Saudi output hasn’t materially changed. The previous strategy was to set the price low enough for output to increase. So seems the new oil minister has changed course is now setting price as high as he thinks he can set it without triggering development of higher priced oil.Let me suggest this GDP ‘forecast’ is about as high as it gets before substantially falling back, as it did last quarter. This is because it is an account of what’s happened in April and May based on actual reports, and is not meant to take into account the reversion of a volatile series over the following months. Nor would it, for example, assume that an inventory increase one month would result in a decrease the next. Or that the downward revisions in employment, for example, raises the likelihood of downward revisions in other series:Yes, the private sector is ‘pro cyclical’. As things deteriorated, beginning, in this case with the collapse of oil capex at the end of 2014, it all started going down hill, as no other spending stepped up to the plate to replace the maybe billion/month of lost capex spending, which also means billion less income than otherwise. The lost sales and income then feeds on itself, in a downward spiral that slowly accelerates until some source of deficit spending emerges.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

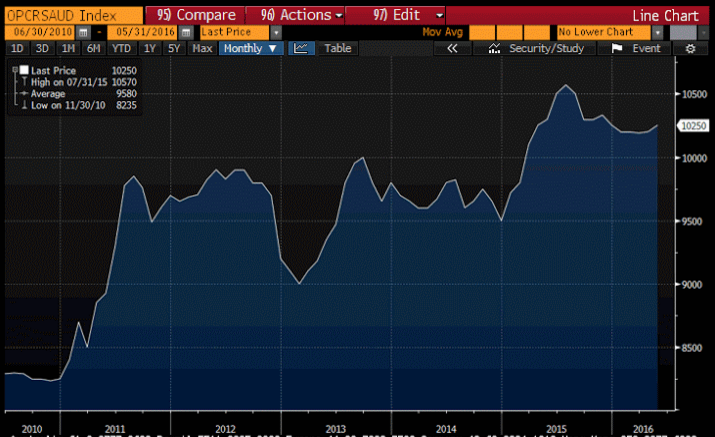

Saudi output hasn’t materially changed. The previous strategy was to set the price low enough for output to increase. So seems the new oil minister has changed course is now setting price as high as he thinks he can set it without triggering development of higher priced oil.

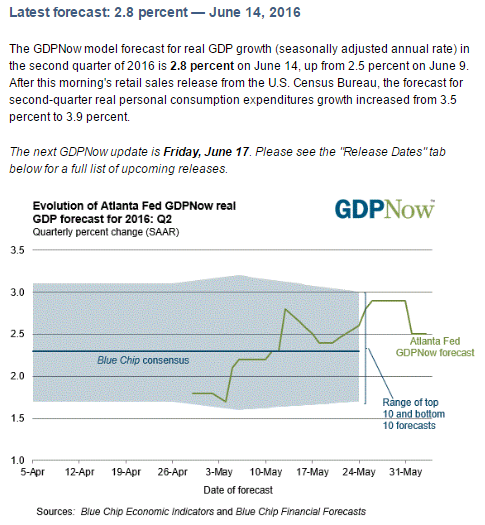

Let me suggest this GDP ‘forecast’ is about as high as it gets before substantially falling back, as it did last quarter. This is because it is an account of what’s happened in April and May based on actual reports, and is not meant to take into account the reversion of a volatile series over the following months. Nor would it, for example, assume that an inventory increase one month would result in a decrease the next. Or that the downward revisions in employment, for example, raises the likelihood of downward revisions in other series:

Yes, the private sector is ‘pro cyclical’. As things deteriorated, beginning, in this case with the collapse of oil capex at the end of 2014, it all started going down hill, as no other spending stepped up to the plate to replace the maybe $15 billion/month of lost capex spending, which also means $15 billion less income than otherwise. The lost sales and income then feeds on itself, in a downward spiral that slowly accelerates until some source of deficit spending emerges. That historically comes either the nice way- a pro active fiscal adjustment such as a tax cut or spending increase, or the ugly way as unemployment compensation increases and tax receipts fall off. And by making unemployment benefits harder to get this time around, that channel has been materially reduced:

“There Is A General Softening In The Consumer’s Ability To Pay” – Why Credit Card Companies Are Crashing

By Tyler Durden

June 14 (Zero Hedge) — Card issuers are warning that credit trends have deteriorated after years of historically low write-off rates. Capital One CEO Richard Fairbank said at a conference this month that soured loans are rising, while JPMorgan Chase & Co.’s Jamie Dimon said that credit is “going to get worse.” Revolving debt held by U.S. consumers increased to $951.5 billion at the end of April, a 5.5 percent increase from a year earlier, according to the Federal Reserve.

Cited by Bloomberg, Daniel Werner, a Morningstar Inc. analyst in Chicago, said that “it sure seems like the market thinks its more of a tidal and secular shift. We’re not at a point where people should really be panicking.”