Here are some things I think I am thinking about…there are a lot of bad tweets these days. Come to think of it, maybe all tweets are bad tweets. But on the scale from bad tweet to very bad tweets these were some that triggered me this week: 1) 401Ks are actually very good. There was this article in Bloomberg arguing that the 401K is no longer a good retirement vehicle. Seemed like click-bait, but then I started reading it and the numbers were somewhat compelling. The author had really put some effort into quantifying the good and the bad. But the deeper I got into it the more I realized how misleading the assumptions were. In summary, the article argues that the tax benefit of a 401K is no longer worth it because the median user is in a very low tax bracket, is charged high fees, has

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about…there are a lot of bad tweets these days. Come to think of it, maybe all tweets are bad tweets. But on the scale from bad tweet to very bad tweets these were some that triggered me this week:

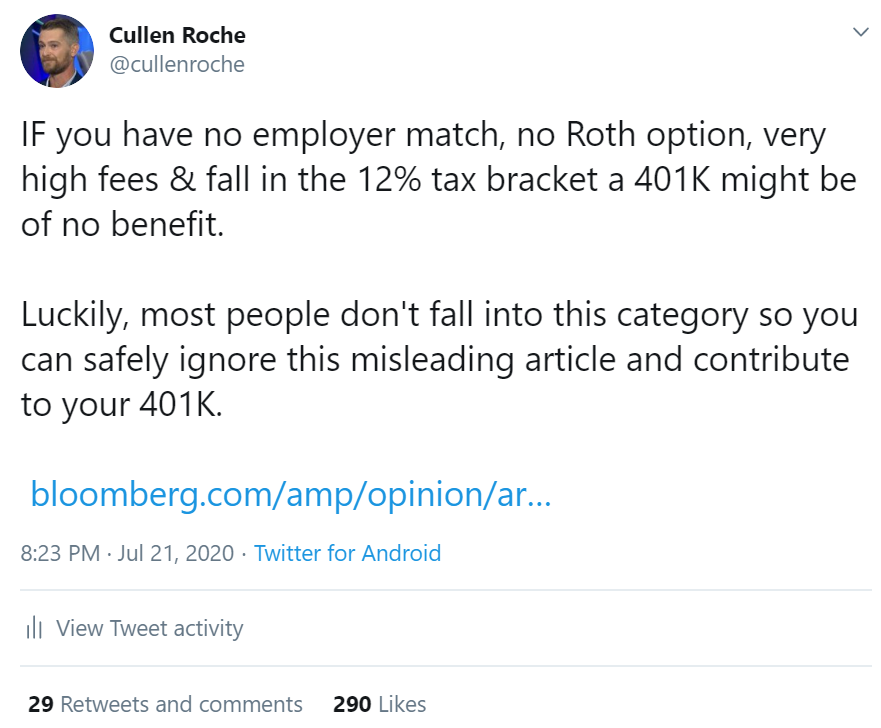

1) 401Ks are actually very good. There was this article in Bloomberg arguing that the 401K is no longer a good retirement vehicle. Seemed like click-bait, but then I started reading it and the numbers were somewhat compelling. The author had really put some effort into quantifying the good and the bad. But the deeper I got into it the more I realized how misleading the assumptions were. In summary, the article argues that the tax benefit of a 401K is no longer worth it because the median user is in a very low tax bracket, is charged high fees, has no Roth option and has no employer match. The only problem with all these assumptions is that they’re largely bullshit. Virtually no one’s 401K options would fall into this bucket. But I’d argue there’s a bigger mistake in this article than the bad assumptions – behavior.

Yeah, yeah. You probably knew I was going there. I am a big believer that behavior is 90% of good investing. You can have the best plan in the world and if you can’t control your own behavior then your plan will still fail. As it pertains to 401K plans, the key aspect of the 401K is that it helps discipline you. It forces you to put away some savings and let it ride. You aren’t inclined to touch it because you’re not legally supposed to touch it. And even if you alter the holdings on occasion you don’t undergo the disastrous tax consequences that hurt so many investors. So 401K plans instill the type of behavior in people that results in good outcomes by forcing you to save and forcing you to think long-term. That alone makes the 401K a tremendously valuable vehicle for retirement savings.

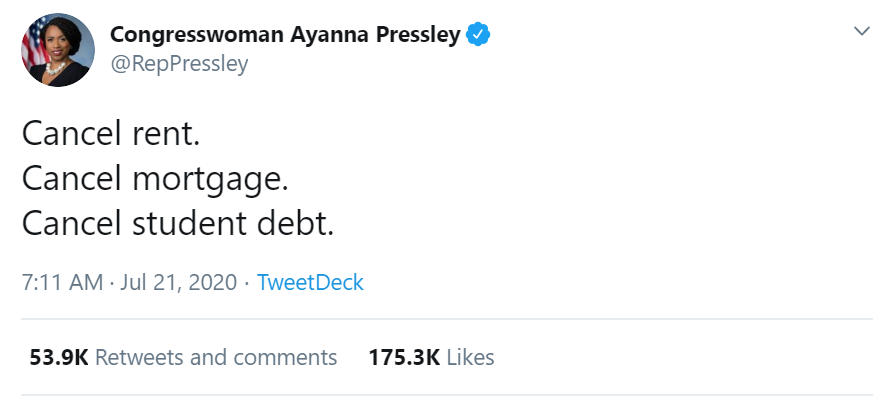

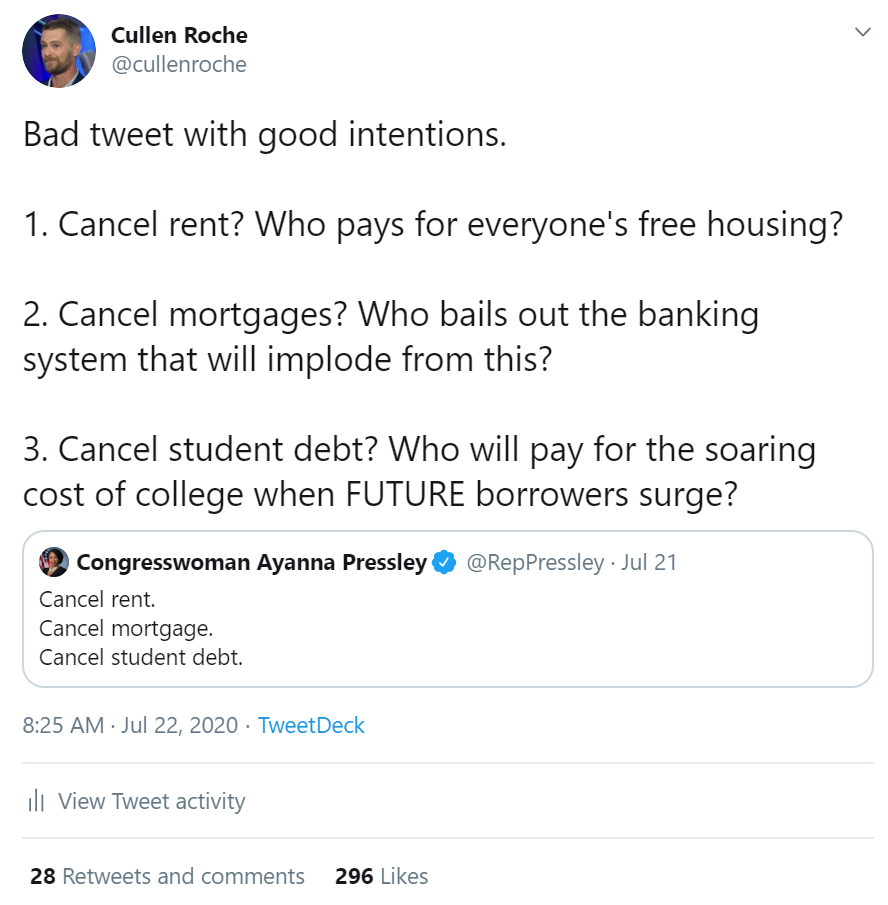

2) Everything’s Gonna be Free! Here is a tweet from an actual Congresswoman in Boston:

I responded saying:

These are hugely expensive programs. She’s essentially calling for free housing for everyone and a cancellation of the largest asset in the entire banking system – the asset that the entire banking system is built around. I honestly can’t even comprehend how that would work. You’d have to implode the entire financial system first. As for student loans, we’ve talked about this in the past. You can’t cancel student debt without solving the underlying problem – the cost of college. Forgiving today’s loans only incentivizes future borrowers to borrow more which gives colleges MORE pricing power which drives up prices more. You actually make the problem worse by cancelling student loans without resolving the cost problem. But in the age of “cancel culture” it seems like people are just going around cancelling everything and everyone without actually trying to understand the issues fully.

On a side note, I was barraged by people responding to this tweet – the gold bugs were telling me the Fed would pay for everything through inflation. And the MMT people were telling me the Treasury can pay for everything because it has a Magic Money Tree that no one has to “pay for”. Sigh.

3) Can Italy Stay in the EMU? Here’s a good tweet about a bad topic.

It got me thinking about the sustainability of the EMU. There was a big fiscal agreement in Europe earlier this week which I thought was fantastic news. 10 years ago I wrote a million articles about the USA and Europe and how Europe is/was weaker than the US currency union because we are actually united. We support our states and redistribute from the strong to the weak which virtually eliminates the risk of state solvency and helps bolster domestic demand in weak states. The EMU has, at times, been hesitant to support its member states. But this chart points to a more worrisome problem. How can countries like Greece and Italy justify staying in a currency union that has been so harmful to their long-term growth? The austerity imposed on these countries after the financial crisis was truly devastating and COVID is only going to make things worse. It all makes me wonder if these peripheral countries can continue to justify remaining in the EMU.