By Eric Tymoigne The following answers a few question in order to illustrate the previous post and to develop certain points. Q1: Can a commodity be a monetary instrument? Or, does money grow on trees? Let us tackle the idea that “gold is money”. Clearly, a gold ingot is not a monetary instrument. There is no issuer, no denomination, no term to maturity or any other financial characteristics. A gold ingot is just a commodity, a real asset not a financial asset. On the other hand, gold coins have been monetary instruments and are still issued at times (Figure 1). Figure 1. Gold (ingots) vs. Gold Coin (2009 American Buffalo Gold Coin) Similarly, it is incorrect to state that “salt was money” because salt is a commodity that embeds no promise; however, Marco Polo noted that in the Chinese province of Kain-du: There are salt springs, from which they manufacture salt by boiling it in small pans. When the water is boiled for an hour, it becomes a kind of paste, which is formed into cakes of the value of two pence each. […] On this latter species of money the stamp of the grand khan is impressed, and it cannot be prepared by any other than his own officers. Eighty of the cakes are made to pass for a saggio of gold.

Topics:

Eric Tymoigne considers the following as important: Eric Tymoigne, money and banking

This could be interesting, too:

Mike Norman writes Banks And Money (Sigh) — Brian Romanchuk

Mike Norman writes Lars P. Syll — The weird absence of money and finance in economic theory

Eric Tymoigne writes Can the US Treasury run out of money when the US government can’t?

Eric Tymoigne writes “What You Need To Know About The Trillion National Debt”: The Alternative SHORT Interview

By Eric Tymoigne

The following answers a few question in order to illustrate the previous post and to develop certain points.

Q1: Can a commodity be a monetary instrument? Or, does money grow on trees?

Let us tackle the idea that “gold is money”. Clearly, a gold ingot is not a monetary instrument. There is no issuer, no denomination, no term to maturity or any other financial characteristics. A gold ingot is just a commodity, a real asset not a financial asset. On the other hand, gold coins have been monetary instruments and are still issued at times (Figure 1).

Figure 1. Gold (ingots) vs. Gold Coin (2009 $50 American Buffalo Gold Coin)

Similarly, it is incorrect to state that “salt was money” because salt is a commodity that embeds no promise; however, Marco Polo noted that in the Chinese province of Kain-du:

There are salt springs, from which they manufacture salt by boiling it in small pans. When the water is boiled for an hour, it becomes a kind of paste, which is formed into cakes of the value of two pence each. […] On this latter species of money the stamp of the grand khan is impressed, and it cannot be prepared by any other than his own officers. Eighty of the cakes are made to pass for a saggio of gold. But when these cakes are carried by traders amongst the inhabitants of the mountains, and other parts little frequented, they obtain a saggio of gold for sixty, fifty, or even forty of the salt cakes, in proportion as they find the natives less civilized.

It seems that salt cakes issued by an emperor (“grand khan”) might have circulated as monetary instruments. However, a lot of details are missing from this description:

- What were the unit of account and face value? (definitely not the pound, it is China)

- What was the term to maturity? Were the cakes accepted in payment at any time by the emperor?

- What were the means for the emperor to make the previous financial characteristics a reality? I.e., what were the reflux mechanics? Did the emperor levy dues that could be paid with salt cakes at par? Did the cakes provide conversion into something? Etc. Bearers need to be convinced so trust about the issuer must be established.

- The bit about the amount of gold that salt cakes could buy is irrelevant. Polo is just telling us that a commodity (gold bullions) was cheaper in the mountains. He might as well have told us about how different the price of apples and potatoes are in different parts of the country.

The broad point is that monetary instruments can be made of a commodity but that commodity itself is not a monetary instrument. We all know the expression “money does not grow on trees.” Monetary instruments are not a natural occurrence and for a commodity to become a monetary instruments some specific financial characteristics must be added: a unit of account, a face value, a term to maturity, among others. All this requires an issuer who promises to implement these financial characteristics.

Say a goldminer wants his gold nuggets to be a monetary instrument, for that to be the case the goldminer must promise:

- To distinguish his gold nuggets from other gold nuggets

- To declare what their face value is in terms of a unit of account

- To implement that face value by promising to take back at any time the gold nuggets in payments at the stated face value.

Now the third condition introduces a problem because it means that the goldminer must be willing to be paid in gold nuggets for his gold nuggets. I let you ponder on that.

Q2: Can a monetary instrument be a commodity?

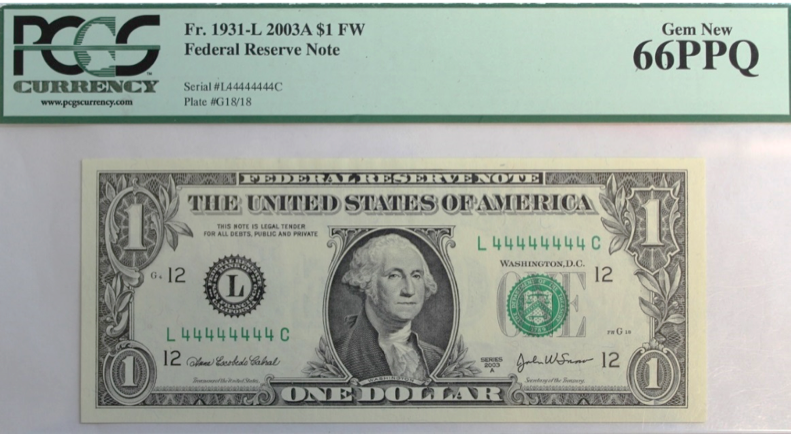

Yes. Numismatists are specialists at treating current and former physical monetary instruments as commodities by determining the price of banknotes and coins in terms of their rarity, peculiarity, etc. For example the $1 FRN in Figure 2 is worth $1200 currently because of its peculiar serial number. But that is not its fair value as a monetary instrument. If one buys this note and goes to a store or to a government office, the person to whom one hands the note will only take it for $1. The same applies to the buffalo gold coins above. One can use them to pay debt owed to the government but only $50 worth, not more nor less, even though the coin is worth thousands of dollars as a collectible item.

Figure 2. A $1 FRN worth $1200 as collectible items

Source: here

The same applies also to gold and silver certificates. Here is how the U.S. Treasury puts it:

Although gold certificates are no longer produced and are not redeemable in gold, they still maintain their legal tender status. You may redeem the notes you have through the Treasury Department or any financial institution. The redemption, however, will be at the face value on the note. These notes may, however, have a “premium” value to coin and currency collectors or dealers. (U.S. Treasury)

One can redeem them at the Treasury (to pay debts owed to the Treasury or to get Federal Reserve notes) or deposit them at banks, but only at face value. That is their value as monetary instrument. Their value as a commodity is sometimes much higher.

Finally, a fun example is the current case of the penny, which brings us back to darker times of monetary history (see next post). A while back, National Public Radio ran a segment on penny hoarders. These are people whose hobby is to hoard pre-1982 pennies. Some even go to their local banks and ask to convert dollar bills into pennies and then spend their evenings triaging boxes of pennies. Why would they do that would you ask? Pre-1982 pennies are made mostly of copper and, given that the price of a pound of copper tripled over the past ten years, the face value of a penny is half the intrinsic value (i.e. value of the content of copper): face value is 1 cent, intrinsic value is 2 cents, 100% profit from selling pennies for their copper content! Currently, there is one small problem with this portfolio strategy: It is illegal to destroy government currency. However, the government is considering the possibility of demonetizing the penny coin because it costs more to make than its face value, and because US residents mostly find it cumbersome to use. If the government ever demonetizes the penny coin, penny hoarders are ready to rush to their local scrap metal dealers.

Q3: Is money what money does?

Francis Amasa Walker concluded in the late 19th century that “money is what money does.” This has been an extremely influential way of analyzing monetary systems is many different disciplines: economics, anthropology, law, among others.

It is used in a narrow way by economists who use the Real Exchange Economy framework and who focus on the function of medium of exchange. In order to avoid the problem of double coincidence of wants induced by barter (Joe has apples and wants pears, Jane has pears but wants peaches), a unique commodity was progressively sorted out as best for market exchanges. Thus, a monetary system can be detected by checking for the presence of a medium of exchange. Anthropologists, among others, reject this narrow functional approach. In primitive societies, exchange was not done principally, or even at all, for economic reasons and so the nonexistence of a double coincidence of wants was not a problem. The broad functional approach classifies anything as monetary instrument as long as it performs all or parts of the functions attributed to monetary instruments. The distinction between “all-purpose money” and “special-purpose money” follows.

A main issue with the functional approach is that it does not explicitly define what “money” is, which creates several issues:

- Inquirers may pick and choose depending on the circumstances, which may lead the inquirer to impose inappropriately his own experience to explain the inner workings of completely different societies.

- Inquirers may tend to assume that monetary instruments must take a physical form when they may be immaterial.

- Inquirers may exclude things that are monetary instruments but are not used for any of the functions. Collectible coins and notes are monetary instruments as long as the issuer does not demonetize them.

More broadly, too much emphasis will be on detecting things that fulfill the selected function and not enough effort will be devoted to a detailed account of the unit of account used, how the fair value was determined and if it fluctuated, how the reflux mechanisms were implemented, etc. The example of the salt cakes above is an illustration of that point. Just noting that something is used as medium of exchange or means of payment, and moving on to something else, is a poor means to perform monetary analysis.

This approach also creates difficulties to convincingly include “money” in models, and pushes to ignore the financial side of the economy and the role of nominal aspects. Monetary instruments are mere commodities and do grow on trees—there are fruits—and all debt payments are denominated in fruits.

Finally, inquirers using this approach may confuse monetary payments and in-kind payments, may assume that there is a monetary system where there is none, may make a truncated analysis of monetary systems consisting mostly in a mere recollection of objects, and may miss the presence of a monetary system. For examples, by relying on the words of an Arab merchant and an Arab historian of the 9th and 10th century, Quiggin reports that more than a thousand years ago cowry shells:

formed the wealth of the royal treasury […] [and] when funds were getting low, the sovereign sent out servants to cut branches of coconut palm and throw them into the sea. The little mollusks climbed on to the branches and were collected and spread out on the sand to dry until only the empty shells were left. So the royal bank was filled again. Ships from India brought goods to the Maldives and took back millions of shells packed up in thousand in coconut palm leaves. It was a profitable trade, for even in the seventeenth century we hear of 9,000 or 10,000 cowries being bought for a rupee and sold again for three or four times as much on the mainland of India. (Quiggin, 1963, 25-26)

However, from this description, one cannot conclude that cowries were monetary instruments used by the king to finance the purchase of foreign goods and services. Indeed, it is not explained what the unit of account of the Maldives was and how cowries were monetized, i.e., who, if anybody, issued them as financial instruments (did the royal authority issue them and was the royal bank ready to accept cowries in payment?), and what was their relationship relative to the unit of account. In addition, the role of cowries as monetary instruments is doubtful for the Maldives because, cowry shells were worth nothing against goods “except by shipload” (Polanyi 1966, 190)—an extremely inconvenient means of payment and medium of exchange. What one can conclude from the description is that the Maldives authorities were involved in the trade of cowries with Indian and Arab merchants. They were exporting cowries against imports of other goods—a situation of bilateral trade, not a situation of cowry monetary system.

Q4: Are contemporary government monetary instruments irredeemable? Or, is the fair value of contemporary government monetary instruments zero?

No. A WELL-FUNCTIONING MONETARY SYSTEM REQUIRES THAT ALL MONETARY INSTRUMENTS BE REDEEMABLE. Federal Reserve notes are redeemable, silver certificates are redeemable even though they are no longer convertible (see the Treasury in Q2), and bank accounts are redeemable. They are redeemable as long as they can be returned to the issuer, hopefully at their initial face value. They can be returned to the issuer through two channels:

- Bearers demand conversion into something else at a given rate: government currency for bank accounts, foreign currency for government currency, etc.

- Bearers pay the issuer with the notes: governments take their currency is payment of dues owed to them, as do banks. The payment allows the bearers to avoid jail time and other legal problems.

So to be redeemable a monetary instrument does NOT have to be convertible. As such the fair value of a monetary instruments, its net present value, is face value.

In the past, some governments did forget to include, or removed, a redemption clause:

Paper money has no intrinsic value; it is only an imputed one; and therefore, when issued, it is with a redeeming clause, that it shall be taken back, or otherwise withdrawn, at a future period. Unfortunately, most of the governments, that have issued paper money, have chosen to forget the redeeming clause, or else circumstances have intervened to prevent their putting it into execution; and the paper has been left in the hands of the public, without any possibility of its being withdrawn from circulation (Smith 1832, 49)

Probably, no government paper money was ever sent forth which was not expected to be redeemed in full value, at some time, although that might be distant. […] Nevertheless, the issues of government money that have not been redeemed, or the payment of which has been either formally or tacitly renounced, have been very numerous. (Langworthy Taylor 1913, 309)

In that case, the fair value of a monetary instrument is indeed zero because its term to maturity is infinity which means that its fair value is:

P = C/i

Given that no coupon was paid, then P = 0. But this does not apply today because monetary instruments are redeemable on demand by bearers at a very stable face value.

All this does not seem to be well understood. For example, recently Adair Turner wrote (and he is far from the only one to have said so):

Monetary base is an asset for the private sector, but for the government it is a purely notional liability (with NPV equal to Zero) since it is irredeemable and non-interest-bearing. (Turner 2015)

This confuses irredeemable and unconvertible. The monetary base is redeemable. This point of view also raises other problems:

- Remember that balance sheets are interrelated so if a financial liability is worth zero in one balance sheet, then a financial asset must be worth zero in another balance sheet. Turner makes an accounting error.

- Why would the private sector be willing to hold something that is worth zero? There is no benefit that comes from accepting a monetary instrument, not even avoiding prison because taxes cannot be paid with government monetary instruments.

- If valued at zero then balance sheets should record a large loss of assets (and net worth) for banks, firms, and households: Your savings are worth nothing in nominal terms!

Q5: Is monetary logic circular?

No. The acceptance of a monetary instrument by anybody ultimately rests in the confidence in the issuer, not in the confidence that other potential bearers will accept.

Q6: Do issuers of monetary instrument promise a stable purchasing power?

No. If that was the case, issuers of monetary instrument would have defaulted on their promise continuously since the beginning of financial times. They never were able to provide a stable purchasing power, even less so since the end of World War Two. As such the demand for monetary instruments would be nil if a stable purchasing power was a promise embedded in monetary instrument because the creditworthiness of the issuer would be nil.

A stable purchasing power is not a promise of any issuer of monetary instruments. This is fine for most bearers as long as the purchasing power of monetary instruments is relatively stable in the short-term. If one wants something that holds purchasing power over the medium to long run, then one should switch to other assets.

Q7: Are monetary instrument necessarily financial in nature?

Yes, remember: “money does not grow on trees.” While monetary instrument can be made of a commodity that commodity does not tell us anything about the monetary nature of a thing. A gold coin is a monetary instrument not because it is made of gold but because of its financial characteristics. Gold is a collateral embedded in the coin. Similarly a house is not a mortgage, a house is a collateral for a mortgage and nothing can be learned about the inner workings of mortgages by studying how a house is made.

The “primitive moneys” would need to be studied much more carefully to determine if some of them were monetary instruments. Just checking if they passed hands in exchange of goods and services, if they were used to pay for a bride, etc. is a poor means of determining the “moneyness” of something given that one cannot make a difference between in-kind payments and monetary payments. We saw above that cowry shells were not monetary instruments in the Maldives but they were in Africa and detailed analysis has been done to establish that fact.

Q7: Are credit cards monetary instruments? What about pizza coupons? What about pretend-play banknotes and coins? What about bitcoins?

No to all questions.

A credit card is not a financial instrument—it does not have a maturity (issuers of credit cards do not accept credit cards in payment) and it is not related to a unit of account (it is not a carrier of the unit of account). The underlying credit line is not financial instrument either. The line represents the maximum amount of a customer’s promissory note (called credit card receivables) that a credit company is willing to take on its balance sheet.

Say that household #1 wants to get a credit card from Bank A. #1 fills up the required documentation so A can check #1’s creditworthiness. #1 is approved by A and gets a $1000 credit line. Where is that recorded on the balance sheet? Nowhere, it is an off-balance sheet item. The line is just saying that A will take on its balance sheet up to $1000 of #1’s promissory notes without asking again to check #1’s creditworthiness. We saw in a previous post what happens when a credit line is used: A’s assets rise by the amount of line drawn by #1, #1’s liabilities rise by that same amount.

What about a pizza coupon? It has an instantaneous maturity (one can go to the pizza shop at any time to claim a pizza), it is a convertible, but it not a financial instrument because it does not involve monetary payments but merely in-kind payments: it converts into a commodity. If the coupon could be used to pay debts owed to the pizza shop at any time, if the pizza shop stated at what value it would take the coupon in payments, then it would be a monetary instrument.

Figure 3 shows a set of play notes that my son got with his cash register. In order for the notes to become monetary instruments, the company that created them would need to do the following:

- Change the design: too close to the design of Federal Reserve notes even though it is a crude imitation. Definitely “The United States of America” should be eliminated because they are not issued by the government.

- Promise to take the note in payments: Bearers can pay the company with the notes to buy things from, and clear debts owed to, the company.

Finally, bitcoins do not have any issuer and are irredeemable. The first problem prevent them to be a monetary instrument, the second problem makes them valueless as monetary instruments. Bitcoins are commodities/real assets, not financial assets.

Figure 3. Pretend-play monetary instruments

Q8: Errors made in past monetary systems

Given the characteristics of monetary instruments, they should circulate at parity all the time; however, actual circulation at par does not define a monetary instrument. Par circulation is only the result of the inner characteristics of a financial instrument, together with the existence of a proper financial infrastructure that allows these characteristics to be expressed in the fair value. Only recently has there been well-functioning monetary systems. They are not without problems but in general they ensure a smooth processing of payments and can be used as a reliable medium of exchange, both of which help to promote economic prosperity to some extent.

For reasons related to poor technics of production, inexperience, political instability, frauds, and poorly developed banking systems, it took quite a long time for the proper characteristics and infrastructure to be established to have a smoothly running monetary system. Here are some errors that were made along the way:

- No stamped face value: In the Middle Ages, King cried up or down (i.e. changes by decree) the face value too many times.

- What is the problem? Nobody had any idea what face value was: “there were so many edicts in force referring to changes in the [face] value of the coins, that none but an expert could tell what the [face] value of various coins of different issues were, and they became highly speculative commodities” (Innes 1913, 386).

- Free-coinage: Anybody with gold can go to the mint and get coins stamped out of ingots (government keeps a portion of the ingots: seigniorage)

- What is the problem? Kings legalized counterfeiting. Anybody with gold could issue a debt of the king, i.e. make the king liable. Today, in the United States, an equivalent would be for the Bureau of Engraving and Printing to print Federal Reserve notes for anybody who comes with paper that respects the Bureau’s specifications

- No redeeming clause: There is no way to return to the issuer its monetary instruments

- What is the problem? Fair price is zero unless there is a collateral or recourse, which is not the case for monetary instruments made of paper.

- There is a redeeming clause but no actual means to implement it because no payment is due to issuer (e.g., sometimes taxes during the time of colonial bills were not implemented when they were supposed to be), or conversion is very difficult (banks during wildcat era).

- What is the problem? The term to maturity is no longer instantaneous as promised but depends on the expectations of bearers. As such the discount factor comes back into the valuation of the fair price and so the fair price is unstable and varies with confidence of bearers about the issuer.

- Full-bodied coins: At issuance the face value (FV) is the same as the market value of the gold content (PgG with PGthe price of gold per ounce and G the ounces of gold in the coin)

- What is the problem? if ∆Pg > 0 => PgG > FV => coins disappear from circulation (melted into ingot or exported as commodities)

- Lack of a proper interbank payment system: in that case interbank debts are difficult to clear and settle. This creates all sorts of problems going from delays in processing payment, to loss of purchasing power because some bank monetary instruments trade at a discount relative to other bank monetary instruments, to full blown financial crisis because payments cannot be processed and so creditors do not receive what they are owed and in turn cannot pay their own creditors.

Q9: Do legal tender laws define monetary instruments? What about fixed price?

Legal tender laws state that, in court settlements, creditors must accept whatever is defined as legal tender in payments of what is owed to them. Creditors cannot refuse payments with something that is legal tender. This does not mean a legal tender cannot be refused during petty transactions. The current legal tenders in the US are Federal Reserve notes but plenty of shops and government offices refuse cash payments.

Something that is legal tender is not necessarily a monetary instrument. In the past commodities such as tobacco leafs have been included in the legal tender laws, forcing creditors to accept payments in kind. The next post will develop the case of tobacco leafs in the United States, which came about because of a shortage of monetary instruments.

Something that has a fixed price is also not necessarily a monetary instrument. It may just be a commodity managed by an economic unit.

Q10: Is it up to people to decide what a monetary instrument is? Who decides when something is demonetized?

The public opinion about what is or what is not a monetary instrument does not matter and popular belief by itself cannot turn something into a monetary instrument. To take an analogy, one can use a shoe to hammer nails but it does not make the shoe a hammer. The fact that everybody thinks that shoes are hammers does not turn the shoe into a hammer. If everybody is delusional enough to believe the contrary, there will be many more work-related accidents and productivity will drop because shoes are not built properly to hammer nails. In a similar fashion if everybody wants to believe that gold nuggets, tobacco leafs, or grains of salt are monetary instruments, the payment system will not work smoothly and economic activity will suffer.

As explained in Q2, some monetary instruments are used merely as collectible items. Some persons may also use monetary instruments as ornaments and for other non-economic uses. These other uses do not demonetize a monetary instrument. That can only happen if a monetary instrument seizes to be a promise and that is up to the issuer to decide.

Q11: Can anybody make a monetary instrument?

Yes as long as one does not counterfeit existing monetary instruments, one can do so. Good luck getting it accepted.

Done for today! Next is the final post of the series: Monetary history.