted with confidence by the entire community […] [and] they continued to circulate at par. (Davis 1900, 10, 15, 18, 20)

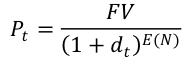

The population was unsure that the government would be willing or able to fulfill the promise to take back the bills at any times at par in tax payment. This lack of trust was compounded by the fact that, while the promise stipulated that bills could be returned at any time, in practice the tax levied to redeem the bills was initially implemented only once a year. Thus, when bills were issued initially, d was positive and bearers’ expectations about the term to maturity (E(N)) compounded the discount applied to the bills.

The government asked for help from Boston merchants who agreed to take the bills in payments at a small discount. Ultimately, the bills circulated at par as the government retired the bills as expected in a timely fashion.

However, as explained in a previous post, tying the issuance of bills of credits to a specific tax created a dilemma. The private sector wanted to accumulate the bills but taxes prevent the accumulation of the desired amount of bills. At the same time, taxes were at the foundation of the monetary system so they needed to be implemented as expected. Ultimately, the provincial government was unsure about how to proceed. One drastic method was to breach the promised term to maturity by postponing the implementation of the tax levy for several years. This was an effective default relative to the terms of the bills and a sure means to decrease the confidence in the bills and so their fair value (ibid., 108); “this fact alone would have caused them to depreciate, even if the amount then in circulation had been properly proportioned to the needs of the community” (Ibid., 20). The discount rate became positive again which lowered the purchasing power of bills given output prices. Later on, the provincial government found a more appropriate solution to the dilemma by broadening the types of obligations that could be paid with the bills.

From this example, one can learn several useful lessons. First, trust in the issuer of a monetary instrument requires some work to be earned but is central for the ability of that instrument to circulate at par. Second, if the reflux mechanisms in place are inconsistent with the promise made, there will be problems to fulfill the promise made. Colonial government promises redemption at the will of bearers but payments owed to the government were only implemented occasionally and narrowly. Third, once one made a promise, one better keep up with it otherwise bearers lose confidence quite quickly.

Medieval gold coins: Fraud, debasement, crying out, and market value of precious metal

The most complex historical case regarding the fair value of monetary instruments concerns the medieval coins made of precious metal. There are three broad problems in this case. One relates to the face value of the coins, another relates to the intrinsic/bullion value of the coins (i.e., the market value of the precious-metal content), and a third one relates to the interaction between the first two problems.

Up until recently, the face value was not stamped so it “was carried out by royal proclamation in all the public squares, fairs, and markets, at the instigation of the ordinary provincial judges: bailiffs, seneschals, and lieutenants” (Boyer-Xambeu et al. 1994, 47). This announcement declared at what nominal value the King would take each of his specific coins in payments due to him; thereby establishing their face value. Frequent changes in face value led to confusion among bearers, especially given that the spread of information was slow and inadequate.

Coins made of precious metals were a way to partly deal with the uncertainty surrounding the face value of coins. Coins with high precious metal content would be demanded from sovereigns that could not be trusted, either because they cried down too much, or refused some of their coins in payments too often, or were weak politically. The higher the content of precious metal relative to the face value, the more limited the capacity of Kings to cry down the coinage because coins would disappear if the face value fell below the market value of the precious-metal content. Coins would be melted (or exported as bullions) to extract the precious metal because more units of a unit of account could be obtained per coin by selling the precious metal instead of handing over coins to the King. Finally, others (e.g., mercenaries) demanded payments in such a form because they did not expect to be debtor to the King or to meet someone in debt to the king, or to meet someone who would expect to make transactions with someone else indebted to the king.

While the issuance of such coins was warranted given the poor political and financial stability of the time, they created several issues related to their intrinsic value and its impact on the fair value. If circumstances in the precious metal market pushed the value of the precious metal higher than the prevailing face value, mint masters and money changers would melt or illegally debase (e.g. clipping, i.e. cutting bits of the coins) the coinage even if the creditworthiness of a King was excellent. In theory, illegal debasements would occur until the intrinsic value was brought back to the face value but it became such a habit that it continued even when the value differential was nil. Expectations about future rises in the price of the precious metal (or future crying down) also encouraged illegal debasements even if no profit could be made right now. Fraud was further encouraged by the imperfect production methods. Coins with the same denomination and date of issuance had different weight and fineness even under the best circumstances. Coins also had uneven edges that made clipping difficult to notice if done moderately.

Fraud was problematic because it disturbed the uniformity and order that Kings wanted to establish to give confidence in their coinage; the stamp being a certificate of authenticity of the weight and fineness of the collateral embedded in coins. The King’s reputation was at stake. If allowed to go on, the country was left with a coinage of an insufficient quantity and quality to promote smooth economic operations, and clumsy and deformed coinage encouraged forgery. In order to prevent this from happening, Kings actively fought any fraudulent alteration of the intrinsic value of coins. They did so through several means. One was to punish severely fraudsters:

The coins were rude and clumsy and forgery was easy, and the laws show how common it was in spite of penalties of death, or the loss of the right hand. Every local borough could have its local mint and the moneyers were often guilty of issuing coins of debased metal or short weight to make an extra profit. […] [Henry I] decided that something must be done and he ordered a round-up of all the moneyers in 1125. A chronicle records that almost all were found guilty of fraud and had their right hands struck off. (Quigguin 1963, 57-58)

Another means was to weigh the coins that were brought to pay dues, and to refuse in payments all coins that had a lower weight than at issuance. Finally, two other ways were either to debase (decrease the quantity of previous metal to decrease the intrinsic value) or to cry up the coinage (increase the face value):

debasements were only necessary alterations in the quantity of silver in the coins, in order to keep pace with the rise in the price of silver bullion in the market; […] It has always been necessary to regulate the quantity of metal in the coins, because, if too much was put in, they would immediately be withdrawn from circulation and sold for bullion, […]; if too little was put, they might be imitated. (Smith 1832, 34)

In this case, debasement was not a means to increase the financing capacity of the King. It was a legitimate means to preserve the stability of a monetary system in which the value of precious metal played a role as collateral. However, debasement was a limited solution to offset the rising price of precious metals because the risk of forgery grew with further debasement. Debasement also negatively impacted the King’s creditworthiness even though, he may have had nothing to do with the problem and was trying to promote a stable monetary system.

Crying up the coins was not constrained by the risk of forgery, but it created another problem as potential inflationary pressures emerged when the money supply was raised unilaterally overnight in nominal terms. Price pressures in the precious metal markets could creep into the market for goods and services, and, once again, the King would be blamed. Finally, frequent crying up created further confusion among the public about the face value of coins; thereby reinforcing distrust and demands for coins with a high content of precious metal.

If one combines changes in face value, changes in intrinsic value, as well as their interactions, the determination of the fair value of coins becomes complicated. On one side, abusing crying down led to two types of speculation, one regarding the occurrence of a future crying down, another concerning the face value of the coins relative to the intrinsic value. On the other side, developments in the precious metal markets affected expectations about future debasements or crying up of coins.

What can we learn from this part of monetary history? First the issuer should have some control over when a collateral can be seized by bearers. If the collateral is embedded in the monetary instruments, a rise in the value of the collateral above face value may lead bearers to seize it even if the issuer has not defaulted. Second, if a monetary instrument is made from precious metal, the intrinsic value of the coins should be lower than the face value by a margin large enough to accommodate significance increase in the market value of the precious metal. Third, anchoring the expectations of bearers about the face value is important for a well-functioning monetary system.

Tobacco Leafs in the American colonies: Legal tender laws and scarcity of monetary instruments

The case of Virginia and other U.S. colonies in the 17th and 18th centuries is usually put forward to make the case that tobacco leaf was a monetary instrument:

Tobacco was an accepted medium of exchange in the southern colonies. Quit rents and fines were payable in tobacco. Individuals missing church were fined a pound of tobacco. In 1618, the governor of Virginia issued an order that directed that “all goods should be sold at an advance of twenty-five percent, and tobacco taken in payment at three shillings per pound, and not more or less, on the penalty of three years of servitude to the Colony.” […] Virginia was using “tobacco notes” as a substitute for currency by 1713. These notes originated after tobacco farmers in Virginia began taking their tobacco crops to warehouses for weighing, testing, and storage […]. The inspectors at the rolling houses were allowed to issue notes or receipts that represented the amount of tobacco being held in storage for the planter. These notes were renewable and could be used in lieu of tobacco for payment of debts. […]Fines in Virginia were payable in tobacco. For example, a master caught harboring a slave that he did not own was subject to a fine of 150 pounds of tobacco. The Maryland Tobacco Inspection Act of 1747 was modeled after the Virginia statute. The Maryland statute required tobacco to be inspected and certified before export in order to stop trash from being put in the tobacco. […] Inspection notes were given for the tobacco that was inspected. Those notes were passed as money in Maryland. The use of warehouse receipts for tobacco and other commodities would spread to Kentucky as settlers began to cultivate that region. (Markham 2002, 44-45)

Hence, tobacco leafs served as media of exchange and so, following the narrow functional approach, were a monetary instrument. However, what the preceding description actually shows is that the colonies of Virginia and Maryland were at the center of a trading system of tobacco which was central to the economy of these states. By accepting tax payments, or any other dues, in tobacco at a relatively high fixed price, governments could influence tobacco output, could centralize output collection and redistribution, and make it easier for farmers—who usually did not have enough monetary instruments because of their scarcity—to pay their taxes. This, however, does not qualify the payment in tobacco as a monetary payment, but rather as a payment in kind at a price that was administered. Like in feudal times, taxes could be paid in kind.

However, the previous quote gives us some clues about the monetary system that existed. First, whereas tobacco was not a financial instrument, tobacco notes were a financial instrument of the government warehouses worth a certain amount of pounds and collateralized by the value of the weight of tobacco that each note represented. Thus, tobacco notes may have become monetary instrument; nothing clear is said about that. Second, the provision of credit through bookkeeping was a common way to avoid the problems of barter:

One method for financing private transactions in the colonies was through records of account kept by tradesmen and planters. Credits and debits were transferred among other merchants and traders. This was a form of “bookkeeping barter” in which goods were exchanged for other goods, and excess credits were carried on account. The barter economy that prevailed in the colonies required “voluminous record-keeping … to carry over old accounts for many years.” This practice would continue through the eighteenth century […]. (Markham 2002, 46)

The bookkeeping system was actually more complicated because credits on an account were sometimes transferable at par. Thus, a monetary system based initially on a unit of account named “Pound” was present in the colonies, even though its functioning was not very smooth given the too high scarcity of top monetary instruments and the localized emergence of bookkeeping transfers. Tobacco leafs were not part of this monetary system.

Somalian Shilling: The downfall of the issuer and continued circulation of its monetary instrument.

In 1991, the Somalian government collapsed but its monetary instruments continued to circulate. One can explain why by noting that:

- The state was central at establishing the trust about the currency prior to 1991. That’s what anchored the expectations about the face value of the Somalian shilling.

- Given the confusion during the time the state collapsed, citizens just relied habits, anchoring induced by inertia provided by historical acceptance created by state.

- If citizens believe that collapse of state is only temporary and shilling will be reissued later then there is an incentive to continue using it. This is very different from the case of the transfer to Eurozone when states spent years educating and informing their population about the demonetization of their currency, and gave a clear date about when demonetization would occur. In Somalia, everybody was left in the dark.

- The belief that shilling would be again the national currency was reinforced by two aspects: a) local governments did accept them for tax payments at least temporarily b) armed militia that substituted for government, started to counterfeit some shilling notes to fill up the void left by the collapse of the official government, and, in addition, may have allow dues to be paid in that currency.

All this is similar to shares that continue to trade even as a company goes through liquidation and reorganization. Bearers are hopeful that the company will come back and be great again.