Share the post "Successful Investing Requires a North Star"The best investors in the world all have one thing in common – they have a well defined plan that they stick with through thick and thin. This plan serves as a north star regardless of where they are along the investment journey. For instance, a great value investor like Warren Buffett thinks that long-term trends will produce positive outcomes for corporate America as a whole.¹ But stock prices don’t follow long-term trends. They follow a series of short-term trends inside of a long-term. And this results in a very volatile path from low values to higher future values over time. But if Buffett can be patient and buy good companies at distressed levels or when they have a margin of safety (ie, buying when others are fearful and selling when others are greedy) then he can create some excess return relative to just buying and holding stocks. In essence, Buffett’s strategy looks like the chart below where the green line reflects the actual path stocks take and the black line reflects the long-term trend:(Value Investing Oversimplified)His strategy is more complex than that, but not by much. The difference between Buffett and most investors isn’t his brilliance. It’s that he has put together a framework for guiding him through the cyclicality of the markets.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "Successful Investing Requires a North Star"

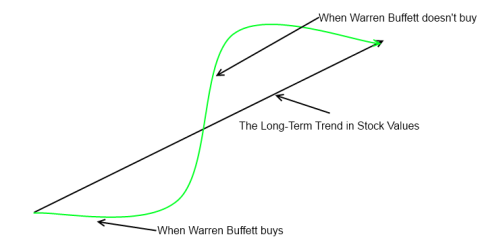

The best investors in the world all have one thing in common – they have a well defined plan that they stick with through thick and thin. This plan serves as a north star regardless of where they are along the investment journey. For instance, a great value investor like Warren Buffett thinks that long-term trends will produce positive outcomes for corporate America as a whole.¹ But stock prices don’t follow long-term trends. They follow a series of short-term trends inside of a long-term. And this results in a very volatile path from low values to higher future values over time. But if Buffett can be patient and buy good companies at distressed levels or when they have a margin of safety (ie, buying when others are fearful and selling when others are greedy) then he can create some excess return relative to just buying and holding stocks. In essence, Buffett’s strategy looks like the chart below where the green line reflects the actual path stocks take and the black line reflects the long-term trend:

(Value Investing Oversimplified)

His strategy is more complex than that, but not by much. The difference between Buffett and most investors isn’t his brilliance. It’s that he has put together a framework for guiding him through the cyclicality of the markets. He has a simple plan that puts the gyrations of the market in the proper context so he never loses sight of his broader plan. And this simple framework helps him avoid the big mistakes that plague so many other investors who can’t avoid the problem of short-termism. While Buffett is certainly brilliant, I’d argue that his patient brilliance is what separates him from most other brilliant investors. His north star is his ability to keep the short-term valuations in the proper context relative to the long-term.

Another simple example of this is a Boglehead approach. A Boglehead takes that long-term trend in stock values and says “just ride that sucker higher in the most diversified, low fee and tax efficient manner possible”. But rather than trying to buy when others are fearful a Boglehead will simply acknowledge that this is too difficult or troublesome for most investors so they should just dollar cost average, don’t bother with anything close to timing the market and if you need a hedge then wrap your equity allocation in a bond allocation to temper the volatility. It doesn’t work because it’s sophisticated. It works because it’s simple and anyone who puts things in the proper context can follow the plan with minimal effort. A Boglhead’s north star is their ability to keep the long-term expected returns in the proper context relative to whatever is happening in the short-term (bull market or bear).

The reason I find macro investing so useful is because it helps take all of these big trends and put them in the right perspective. It serves as a north star. And having a north star is essential to having a plan you can stick with because even when the world looks darkest you can still look up and find that guiding light to remind you of the direction you’re headed in.²

Unfortunately, a lot of investors don’t have a north star so they wander aimlessly through the short-term gyrations of the market always wondering when the next 2008 is about to wipe them out. This is precisely what happened at times last year and during the first few months of 2016 when predictions about impending doom were rampant. I have repeatedly stated in the last few quarters that a repeat of 2008 was not on the horizon. In fact, I still think this environment looks more like 1998 than 2008. At the start of the year I gave a talk at the AAII annual meeting in Los Angeles and the most common question I kept getting was “is this another 2008?” I said, I don’t know, but my simple macro framework isn’t consistent with that. Macro is my north star. It’s how I digest the short-term movements of the market, keep them in the proper perspective and avoid making the short-term mistakes that hurt so many investors. The question is, do you have a north star that helps serve as a guiding light through good times and bad? If you don’t, you’re likely to feel lost at times and wander off course.

¹ – This long-term trend is an assumption of course, however, it’s a very smart probabilistic assumption given the fact that the long-term is comprised of short-term trends in which human beings are constantly trying to improve their own living standards.

² – The leading cause of abandoning a good plan is the lack of a north star to guide you through your plan. This results in excessive short-termism and plan abandonment when you feel lost or uncertain of how to put short-term market gyrations in the proper long-term context.

Share the post "Successful Investing Requires a North Star"